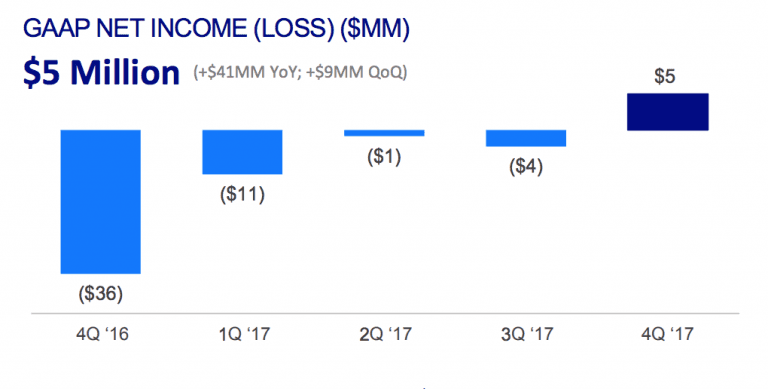

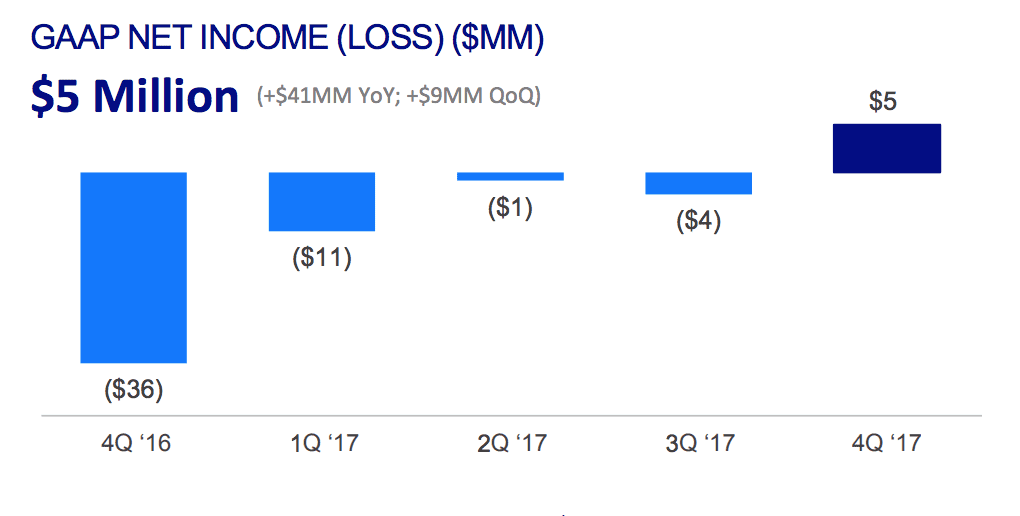

As projected, OnDeck reported GAAP profitability when they announced their Q4 2017 earnings earlier this morning. They have been on this journey of driving efficiency across their business as they shifted their funding model to a balance sheet centric model. In the fourth quarter they generated $5 million of GAAP profit. To put this in perspective, this is $41 million better than the prior year period. This puts them on solid footing as they look towards priorities for 2018. Originations for the quarter were $546 million, up 3% from the prior quarter.

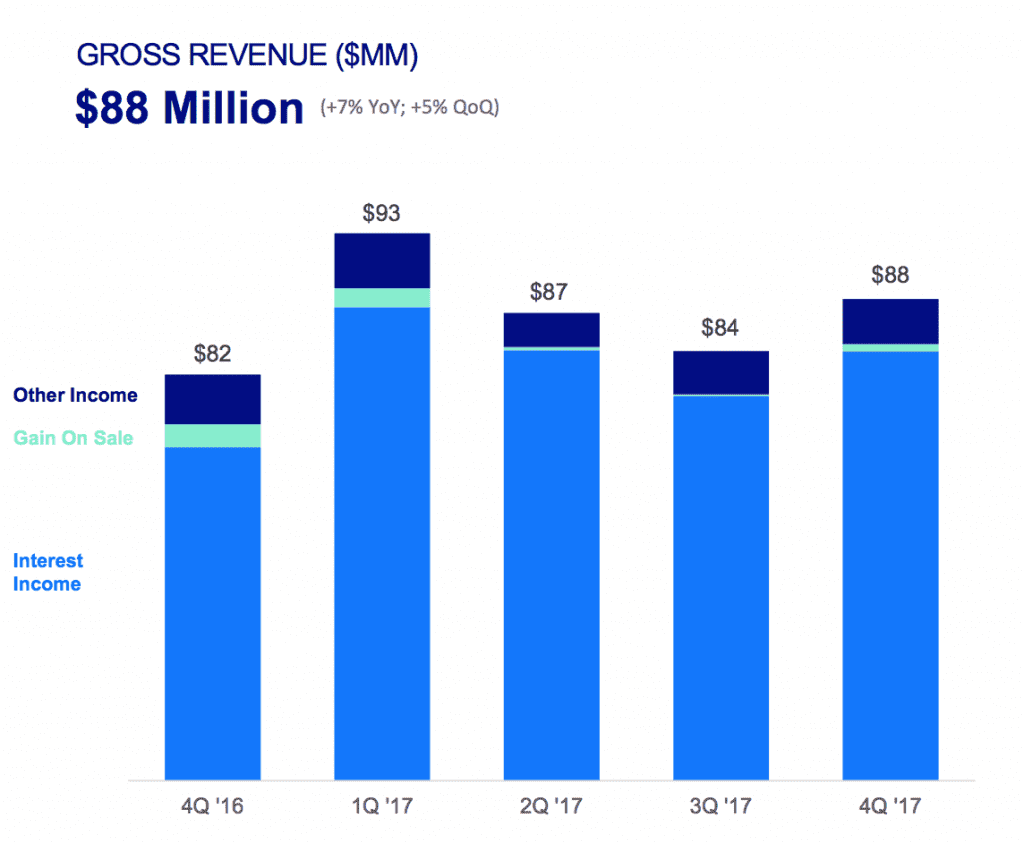

Gross revenue came in at $87.7 million, up 7% year over year. Gain on sale revenue or revenue from loans sold on OnDeck’s marketplace to investors totaled $0.6 million. As with previous quarters in 2017 this now represents a pretty small part of OnDeck’s business. Other income totaled $3.5 million, up slightly from $3.4 million in the previous quarter. This is primarily income from their OnDeck-as-a-Service business which includes the partnership with JPMorgan Chase. While it is still a small part of their business, this is where I believe there is tremendous upside for the company.

Even though they reported an originations record with their JPMorgan Chase partnership, it is clear it is still early days. Loans are currently only available to select JPMorgan Chase customers and there is much more potential as they expand the scope. While still small, OnDeck-as-a-Service offers higher gross margins for the company.

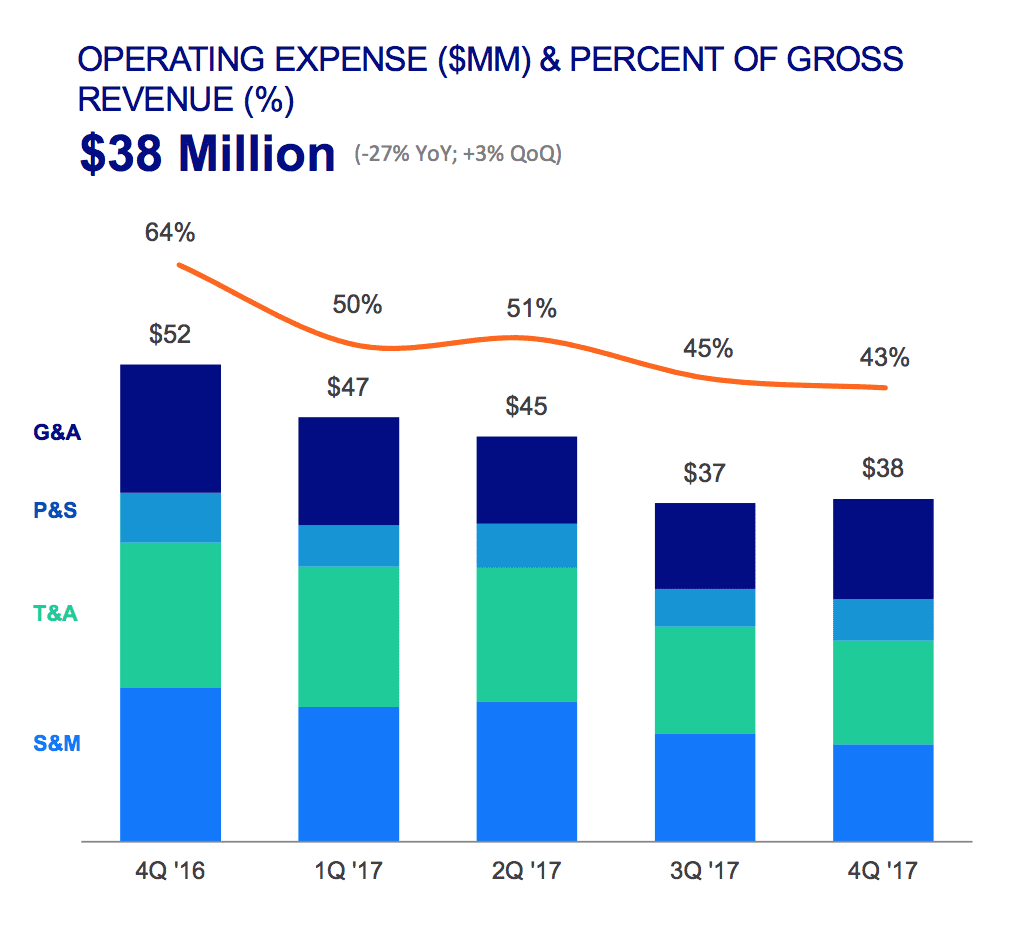

As mentioned previously, OnDeck has significantly reduced their operating expenses as part of their cost rationalization program instituted in 2017. They continued to cut expenses, announcing the termination of a portion of its New York headquarters lease. They also plan to shift hiring to lower cost offices.

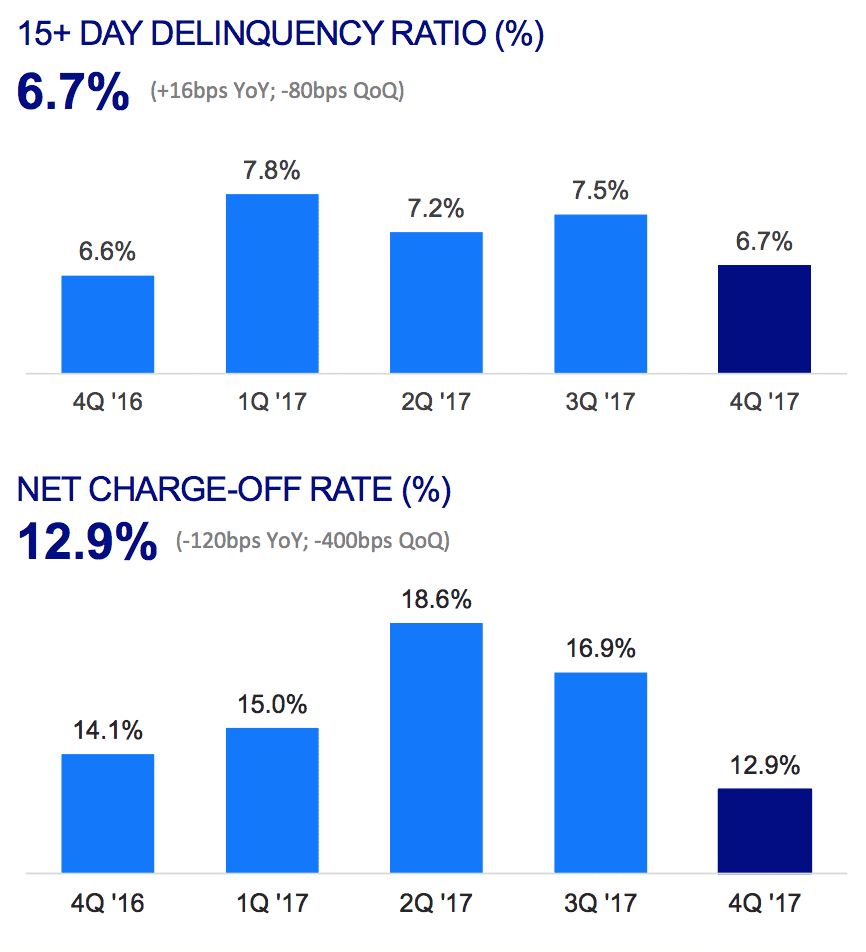

Three other positive data points from the company in the fourth quarter were Provision Rate, 15+ Day Delinquency Ratio and Net Charge-Off Rates. These all hit 2017 lows for the quarter. In the earnings call, they noted this was due to multiple factors such as their credit tightening, modifying offer terms, adding manual underwriting where appropriate and their improved collections practices. Interestingly, OnDeck is finding more success in recovery rates by litigating charged off loans themselves instead of selling them post charge off.

OnDeck has several 2018 strategic priorities worth noting. Related to loan originations, they are looking to drive 10-15% loan growth. They are also investing $5 million in technology and analytics and will announce their second major bank leveraging OnDeck-as-a-Service. A new small business lending product is also slated to be announced in 2018.

OnDeck provided the full year and Q1 2018 guidance below:

Full Year 2018

- Gross revenue between $370 million and $382 million.

- GAAP Net income (loss) attributable to OnDeck between $(2) million and $10 million.

- Adjusted Net income between $16 million and $28 million.

First Quarter 2018

- Gross revenue between $86 million and $90 million.

- GAAP Net income (loss) attributable to OnDeck between $(5.5) million and $(1.5) million.

- Adjusted Net income between $1 million and $5 million.

Conclusion

Unsurprisingly there is a lot of interest from analysts about OnDeck-as-a-Service. Another significant bank partner announcement is going to be a big coup for the company. As CEO Noah Breslow noted though tech investments to build out these partnerships have a medium to long term payback. Some of their tech investments they are making now will make for less fixed costs down the road as new partners sign up. Breslow shared that inbound interest from other banks is gaining steam. As these partnerships build and the scope increases it is going to be interesting to see how this affects the bottom line. It wouldn’t surprise me if OnDeck continues to become more of a software provider than a lender themselves over the long term.