Even though Prosper is a private company because the SEC regulates it, every quarter it has to furnish financial statements in a Form 10-Q. I have been keeping an eye on these statements for many years. And the 10-Q filed with the SEC yesterday is the first time Prosper has ever shown a profit.

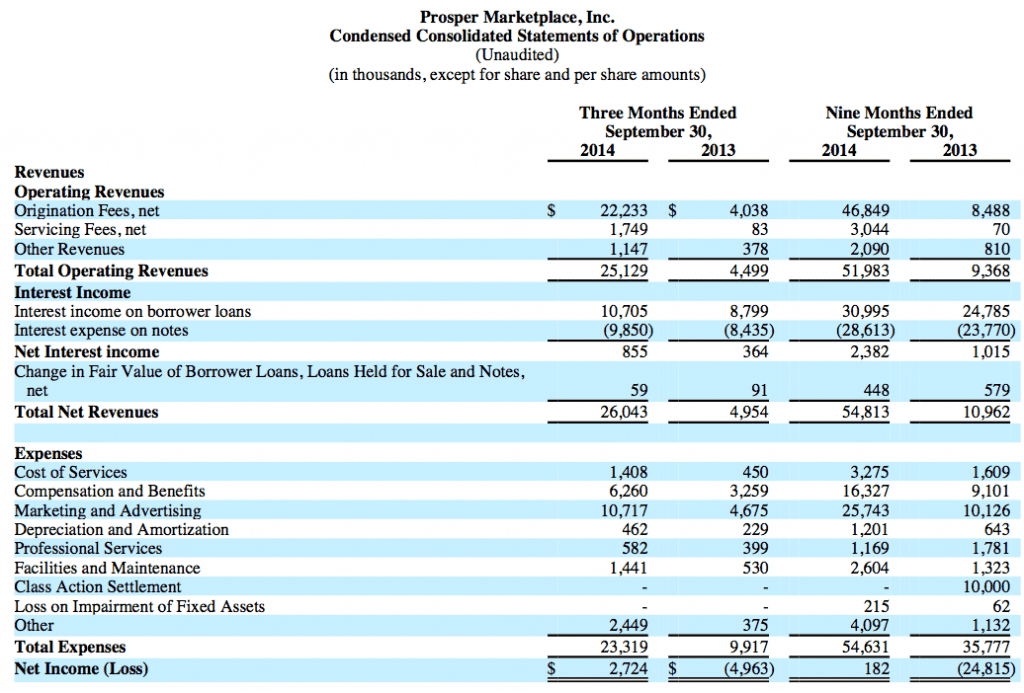

I have copied their Statement of Operations below because it is worth highlighting here (click on the image for a larger picture).

Compared to the third quarter of last year total revenue jumped from $5 million to $26 million while at the same time expenses increased from $10 million to $23 million. So, a $5 million loss was turned into a $3 million profit.

After losing money every quarter since they began operations in February 2006, Prosper has finally turned the corner. They are even showing a small profit on year to date numbers so they should close 2014 well into the black. And with $53 million in cash on their balance sheet Prosper is in a very strong financial position today.

Vote in Prosper’s Borrower Photo and Video Contest

In celebration of crossing $2 billion in total loans last month Prosper has been running a contest. Borrowers were asked to submit photos and videos about why they liked taking out a Prosper loan and the lucky winners will get cash prizes. The video winner actually gets their loan completely paid off by Prosper.

This lead to some motivated entries. The Prosper team culled through thousands of entries and came out with their top 5 in each category. The Prosper community will decide the winners. There are some great entries here and I have voted for my favorites.

As investors we don’t have any real contact with borrowers. This Prosper contest is a good reminder that there is a real person with their own story at the end of every investment we make. This contest celebrates the best of these stories.

I urge everyone to vote – all five finalists are very deserving of having their loan paid off. Click here to vote for a photo, click here to vote for a video. Voting is open until November 24th.