On May 25th, Prosper announced the closing of the first securitization they facilitated themselves. The news was not widely reported, with the exception of this excellent piece by PeerIQ, and we believe the securitization marked an important milestone for the company. In order to learn more about this deal we reached out to Usama Ashraf, Prosper’s new CFO, for his take on the transaction and highlight below why this securitization was a big deal for the company.

The Prosper Marketplace Issuance Trust, Series 2017-1 or PMIT 2017-01 initially planned on issuing $450 million of notes, but the deal was increased to $495 million due to heavy investor demand. Approximately 30 investors participated in the oversubscribed deal, and the strong investor interest was a good sign for Prosper. The securitization included solely loans purchased by the large consortium that committed to purchase up to $5 billion of Prosper loans.

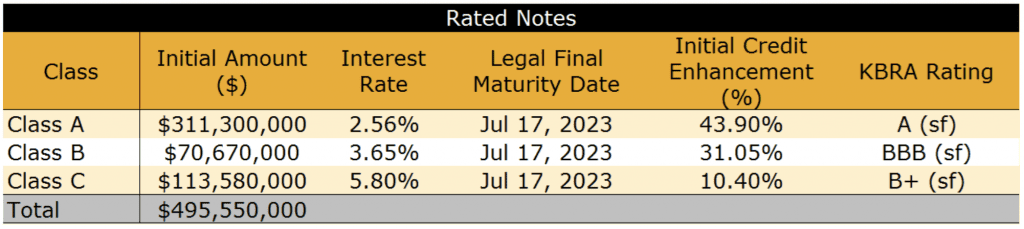

When we asked Usama about how this securitization will affect Prosper going forward he had several comments. Firstly, he stressed the importance of having 30 investors on the deal with some investors buying more than one class of the securitization. As we’ve learned in the past in the online lending industry, investor diversification is very important. Additionally, the transaction was rated by both Kroll Bond Rating Agency, Inc. (KBRA) and Fitch Ratings, Inc., which haven’t rated Prosper deals for a while. The details of the ratings are outlined below courtesy of KBRA.

While Prosper was pleased with having the deal rated by two rating agencies, Usama said there is still room to improve the structure. From Prosper’s perspective, the rating agencies were conservative in their approach. Moving forward Prosper will continue to focus on demonstrating solid credit performance and stability. This may give them the ability to reduce credit enhancement requirements over time.

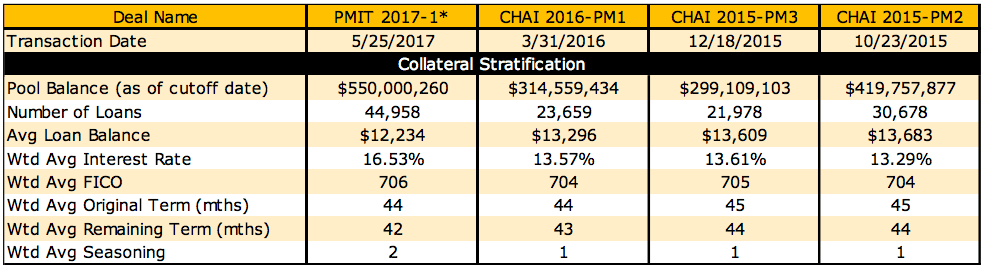

Lastly, it’s important to understand that this securitization is the first one facilitated by Prosper. This deal was structured by Credit Suisse Securities (USA) LLC and co-led by Jefferies LLC. In the past, Prosper’s securitizations were issued by Citi (CHAI) and Prosper did not have much involvement in the process. This new structure will hopefully lead to better outcomes going forward with this first deal being a perfect example. The PMIT 2017-1 and previous CHAI deals are compared below in a table from KBRA.

Conclusion

This is just the first of many potential securitizations coming from the Prosper Marketplace Issuance Trust program. This transaction was well received by investors and Usama noted that this will likely become a quarterly fixture for the company. The consortium plans to continue purchasing loans which will in turn be permanently financed through the securitization market once a quarter. The entire Prosper team was extremely pleased with the outcome and strong execution of PMIT 2017-1. The significant investor demand is a great sign for Prosper and the industry more broadly.