Even though they are a private company, every quarter Prosper files a 10-Q with the SEC which highlights their financial performance. We last covered their 10-Q last year when Prosper recorded their first quarterly profit, but their latest 10-Q for the quarter ending September 30, 2015 was released yesterday. The biggest takeaway is that sales and marketing costs are significantly higher as Prosper looks to grow the business.

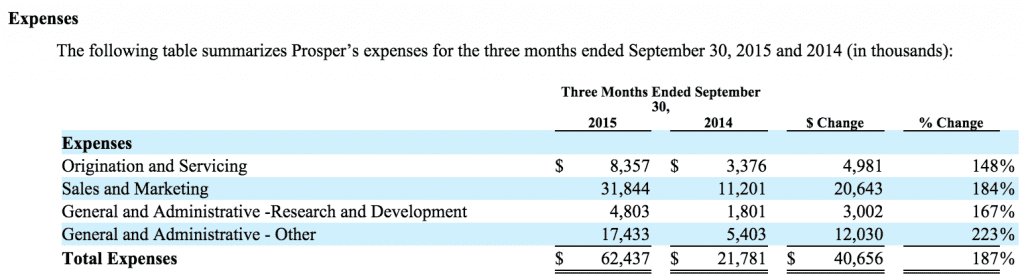

Their expenses for the latest quarter were nearly three times higher than the same quarter last year. The cost increases for the three months ending September 30, 2015 are related to numerous marketing channels where they have been investing to increase originations. The biggest percentage increases in spend comes from online marketing ($1.3 million increase, 366%) and marketing staff ($3.3 million increase, 699%). Direct mail and affiliate marketing increased 187% and 159% respectively. When looking purely at the dollars spent, it is clear that direct mail continues to be a big channel for Prosper as they increased spending by $9 million. Affiliate marketing spend increased by $6.7 million. See below for the breakout of other expenses.

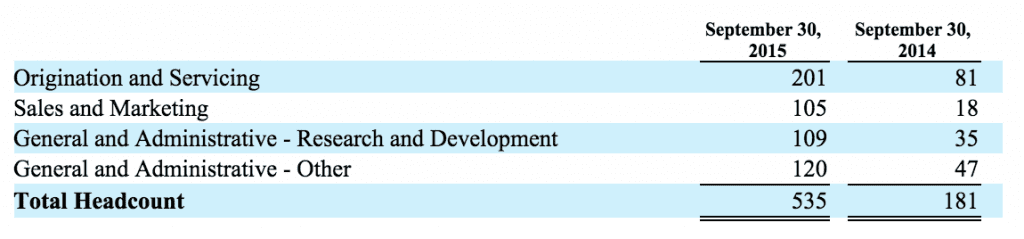

The 10-Q also notes that they have hired eighty-seven additional employees in the marketing and sales department, but they are also hiring aggressively across the board. In the past year, they have hired 354 staff bringing their total to 535.

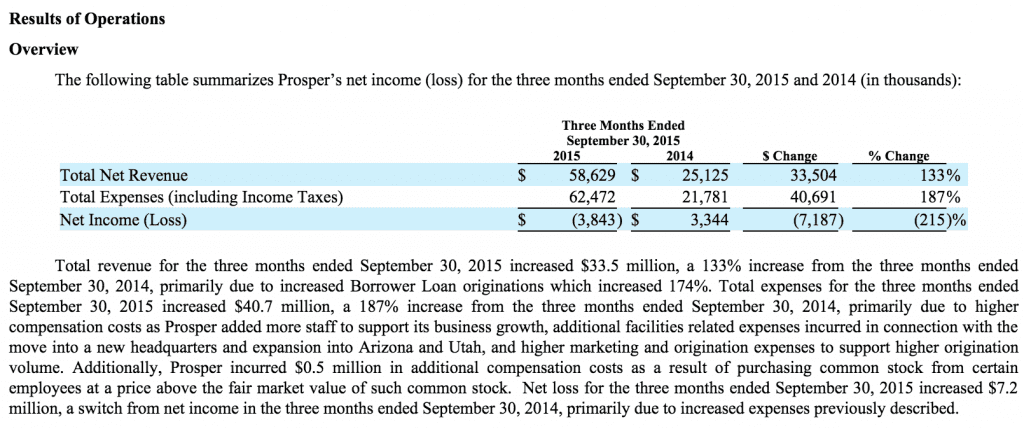

Revenue more than doubled, but was not enough to turn a profit for the quarter ending September 30, 2015.

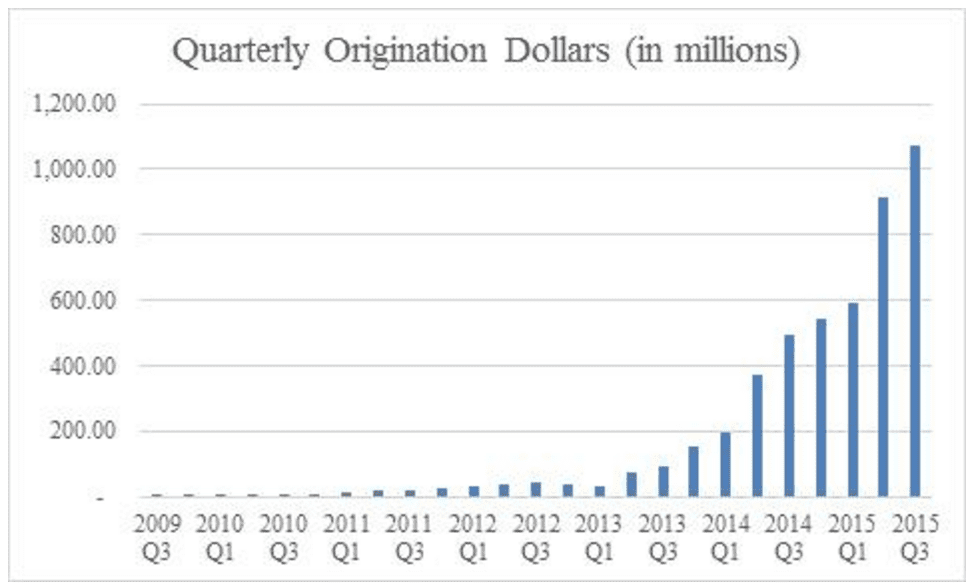

It is clear that Prosper is focused far more focused on growth today than they are on profitability at this time. Prosper has seen extraordinary growth over the last year as they continue to more than double their originations year over year. The graph below illustrates their quarterly growth, including their most recent quarter where they surpassed $1.1 billion in originations.

We reached out to Prosper for some additional color on their 10-Q financials but they declined to comment.