There has been a shift in focus at the large online lending companies over the last year and a half in the US. Gone are the days of relentless growth and now we see a focus on cash generation and the bottom line. Companies have proved that they can use technology to better serve borrowers, but many investors are wondering if they can do it profitably. Last week we shared third quarter earnings releases from LendingClub and OnDeck and yesterday Prosper released their third quarter results.

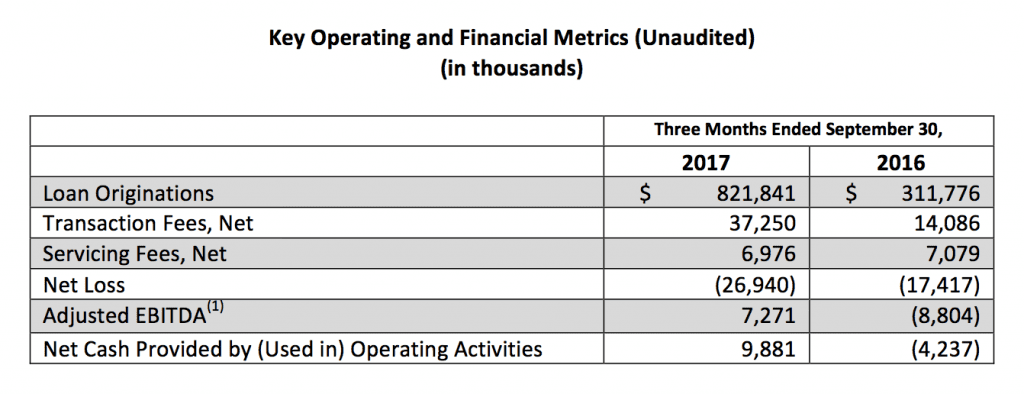

Originations grew to $821 million in the quarter, up from $311 million in the same period last year and grew 6% from the previous quarter. The company also increased the fees it collected. Prosper reported a net loss of $26.9 million for the quarter, which was an increase of about $10 million from last year. According to the press release the amount, “included $28.1 million in non-cash charges related to warrants to purchase preferred stock that were issued to a consortium of investors and a third party in connection with a settlement agreement.”

The consortium referenced was announced earlier this year and included loan purchases of up to $5 billion over two years. This is the reason you’ll notice an Adjusted EBITDA of about $7 million for the quarter in the table below. More importantly, you will see net cash flow in Q3 of $9.9 million up from $8.6 million in Q2 and -$4.2 million in the same period last year.

Other highlights for the quarter include a third securitization totaling approximately $500 million of notes. In total Prosper has closed three securitizations this year, totaling $1.5 billion.

David Kimball, CEO of Prosper stated in the press release:

We continued to see growth during the third quarter as people turned to Prosper’s personal loan product to refinance high-interest debt, pay for medical expenses, and finance home improvement projects. As we look to the end of the year and 2018, our ability to consistently generate positive operating cash flow along with the $50 million capital raise in the third quarter will help drive strategic investments in the company’s platform and products.

Conclusion

Clearly the consortium deal is having an effect on Prosper’s financial results, but as discussed previously this deal was critical to ensure the success of Prosper over the long run. Coming off from a significant decrease in originations in the second quarter of 2016, Prosper has steadily increased originations again. The company also closed their Series G round in September albeit at a much lower valuation than the round in April, 2015. Looking towards the future I expect the company will steadily grow the business while at the same time continuing to generate cash. What will be interesting, though, is what new projects they decide to invest in with the influx of cash.

The full 10-Q report for the third quarter is available on Prosper’s website.