On Tuesday, the b2b SaaS provider Provenir introduced Provenir AI, a no-code AI credit risk underwriting solution. The release came just days after a Provenir published a study that showed most fintechs or fin services were not confident with their current underwriting models.

“Provenir AI propels faster innovation by supporting a lending strategy that delivers the best returns in customer satisfaction and revenues,” Carol Hamilton, SVP, Global Solutions said, “through deeper insights, continuous optimization and smarter, and more accurate risk decisioning.”

Last week, the firm released a joint survey with Pulse, discovering 18% of fintechs and fin services were confident in their underwriting models just three-fourths of the time. The firm envisioned the study as an industry litmus test for the current challenges, but the b2b marketing team said it supported the soon-to-be-announced AI product.

Read the study and findings here.

Study on fintech credit: barriers worldwide

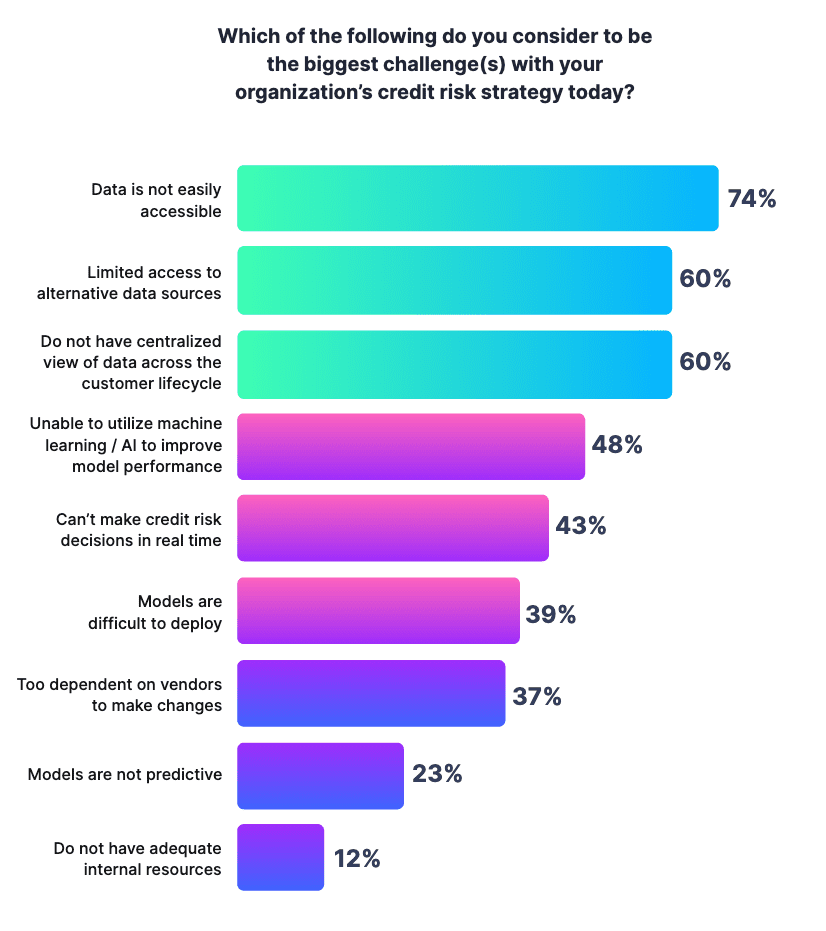

With input from 400 fin services worldwide, the study also reported the most significant pain points in credit decisioning. They found that most decision-makers struggle with their organization’s credit risk strategy because data is not easily accessible (74%,) and access to alternative data sources is limited (60%.) 60% also reported that they didn’t have a centralized view of data across the customer lifecycle.

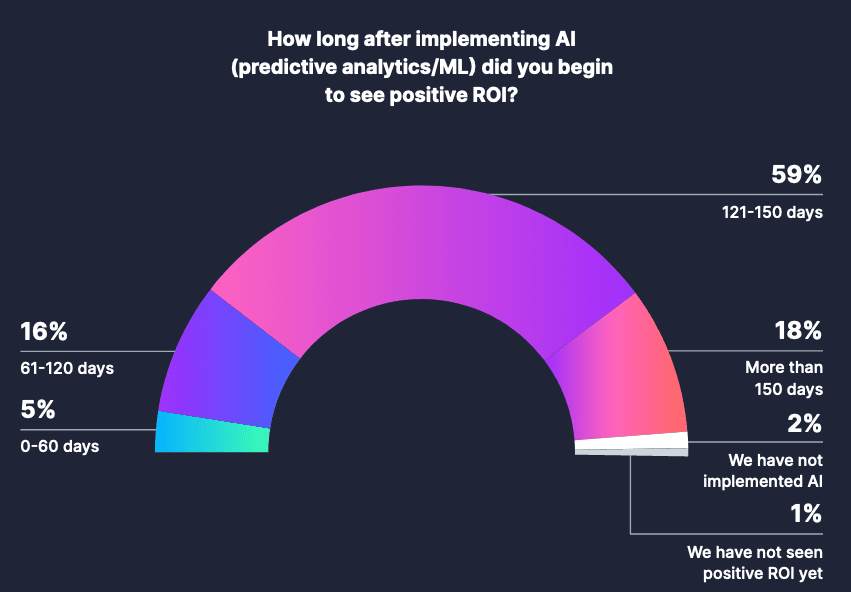

Even for those who used AI products, only 21% said they began to see returns within 120 days. 59% of respondents reported that they did not start to see ROI from their AI implementations for over 3-4 months.

“Consumer credit markets have changed dramatically over the past two years, yet many financial services organizations are still employing legacy approaches to credit risk decisioning,” CEO and Founder Larry Smith said. “The net result is that organizations today have a substantial level of uncertainty in the accuracy of their risk models, which results in less inclusive credit, fewer approvals, and reduced opportunity for business growth.”

Solving Pain Points

Provenir’s new AI product attempts to solve these pain points, aiming to shrink the cost, complexity, resource requirements, and time-to-market of AI with models tailored and trained for risk decisioning.

Reps from the firm said that the new solution offers:

- zero upfront development costs.

- 60-to-90-day implementations for greater time-to-value.

- Full AI explainability provides transparency around the “why” and “how” decisions are made, and more

Additionally, Provenir AI connects with the Provenir Marketplace to mitigate model bias with data diversity. SoFi is one of many firms that use Provenir’s data-driven AI for competitive advantage.

“AI and machine learning are part of the modern toolset that financial services organizations need to build and fine-tune predictive models to deliver high levels of responsiveness and the best customer experience,” Adam Colclasure, SoFi Sr., Director of Risk Infrastructure, said.

The whole point is to implement a solution so fintechs who choose the platform can accelerate the launch of their products, like BNPL, small and mid-size enterprise lending, automotive financing, and more.

“AI finds relationships in your data that traditional decisioning cannot, empowering financial institutions to optimize their portfolio, support greater personalization in product offerings for improved competitive advantage, and elevate fraud prevention and financial inclusion.” SVP Hamilton said.