Fintech Nexus asked peers to recommend female fintech founders who they felt we all should watch over the next year.

Today is part one of our series recognizing a group of women who are inspiring the future of the financial technology industry, according to their peers. Fintech Nexus asked the LinkedIn universe, “who are female fintech founders that I can feature in an article related to who we should be watching over the next year?”

I received nearly 100 comments with recommendations on fintech founders who are doing myriad things in the industry, from promoting financial literacy, to helping disadvantaged populations have access to credit to securing venture capital funding to taking their company to unicorn status.

Speaking of funding, while fintech continues to dominate the technology landscape, female founders and co-founders still don’t get the kind of venture capital backing of their male peers. Pitchbook’s recent report shows a significant gap between U.S. venture capital deals and amount of investment in female founders versus companies with male and female founders.

There is a bit of good news with the new numbers — the drop in investments to female founders seems to be leveling off a bit and capital invested skyrocketed in the first quarter of 2025.

That said, let’s take a look at the female fintech founders captivating their peers. I couldn’t include all of the recommendations, but you can see most of them in the LinkedIn post. The following are listed in alphabetical order.

Ximena Aleman

Co-founder and co-CEO of Prometeo

What she’s doing: A single application programming interface for cross-border payments in Latin America that connects over 1,200 financial institutions in 11 countries.

Why Ximena is crushing it:

- A pioneer in open finance, she champions female entrepreneurship and highlights the funding gap faced by women-led startups in Latin America.

- Under her leadership, Prometeo has partnered with major financial institutions, including global megabanks, and secured backing from investors like Antler Elevate, PayPal Ventures and Samsung Next.

- Her achievements in the fintech community have earned her roles such as WeFinTech Ambassador and accolades including Global Catalyst and Entrepreneur of the Year by AMBA in 2022, “Top 100 Women in Fintech” by FinTech Magazine in 2024.

Where you may have read about Ximena:

Latin America Reports’ 40 Under 40 in 2025

Prometeo Co-CEO on What It Takes to Create Latin America’s Connected Financial Ecosystem

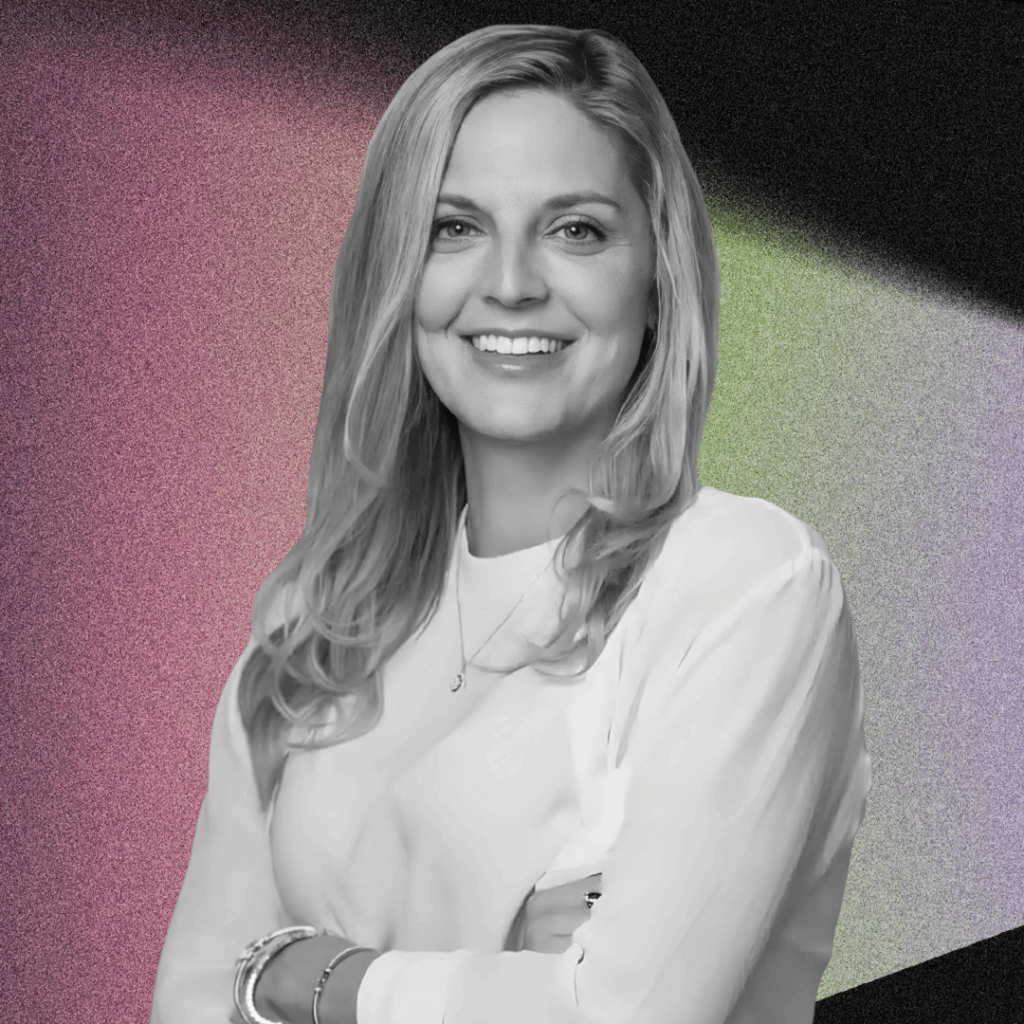

Rebecca Kacaba

Co-founder and CEO of DealMaker

What she’s doing: Rebecca grew DealMaker from a scrappy startup to a business transacting over $2 billion in retail investments. Now she is leading the charge for a new era of “crowdfunding.”

Why Rebecca is crushing it:

- Holds the record for the largest month of Reg A, CF and D raises ever achieved by any platform, surpassing $100 million in a single month, according to the company.

- Scaled the business 875% from fiscal year 2021 to fiscal year 2024.

- Tout a list of clients that have raised retail capital with DealMaker, including Green Bay Packers, EnergyX, Newsmax and Monogram Technologies.

- Was called to testify in front of Congress about strengthening public and private markets by increasing investor access and facilitating capital formation.

Where you may have read about Rebecca:

Disrupting Traditional Fundraising With Digital Innovation

Ana Mahony

Founder and CEO at Addition Wealth

What she’s doing: Provides a customizable, AI-powered financial wellness platform for employers and financial institutions. The platform leverages data and insights to create highly personalized experiences for individuals and employees and provides digital tools, educational content, and access to financial professionals based on their specific needs.

Why Ana is crushing it:

- She led the onboarding of dozens of new companies and formed partnerships with Fortune 500 institutions, now supporting hundreds of thousands of individuals.

- Just announced its B2B financial wellness platform for large enterprises that powers financial wellness platforms behind the scenes for major financial institutions, which allows it to reach even more people at scale and with meaningful personalization.

- Ana and her team were featured as a 2025 Inc. Magazine Female Founders 500 honoree.

Where you may have read about Ana:

Ana Mahony, Founder & CEO of Addition Wealth on the digital plus human approach to financial health

How financial literacy can transform employee confidence and wellbeing

Employees can count on Addition Wealth for free, holistic financial planning services

Alexandra Mysoor

Co-founder and CEO of Alix

What she’s doing: Helps customers settle the estates of their loved one with expert-led resources.

Why Alexandra is crushing it:

- She’s launched and scaled over six multi-channel consumer brands.

- Works to make the expected $84 trillion in wealth transfer process easier. This is a relatively new concept — a company helping families through the estate settlement process.

- In the past year, Alix secured a deal with aftercare company Elevia to offer its services to Elevia’s 1,500 funeral home partners.

Where you may have read about Alexandra:

Alix Simplifies Estate Settlement for Families

Founder Spotlight: Alexandra Mysoor, CEO and cofounder of Alix

Shari Noonan

Co-founder and CEO of Rialto Markets

What she’s doing: Rialto Primary supports companies looking to raise capital and issue equity and debt securities using Regulation A+, Regulation CF and Regulation D, by providing the companies with an administrative and compliance infrastructure to receive and process investments and issue shares using online methods to retail and accredited investors.

Why Shari is crushing it:

- In July, Rialto received regulatory authority to launch first-to-market America Depository Receipts programs in digital format via the Digital Securities Depository Corporation network. Meaning, it is the first FINRA-regulated broker dealer to be allowed to tokenize the public equity market.

- Rialto Markets supported Atlis Motor Vehicles, a woman-founded electric vehicle company, from its first crowdfunding campaign through to its IPO in 2023.

Where you may have read about Shari:

Capital Ideas: Rialto Markets CEO Shari Noonan Highlights Community Capital and Tokenization Trends

Obiaku Ohiaeri

Founder and CEO at Binkey

What she’s doing: API-enabled payment service that helps merchants accept pre-tax health benefits, like Flexible Spending Accounts and Health Savings Accounts, as a form of payment at checkout and allows customers to save on out-of-pocket health expenses.

Why Obiaku is crushing it:

- Through Binkey, she is helping people increase access to financial wellness.

- Months after launching in 2023, Binkey was the first IRS compliant, end-to-end payment processor for FSA/HSA payments in the market, according to the company.

Where you may have read about Obiaku:

Binkey Rewind: A Lookback Cashback Program Redefining FSA/HSA Claim Filing

Binkey, a financial technology company that maximizes health benefits, seeds $3.3M

Stay tuned for part 2 of our amazing list next week!