The easiest way to get insight into the marketplace lending securitization market is through PeerIQ’s quarterly reports. It feels like every quarter brings more good news for originators and the fourth quarter of 2017 was no exception.

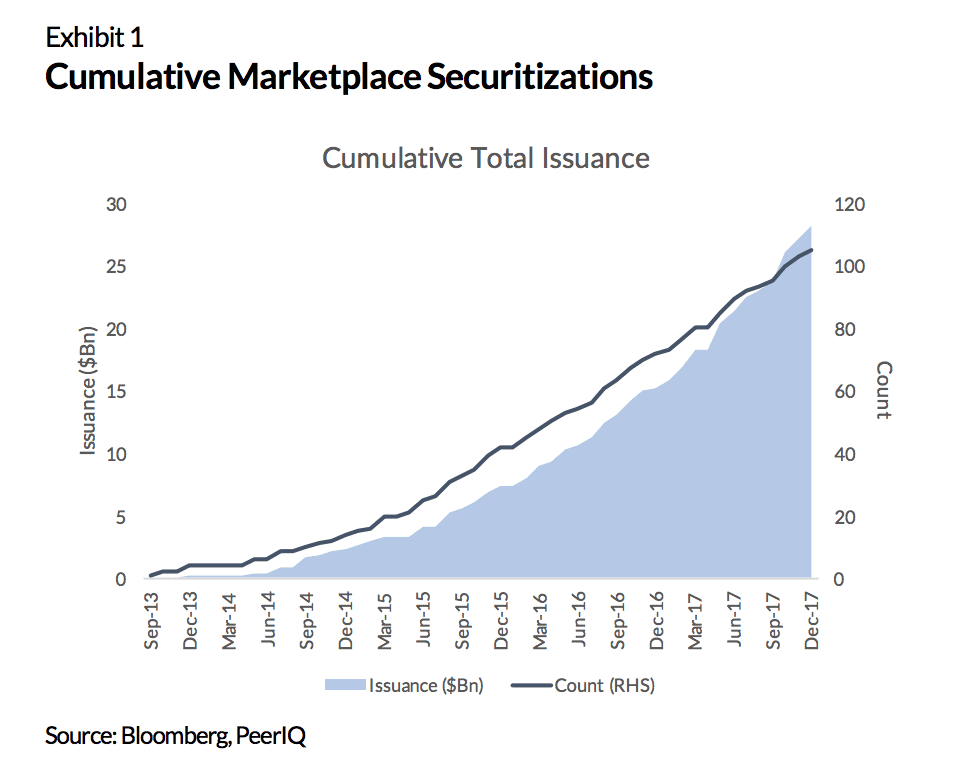

Issuance in the quarter totaled $4.4 billion, which is another record and represents a 100% increase over Q4 2016. Total issuance is now $28.2 billion and PeerIQ expects issuance to grow by 30% annually to $18 billion in 2018. PeerIQ shares that investor appetite for these securitizations continues to grow.

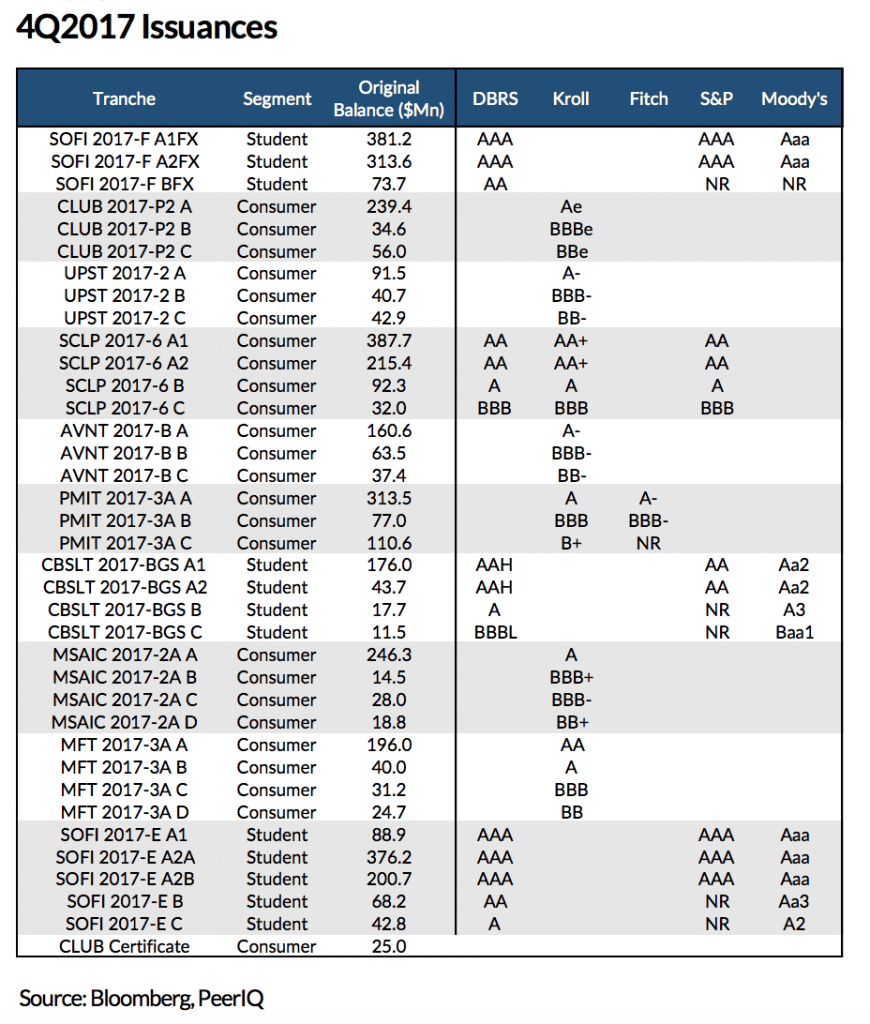

All deals for the quarter were rated by at least one rating agency. Kroll Bond Rating Agency leads in rating consumer deals while DBRS leads in rating the student lending deals. SoFi continues to impress as they issued the largest consumer and student lending deals ever in marketplace lending. Upstart issued their second securitization and is expected to be an annual issuer. Besides their standard securitizations, LendingClub also completed a whole loan pass through security to a single investor which is listed at the bottom of the below table.

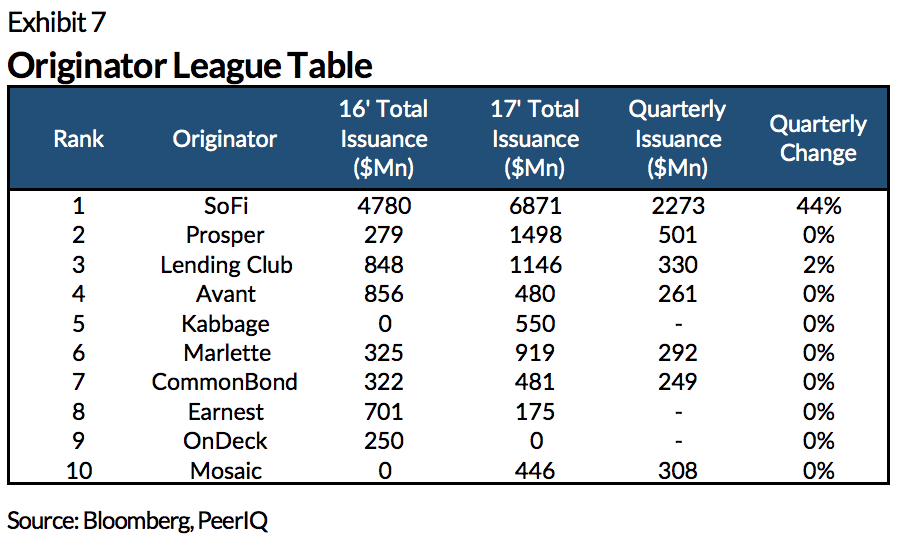

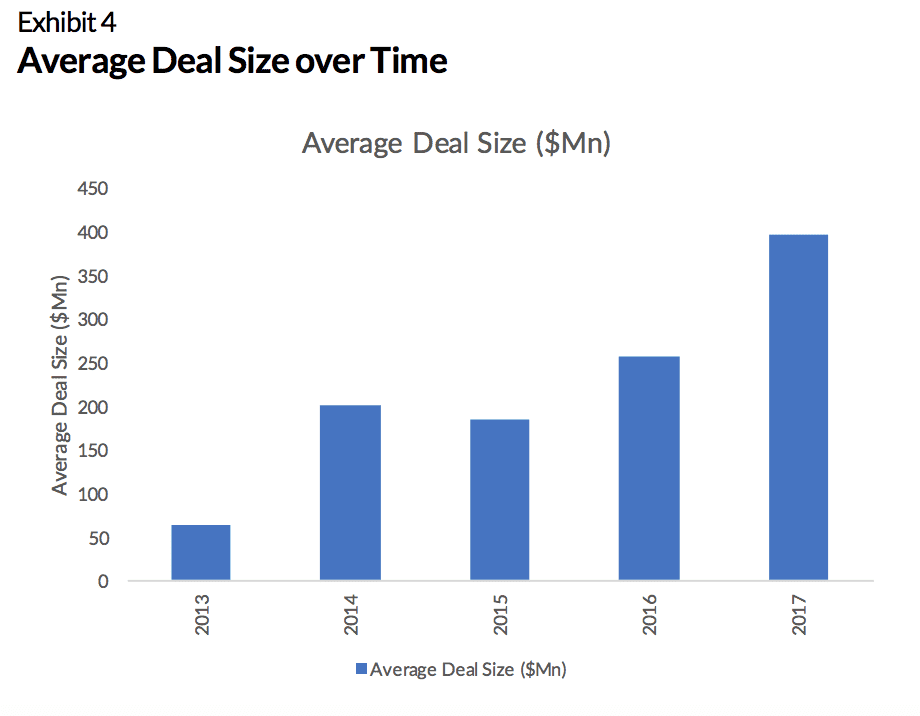

PeerIQ also shares the breakdown of issuance by company across 2016 and 2017. Not surprisingly, we’ve also seen the average deal size increase over the years.

Conclusion

What’s fascinating to me is to think about how far the securitization market has come since the early days of the industry. I still remember back in 2014 when Eaglewood was awarded LendIt’s Innovator of the Year Award for putting together the first securitization in the marketplace lending space the previous year. It’s impressive how robust the market is now and how it has grown in such a short amount of time.

If you’re looking for more details of the securitization market you can download the full report for free on PeerIQ’s website. We also recently interviewed Rosemary Kelley from Kroll Bond Rating Agency on the Lend Academy podcast who shared her perspective on the securitization market.