It was only a couple of months ago that we wrote about Prosper’s 2017 results. The major highlights were growing originations to $2.9 billion and the consortium deal that closed at the beginning of the year. Yesterday Prosper shared their Q1 2018 results.

The company continued its growth in originations which totaled $744 million in Q1 2018. Remember, as discussed last week in LendingClub’s earnings that Q1 is typically a lighter quarter for originations.

Prosper’s originations were up 27% from the prior year period. For comparison purposes, LendingClub increased originations 18% over the same period although it’s worth mentioning that LendingClub originated about three times as many loans in the first quarter.

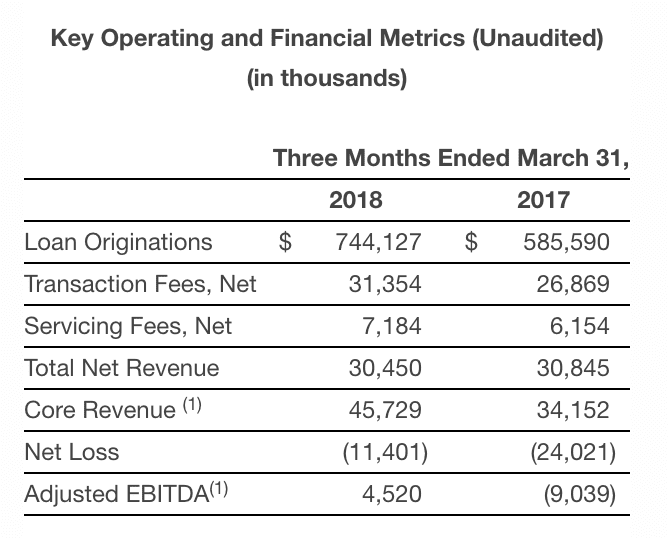

Prosper also made progress in improving their financials, producing a net loss of $11.4 million compared to a net loss of $24 million in Q1 2017. The company produced a net loss of 22.7 million in Q4 2017. Total net revenue was approximately flat year over year coming in at $30.5 million in Q1 2018. Prosper highlighted in their press release that this includes the non-cash impact related to warrants to purchase preferred stock. Excluding these warrants, Prosper reported that core revenue increased to $45.7 million, up 34% from the prior year period.

Prosper included their fourth and largest securitization as a milestone for the company which closed in the first quarter. It was a $650 million transaction which put the company over the $2 billion mark in securitizations. Prosper also closed their first $100 million revolving warehouse facility to participate in loans originated by the platform.

Below is a table which summarizes their financials for the quarter:

Prosper’s 10-Q is available in its entirety on the SEC’s Edgar website. While there are plenty of details about Prosper’s business there, I’ve taken our a snippet below which discusses Prosper’s investor concentration. There are two takeaways here. One is that Prosper is relying significantly on one whole loan buyer. The second is that the retail channel continues to shrink. Only 7% of loans are funded through the fractional marketplace, down 3% from the prior quarter.

Prosper is dependent on third party funding sources such as banks, assets managers and investment funds to provide the funds to allow WebBank to originate Borrower Loans that the third party funding sources will later purchase. Of all Borrower Loans originated in the quarter ended March 31, 2018, the largest party purchased a total of 45% of those loans. This compares to 33%, 24% and 12% for the three largest parties for the three months ended March 31, 2017. The party purchasing 24% for the three months ended March 31, 2017 is a member of the Consortium and purchased these loans prior to the closing of the Consortium Agreement on February 27, 2017. Further, a significant portion of our business is dependent on funding through the Whole Loan Channel, for which 93% and 90% of Borrower Loans were originated through the Whole Loan Channel in the three months ended March 31, 2018 and March 31, 2017, respectively.

One piece not explicit in Prosper’s press release is loan performance. One of the other resources I get value out of is Prosper’s monthly performance updates which they post to their blog. The latest post highlights takeaways from March. These are a great way to better understand how loans are performing, how loan grades are shifting and what Prosper is seeing overall from their borrowers without having to dig deep into their 10-Q.

Conclusion

Prosper has made significant progress over the last year. While it is apparent that the consortium has had an effect on their net revenue it also has allowed the business to grow over the same time period. It’s going to be interesting to see whether we continue to see significant origination growth over the coming quarters and how that effects the company’s bottom line.