Economic challenges have affected individuals nationwide this year. Economic growth has stayed consistently low, and inflation, although declining, has dropped due to drastic rate hikes, pushing the cost of living to new levels. All consumers have felt the pinch.

However, according to a new report released today by the Financial Health Network, the impact has varied. Factors such as age, race, and location have influenced how consumers can navigate the difficult climate, making suitable financial solutions critical.

“With 43 million Financially Vulnerable people living in the U.S. today, this year’s Trends Report is a sobering reminder that financial health is out of reach for many Americans,” said Kennan Cepa, principal investigator and Senior Manager of Policy and Research at the Financial Health Network.

“With increases in Financial Vulnerability disproportionately concentrated among historically disadvantaged groups, there is an urgent need to identify solutions that work towards financial health for not just some, but all Americans.”

Financial Vulnerability reaches new high

Analysts have written about how 2022-2023 has represented a period of normalization for the economy, a reset from the highs in growth and inflation seen in 2021. While this may be true, its effect on consumers has led to new highs in financial vulnerability.

This year, the Financial Health Network (FHN) found that 17% of Americans are now considered financially vulnerable, meaning they typically struggle to meet expenses, have high levels of debt, and have no emergency savings.

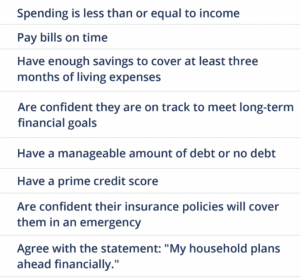

The decline has affected five of the eight factors indicating financial health and the most dramatic shift was found in disposable income. According to their findings, just under half of Americans reported disposable income, meaning that they spend less than their income, the lowest number since the FHN’s reporting began in 2018. This trend follows the drop in financial health seen in 2022, which marked the first time financial health had declined in five years.

Although the effect has been widespread, the impact has concentrated on historically marginalized groups. The share of Black and Latinx Americans who were financially vulnerable increased by 6 and 7 percentage points, respectively, between 2022 and 2023, while there was no meaningful change for White, Asian, and Multiracial consumers. The findings indicated that an existing gap in financial health between the groups was getting wider, with Black and Latinx consumers facing increased challenges, particularly in borrowing and financial planning.

Within these groups, younger demographics and single women were the most afflicted, facing challenges in spending, borrowing, and planning.

Factors such as location and nature of employment also made an impact. One out of 5 Americans living in Southern states was financially vulnerable, a higher share than in any other region of the United States. Consumers who were employed by smaller businesses were found to have a more challenging financial situation, with those who were employed at businesses with under 100 employees twice as likely to be financially vulnerable than those at larger institutions.

“The findings around Financial Vulnerability reinforce the multi-faceted nature of financial health,” said Jo Christine Miles, director of Principal Foundation and Principal Community Relations. “To mitigate these factors and remove barriers to financial health, we must collectively work with stakeholders across sectors and institutions to provide Financially Vulnerable people with access to essential needs and opportunities so they can improve their future financial health and security.”

The report’s focus on the eight indicators that make up the financial health of consumers identified key problem areas affecting particular groups. For many, borrowing and financial planning were the most challenging, reflecting the tough economic conditions facing the US this year. The report stated that financial solutions targeting demographics at their particular pain points were vital.

Brandee McHale, Head of Community Investing and Development at Citi and President of the Citi Foundation, who collaborated on the report, said, “As the number of Financially Vulnerable people in the U.S. increases, so does the need for innovative interventions and solutions.”

RELATED: Financial Health Network posts grim 2022 report