Pinwheel released a consumer finance survey that showed 75% of respondents wished consumer finance relied on more than just credit scores.

Out of 2,000 survey respondents, most wanted a more open financial system.

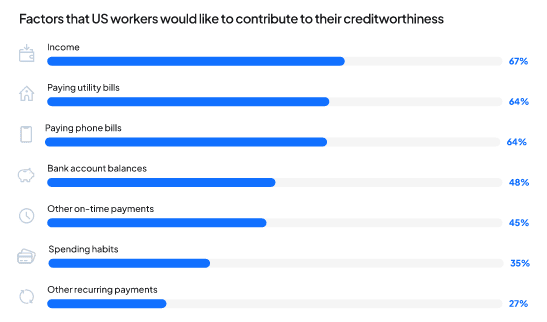

\More than half of customers agreed credit scoring lacked transparency and was not updated fast enough. 67% said that they wished credit scoring included income data. As Pinwheel would argue, income data can help lenders offer personalized services like ID verification, earned Wage Aces, and Cash Flow underwriting.

Beyond the credit score

Card debt is rising at record rates, and Pinwheel said struggling consumers face limited avenues to climb out of debt, with predatory options like payday loans the most accessible. Research shows that most respondents were comfortable sharing their income and payroll data, over 80%.

53% said credit scoring methods were not transparent, and 42% said they did not feel included in the current credit scoring system and had limited control over their financial data.

Almost half, 49%, said that the current system is missing information that would otherwise show they are financially responsible. Broken down by income demographics, lower income brackets had twice as much impact on their lives of bad credit history. Data show 14% of those making $75,000-$100,000 had an insufficient credit history. Comparatively, 29% of those making a yearly income of less than $30,000 said an incomplete credit history hurt them.

The report cited research by the Consumer Financial Protection Bureau that showed inaccurate information is more likely to affect younger people, those with poor credit, and people living in majority Hispanic and Black communities. Director Rohit Chopra said errors undermine financial recovery.

“Families living in majority Black and Hispanic neighborhoods are far more likely to have disputes of inaccurate information appear on their credit reports,” Chopra said. “Error-ridden credit reports are far too prevalent and may be undermining an equitable recovery.”

Propelling consumer finance into the future with income data

Pinwheel promoted two income data insights to support better financial services. Pinwheel Verify connects financial service providers with their customer’s user-permissioned payroll data, so they can reduce fraud and risk, expedite application processing, and enhance underwriting models with more data. The API features live access, meaning that financial providers’ access to payroll data is ongoing, with alerts when changes occur.

Pinwheel Earnings Stream takes payroll data, analyzes it, and returns real-time insights into a customer’s earnings. It displays actual historical cash flows, accrued earnings in the current pay period, and projected earnings and pay dates. With these insights, Pinwheel said financial providers could lower risk, increase customer engagement, and support new financial products.