One of the main advantages that marketplace lenders tout is that technology powered lending takes many of the pain points out of the loan origination process. Probably the most cumbersome and complicated process in lending that consumers will face in their life comes when they apply for a mortgage. It’s a process that should be more efficient. Blend was founded in 2012 and hopes to improve the mortgage process for both lenders and borrowers by providing an experience far better than the decades old technologies that are currently in place.

Blend is well funded, having raised a $40 million Series C round in January 2016, led by Founders Fund (Peter Thiel’s investment company), Lightspeed and Formation 8. Other notable investors include Andreessen Horowitz, Max Levchin and Hans Morris.

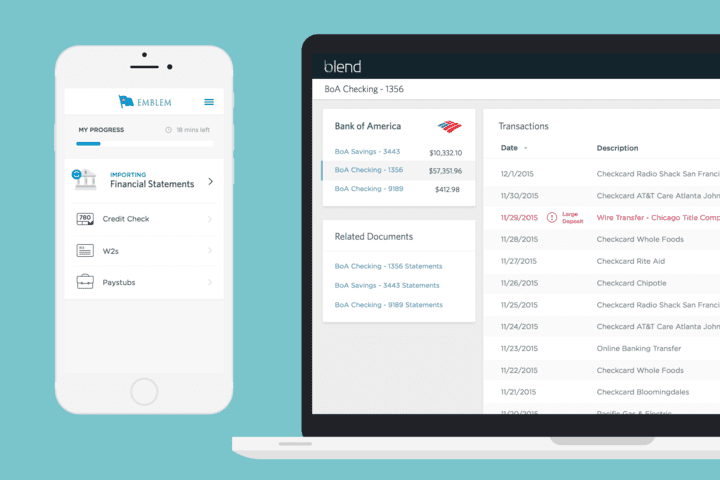

On the consumer side, they aim to simplify and automate the application pre-approval process. This includes the use of electronic statements, the ability to take pictures of documents such as W-2s and a soft credit pull earlier in the process. This process isn’t new in the unsecured lending space with companies such as Lending Club and Prosper among many others who were pioneers in getting a loan online, but this trend is just starting to take hold in the mortgage market. The result is a much better borrower experience.

To tackle the market, Blend is partnering with lenders which can benefit from using their technology as well. Blend believes lenders are much better suited to leverage a tech platform instead of trying to build it themselves since building the tech is both complex and expensive. It is much more efficient for the lenders to automate the mortgage process by partnering with a technology partner like Blend and take out the human element.

Paying a mortgage processor can range anywhere from $100 to $1000. In most cases, these processors are simply pulling pdfs and tracking information along the mortgage process. If the total cost of funding is $7,000, this can mean significant savings from the lenders perspective. The goal is cutting the cost of funding down significantly from $7,000 to $500 or even less. This leads to higher profitability and the potential of passing the savings on to a borrower in a vertical where most customers are lost due to price competition. Once lenders can compete on price, Blend believes lenders should try to differentiate on product.

Peter Thiel explains his take on the lenders as part of the press release in their latest series C round:

This is a technology challenge that lenders are not positioned to solve on their own, Blend’s engineers and data scientists are making the high-stakes mortgage transaction better for lenders and borrowers. They are changing the way the entire industry operates.

Conclusion

Most people would agree that the mortgage industry needs a more modern infrastructure. While this is something that will take time, Blend has already secured several top-30 lenders as clients. At one client, thirty percent of borrowers are using their mobile device to fill out their mortgage application. Near half of these customers are doing so on nights and weekends when no customer service would be available if they were applying for a mortgage using traditional methods. Having been through the mortgage process several times I can appreciate what Blend and other companies are doing to try to make the process more simple, transparent and efficient.