The addressable market for marketplace lenders is massive. The one trillion dollar figure has been thrown out as the market for consumer loans alone. But one thing we don’t hear a lot about is the market share of marketplace lenders related to banks. Lenders like Prosper and Lending Club are beginning to achieve scale. But what kind of impact will marketplace lending really have on traditional banks? How much does the traditional banking sector stand to lose if they fail to adapt?

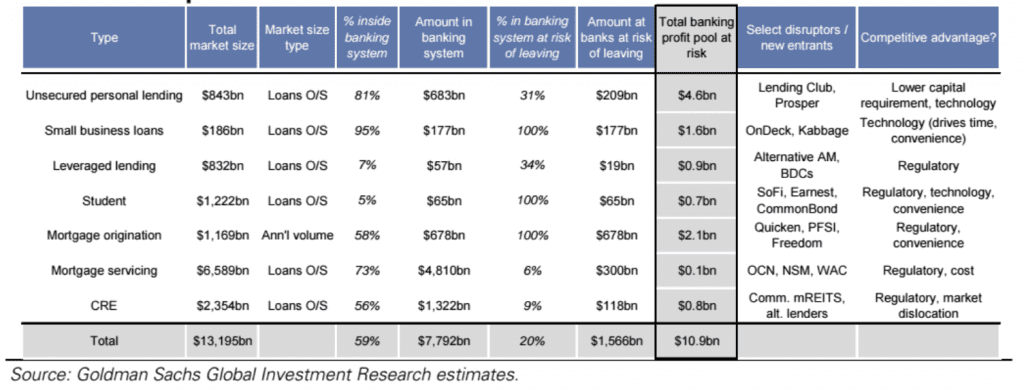

In a recent report from Goldman Sachs, titled “The Future of Finance – The rise of the new Shadow Bank”, analysts try to answer that question. Shadow banking is defined as any lending activities that take place outside of the traditional banking system which would include the marketplace lenders. The estimate is that around $11 billion out of $150 billion in annual profit is at risk to leave the banking system over the next 5+ years from marketplace lending. There are many verticals when it comes to lending, so looking at the breakdown can help us understand the opportunities that lie ahead for the industry.

To no surprise, unsecured personal lending is at the top of the list of total banking profit pool at risk with $4.6 billion. Lending Club and Prosper are dominating this space, which is a $843bn market. Their current market share is just 2% and Goldman analysts estimate that this could grow to 15% in the next 5 to 10 years.

Small business loans is the second most established vertical in marketplace lending as companies like OnDeck and Kabbage take on the $186 billion addressable market. To get an idea of the need that exists, the report states that alternative lenders approved 62% of the small business requests in January 2015. Big banks approved just 21%.

How are they able to compete?

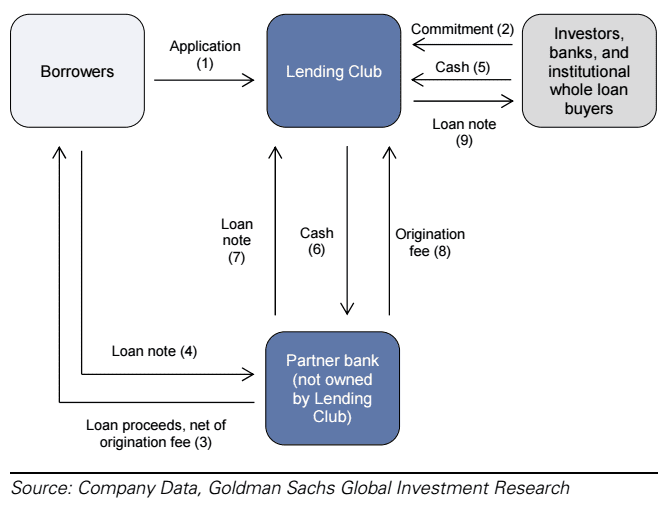

The report outlines three things that have lead to the rise of the marketplace lenders. One is regulatory arbitrage. Recent regulations have increased the cost for traditional banks, which further hampers their ability to compete. The new marketplace lenders are currently not subject to many of these regulations or are able to avoid them altogether. For instance, instead of originating the loans themselves, Lending Club and Prosper partner with WebBank. WebBank handles the origination of the loan, which is then purchased by Lending Club or Prosper.

In the future, we could see additional regulations, which could slightly narrow the cost advantage gap that marketplace lenders offer over traditional banks.

The second is technology, which I believe is the biggest advantage and accounts for a majority of the cost savings for borrowers. Marketplace lenders now have an incredible amount of data on borrowers. They can continue to refine their underwriting to more appropriately set interest rates. Decisions are made within a matter of seconds and the application is all online. Above all else, online lenders can achieve scale in a way that no traditional bank can.

Finally, the Goldman Sachs analysts point to a favorable macro environment as a factor in moving towards non-bank lending. Both interest rates and delinquencies are at historically low levels. Investors are hungry for yield, making this a perfect time for the marketplace lenders to grow.

Besides leveraging technology and the lack of a need for a brick and mortar bank, there is something else that differentiates the p2p lenders. It’s the way the loans are funded. Since Lending Club and Prosper don’t fund the loans themselves, the loans aren’t on their balance sheets and they don’t need to hold deposits. The banks bear the credit risk. Many people will argue that this is an issue that some marketplaces don’t have skin in the game, but because of this, they are able to achieve massive scale.

It’s clear that Goldman analysts are bullish on this sector. However, they warn against the potential of increased regulatory constraints and the road bumps ahead as companies move into other asset classes like mortgages. The banks are unlikely to sit on the sidelines as their market share is gobbled up by marketplace lenders. This report serves as a blunt reminder that the marketplace lenders are here and there is market share for the taking.