Sunlight Financial is not your typical fintech company. For a start, they are profitable and have been for some time. They have never closed huge funding round (they didn’t need to) and they don’t have their logo on a sports stadium or basketball jersey. They have kept a relatively low profile going about their business of providing affordable loans for clean energy projects to prime borrowers.

For their SPAC deal, they partnered with one of the leading alternative asset managers on the planet, Apollo Management, whose Spartan Acquisition Corp II just closed their merger with Sunlight Financial last Friday. Tiger Infrastructure, Sunlight’s original equity investor, announced the merger was complete in a press release today.

The merger gives the new company a valuation of around $1.35 billion and the $250 million PIPE (Private Investment in Public Entity) was led by Chamath Palihapitiya and included Coatue, BlackRock, Franklin Templeton Investments, and others.

I caught up with CEO Matt Potere earlier today just before he rang the closing bell at the NYSE. When I asked him about becoming a public company he said it will help the company achieve its growth goals and it was also a natural evolution for the company. They only took $50 million from the transaction onto their own balance sheet, the remaining money went to existing shareholders.

Matt talked about the solar market and how there is only 3% of U.S. rooftops have solar today. The industry has grown 10x over the last decade and Sunlight Financial is growing even faster than that. And it has a lot more room for growth going forward.

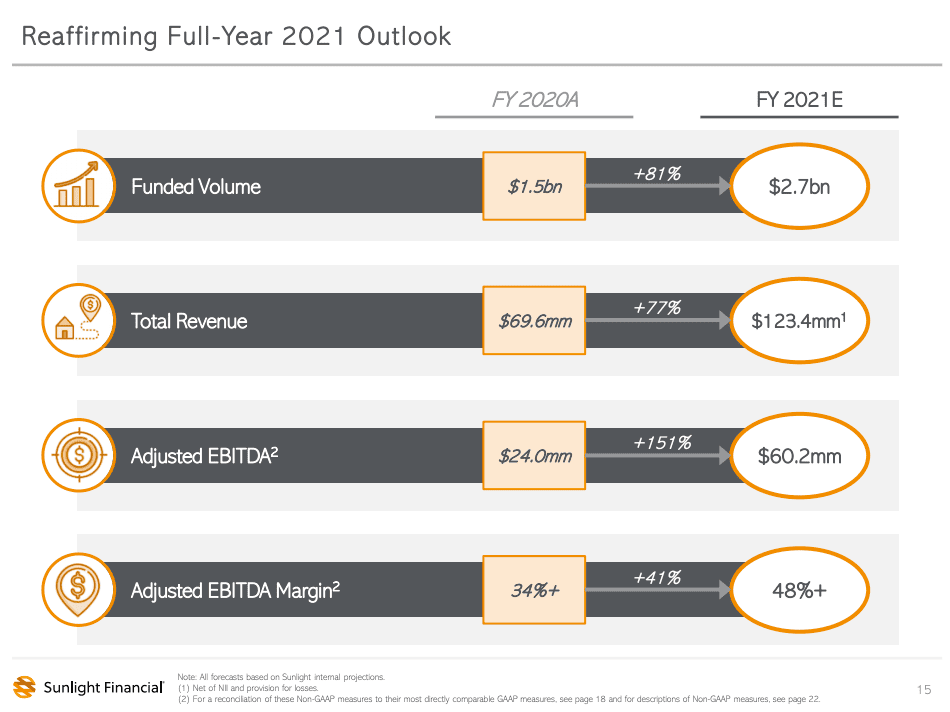

You can see this growth in the numbers they shared from their Q1 2021 results in the above slide with 81% origination growth expected this year. I asked Matt if those numbers still hold and he said there has been no change to their expectations for 2021.

They have also expanded into home improvement projects, a third of which are concerned with energy efficiency, their core focus.

Personal Experience With Sunlight Financial

After recording my podcast with Matt Potere last year I decided to put solar panels on my house. I live in Denver where there is plenty of sunshine and we have no major trees blocking the sun. Matt recommended a local installer and by early Spring we had solar panels on our roof, financed through Sunlight Financial.

It was a smooth and easy process. My only complaint was the permitting process with the city of Denver which seemed to take forever but that is par for the course in many parts of the country. We are now generating around 150% of our electricity needs (that will drop well below 100% in the winter I am told) via the sun and selling the excess back to our local utility.

First Day of Trading as a Public Company

With the merger completed last Friday, Sunlight Financial began trading today on the New York Stock Exchange under the ticker SUNL. They ended their first day of trading up 4.86% to $9.92.

Now, we will see what appetite the investing public has for a fintech company that is growing steadily and makes money. Eventually, all fintech companies will need to do this or their valuations will suffer. So, Sunlight Financial is, in many ways, ahead of the game.