There was an article in Bloomberg earlier this week that called into question the performance of a 2015 SoFi securitization. Given that I have always held SoFi out as the gold standard in industry performance I was surprised to read about these issues. So, I did some digging and discovered that Matt Scully (the author) did not provide the complete story.

Now, before I go any further I should point out that I am fully aware that many securitization deals closed in recent years have performed below expectations and that some platforms have breached triggers significantly. But that is not what happened here.

We are talking about the very first securitization of SoFi’s unsecured consumer loans that closed in August 2015 and was issued by SoFi Consumer Loan Program 2015-1 LLC or SCLP 2015-1 for short. It was a private unrated securitization. Sources familiar with this deal said it was a one-off deal organized between the debt buyer and the equity holder. It had unusually tight triggers but this was part of the negotiation of the deal and SoFi did not actually set these triggers.

The Cumulative Net Loss (CNL) trigger for this deal in February was very low, reportedly below 3% and the actual CNL for February barely went above these low trigger points. But what is more important is that it is misleading to use this case as another example of underperformance. As I said this was a one-off deal between a motivated buyer and seller and was much tighter than subsequent deals.

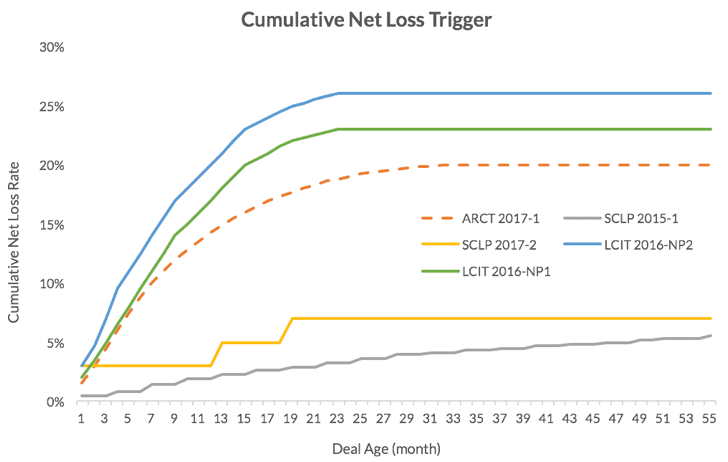

Look at this chart below from the latest PeerIQ newsletter (reproduced here with permission). In this newsletter PeerIQ was examining a new securitization of Lending Club loans but they included a fascinating chart that demonstrates what a one-off SCLP 2015-1 was.

The gray line shows the CNL triggers for SCLP 2015-1 and the orange line shows the latest SoFi deal SCLP 2017-2. As you can see for the deal age (around 18 months) the triggers for new deals are almost double what they were in SCLP 2015-1.

Now, I should point out that while this deal was unrated, Kroll Bond Rating Agency did assign a rating to SCLP 2015-1 in November last year. At the request of the senior bondholder (who owned the entire senior tranche) Kroll assigned a single A rating to the senior bonds. Apparently that rating is not in jeopardy.

One final point. Because the triggers were barely breached it is quite possible that in coming months future triggers will not be breached and the deal will cure. The reality is that triggers were not set at the appropriate level for this deal. SoFi did not set these triggers and likely did not agree with them as they were negotiated directly between the buyer and the seller. So to read anything into this particular breach is misleading.