The Securities and Exchange Comission punted again on allowing a passive Bitcoin ETF to enter the market. It failed to approve the VanEck SolidX Bitcoin Trust, instead opting to open a commentary period to address several questions around Bitcoin price formation and the health of the exchanges. A similar outcome faces the Bitwise Bitcoin ETF. You can tell I am not a fan of this waffling, and there are two core reasons: (1) the years-long delay and uncertainty is responsible for financial damage to both traditional and crypto investors, and (2) the premise of the objections misunderstand the environment of the Internet and the way our world is shaping up in the 21st century.

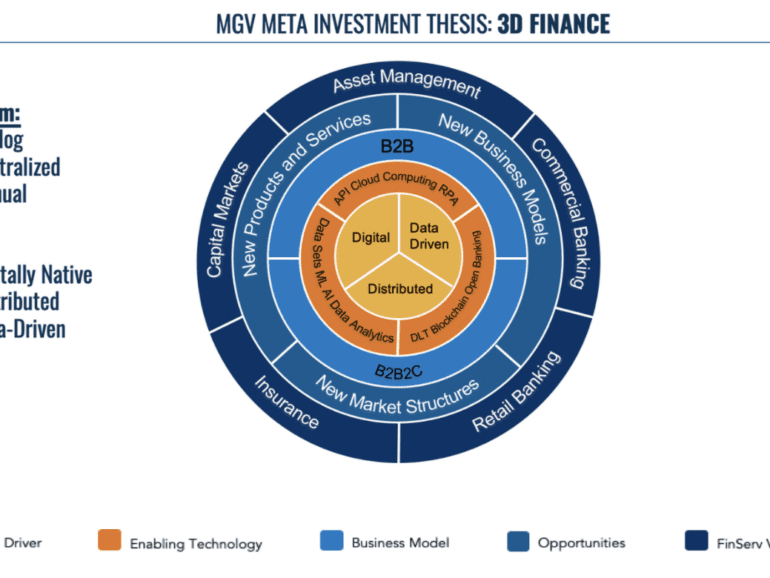

In this conversation, we talk all things Wall Street, FinTech, and Venture Capital with Patrick Pinschmidt, who's the general partner and co-founder at MiddleGame Ventures.

More specifically, we discuss the ups and downs of sell-side research in the early 2000s, the evolution of financial technology to today’s FinTech, an insight into the Financial Stability Oversight Council at the US Treasury Department, the founding of Middlegame Ventures and its impressive investment portfolio, and the transformation of financial services fueled by the rapid innovation in FinTech.

The use of messaging apps raises compliance issues that SnipperSentry addresses. This issue is not going away for fintechs and banks.

A new LexisNexis Risk Solutions report shows how an explosion in sanctions over the past few years has made compliance increasingly challenging for financial institutions.

Blockchain progress through the lens of Binance’s $180MM profit and Greensill’s $1.5B SoftBank raise

Look at the difference between (1) building out the crypto asset class, and (2) operating infrastruture for a blockchain-based digital economy. There are so many little logic pot holes into which you could fall! There are so many things one could believe that make the whole thing make no sense at all! I am anchoring around two primary data points -- a Multicoin report about Binance's financial progress and its massive (though unaudited) $180 million profit in Q3 of 2019, and a post by supply chain company Centrifuge about marrying cashflow financing with the decentralized web.

Anyone watching Fintech over the last decade has recognized an increasing shift of power from product manufacturers to the platforms where those products are sold. In the case of Amazon, Google, and Facebook -- finance is just a feature among thousands of others. I've made this point since 2017, when Amazon launched lending into its platform. Brett King has been a bit more generous in the categorization, calling the shift "embedded banking". This means that banking products are built into you life's journey, not accessed in a separate customer center location. The financial API trend is a tangible symptom of this vector.

artificial intelligenceaugmented realityCryptodecentralized financeenterprise blockchainMetaverse / xRnarrative zeitgeistNFTs and digital objectsregulation & complianceventure capital

·In this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

I anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.

This week, we look at:

What it means to ask questions and find answers

From asking simple questions that result in neobanks and roboadvisors. Who will win — Schwab or Robinhood?

To asking macro questions about the finance / high-tech competition. Who will win — Goldman Sachs or Google?

To asking profound questions about the nature of the work, and the art of finding your own questions.

We can't formulate the questions for you. But we can give you a framework of needs for both the individual, and the organization.

The questions that you ask are the answers that you will get.

In this conversation, we talk with Patrick Berarducci of ConsenSys, about the valuations and multiples of capital markets protocols in Decentralized Finance on Ethereum, now making up over $60B in token value. Additionally, we explore the nuances of scaling Ethereum and its solutions, such as Metamask and the emerging Layer 2 protocols.

We also discuss law and regulation, including a fascinating story about Bernie Madoff from when Pat was a practicing attorney. This leads into a conversation about the embedded compliance nature of blockchain and crypto technology, the early days of ConsenSys, the path of crypto brokerages like Coinbase, and Metamask exhibiting emerging qualities of a neobank.