DailyPay launched a reloadable prepaid card powered by Visa and Bancorp Bank for on-demand paycheck spending.

Pinwheel’s partnership with payroll provider Workday company One Source Virtual (OSV) ushers payroll into the same convenience levels as other areas of finance. It will also help banks achieve primacy with their customers.

It is time for digital wallets to come into their own. They can and should be more than a payment method, they could become the financial

Financial institutions struggle to meet consumer demand for more payment types, mainly because they lack the proper data science capabilities. This drives suboptimal strategies like layering multiple payment types.

Barte aims to scale its operations with the bolstered cash, launching a new credit product later this year.

With increasingly unaffordable healthcare costs, higher deductible health plans, and confusing medical billing statements, Americans are simply turning away from healthcare. This article will discuss how healthcare affordability and care avoidance are closely linked and how both affect patients, employers, and providers. In addition, it will explain why even patients with insurance are in desperate need of a new financial payment model that addresses the burden of healthcare costs.

Druo's technology creates an ecosystem that enables B2B users to charge or pay directly to any bank account without having to go through the complex network of financial intermediaries.

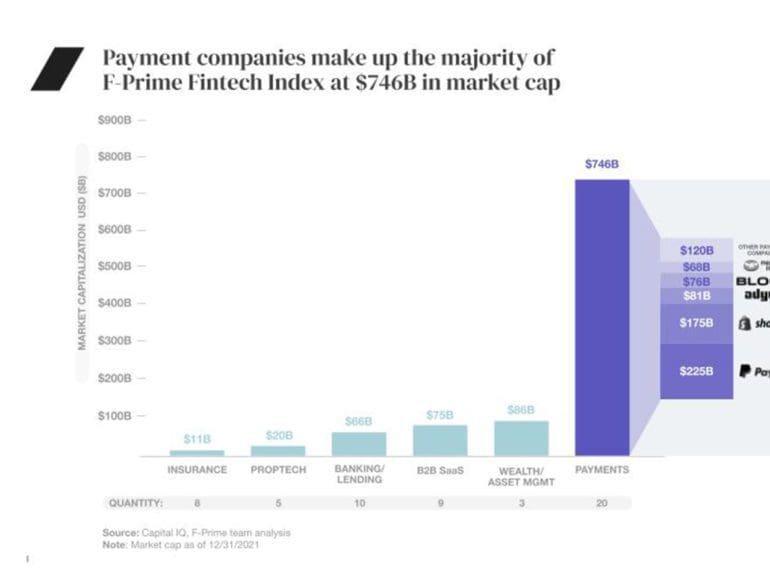

The F-Prime Fintech Index tracks the performance of emerging, publicly traded financial technology companies.

There is a treasure trove of data within a payments flow. By understanding payments analytics fintechs and banks can transform the user experience.

One of the most popular payment methods in Brazil, Pix is now set to take over online commerce too, a study by fintech EBANX shows.