This week, we look at:

Over $1 billion in raises announced last week, and over $10 billion in Fintech company value creation: Checkout.com with $450 million at a $15 billion valuation, Affirm more than doubling after its IPO to $30 billion, lending enabler Blend raising $300 million, and payments enabler Rapyd raising $300 million.

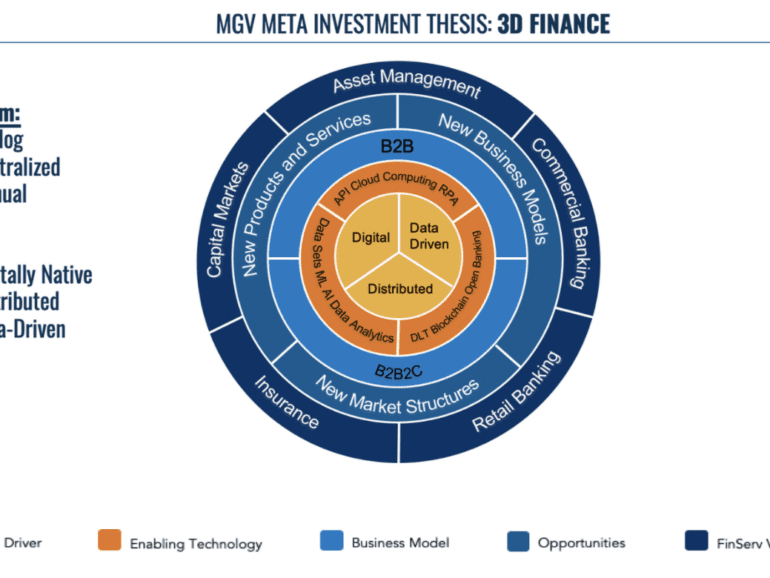

A systems theory framework that explains the stocks and flows of goods and services, and what monetization strategies are available to fintechs

How transactional models are thriving and creating 50-100x revenue multiples