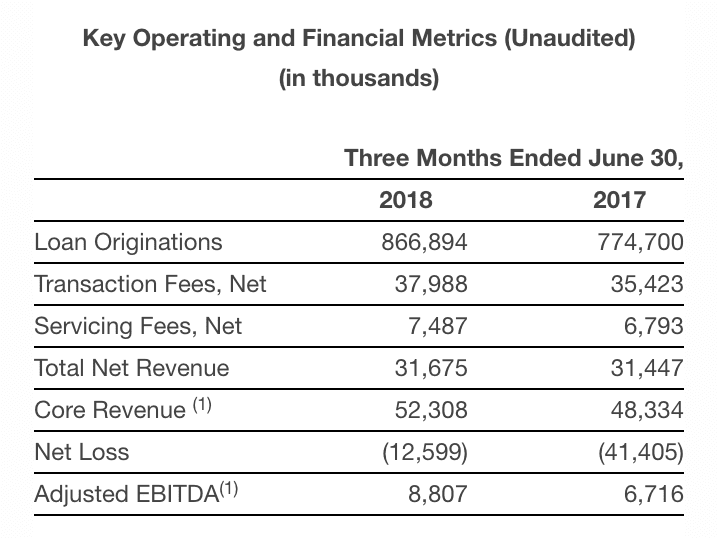

Yesterday, Prosper reported their Q2 2018 results. The company facilitated $867 million in loans for the quarter, up 12% from the prior year period. Prosper reported a net loss of approximately 12.6 million. While this is significantly better than the prior year period of $41.4 million, their losses increased slightly from the first quarter ($11.4 million). Total net revenues for Q2 2018 were $31.7 million, up slightly from the prior year period.

Below is a summary of Prosper’s key operating and financial metrics:

With their recent quarter, Prosper crossed the 1 million loan mark and surpassed $13 billion in loans total. David Kimball, Prosper CEO provided his perspective on the company’s progress related to adjusted EBITDA as well as platform changes in a prepared statement included in the press release:

“For the fifth consecutive quarter we successfully balanced growth with generating positive Adjusted EBITDA…Maintaining a balanced marketplace that provides value to both borrowers and investors remains our highest priority. Throughout 2018, Prosper has been raising interest rates and significantly tightening credit in order to ensure that we continue to provide a fair price for borrowers and a solid risk-adjusted return for investors.”

Prosper also highlighted that they have upsized their committed revolving warehouse facility to $200 million to continue to participate alongside their investors. We’ve seen this elsewhere in the marketplace lending space with LendingClub holding more loans on balance sheet for the purposes of selling these loans to investors at a future date. As of June 30, 2018 Prosper had $116.8 million of loans on their balance sheet held for sale.

You can view Prosper’s full 10-Q report on the SEC website.