Today, Prosper reported their full year results for 2017. Prosper is still a private company, but is regulated by the SEC which requires them to provide quarterly and year end results. Prosper’s full 10-K which includes all of the details about their business is available using EDGAR on the SEC website.

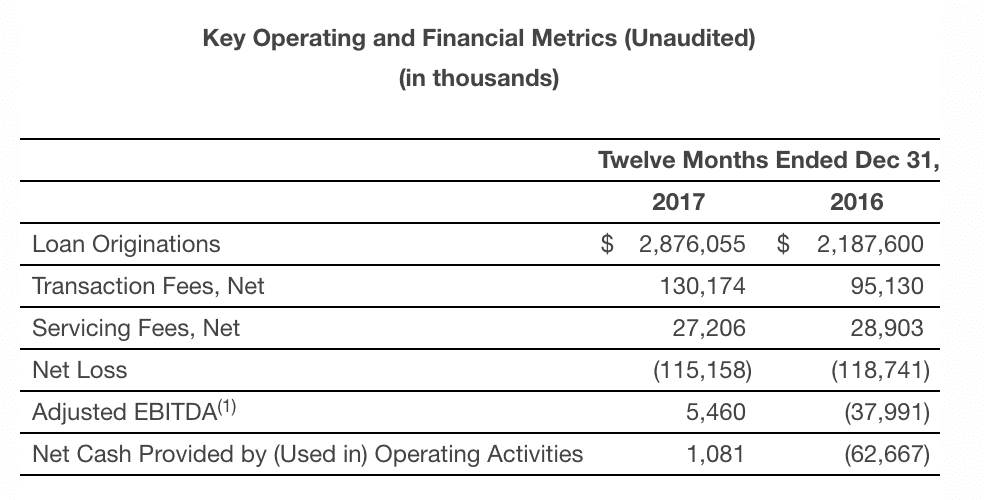

The company originated nearly $2.9 billion in loans, up from approximately $2.2 billion in 2016. From our perspective there were two major milestones for the company in 2017. One was the $5 billion consortium deal announced at the beginning of 2017 which was a commitment from investors to purchase loans over a two year time period. The company also successfully raised their Series G funding in September, 2017. As noted in our piece on the announcement this was a significant down round from their previous fundraise in 2015 but it reflected the reset expectations when it comes to valuations.

While the company had a net loss for the year of $115 million, this was largely due to the consortium of investors as noted in the press release: “Net loss of $115 million included $89 million of non-cash charges related to warrants to purchase preferred stock that were issued to a consortium of investors and a third party in connection with a settlement agreement.”

Adjusted EBITDA was $5 million, up $43 million from the year before and more importantly Prosper was cash flow positive for the year, generating just over $1 million in cash. Other financial metrics are shared below:

Prosper’s accomplishments in 2017 were critical to their success going forward. While there are no longer headlines touting massive growth at Prosper, they still are originating a significant amount of consumer loans and they are doing so profitably. The consortium secured investors for a 2-year period and they now have cash to invest in new projects. It’s going to be interesting to see what innovations come to bear in what seems like an ever increasingly competitive consumer loan market.