The 2017 Small Business Credit Survey from the Federal Reserve shows that nearly 60 percent of small businesses applied for financing...

Leaders at the Federal Reserve, the OCC and the CFPB spoke at the Consumer Bankers Association annual conference about the need to be more flexible when applying oversight to bank & fintech partnerships; “We need to do a better job of educating our supervision staff, in some cases, in terms of interpretation of the guidance,” said Dan Quan, who leads the CFPB’s Project Catalyst, as reported by American Banker; they also talked about better coordination to ensure consistency in oversight. Source.

While speaking at an event by the office of Financial Research Federal Reserve Vice Chairman for Supervision Randal Quarles talk about the issues digital currencies could pose to the markets; the current level of use doesn’t pose a risk but as the scale of usage increases so does the potential potential problem; Quarles said, “if the central asset in a payment system cannot be predictably redeemed for the U.S. dollar at a stable exchange rate in times of adversity, the resulting price risk and potential liquidity and credit risk pose a large challenge for the system.”; he also talked about the the benefits of blockchain technology and if the central bank would issue their own digital currency. Source.

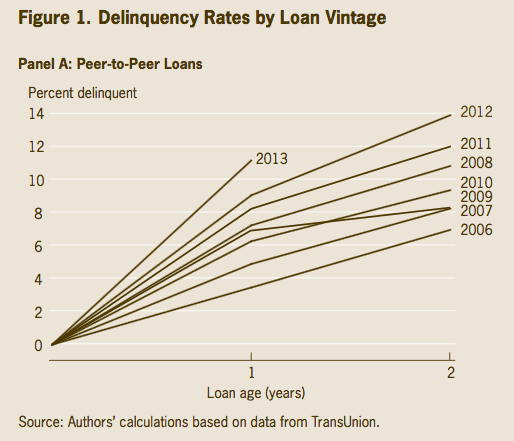

Last week the Federal Reserve of Cleveland released a report titled Three Myths About Peer-to-Peer Loans that had some pretty...

The Federal Reserve released a report on its initiative to provide real time payments by 2020; the report was created by a task force of over 300 industry contributors; the report, titled, "The U.S. Path to Faster Payments: A Call to Action" outlines payment processing proposals, the task force's vision and goals for the initiative; details on the payments initiative can also be found at FasterPaymentsTaskForce.org. Source

A new survey by 12 Federal Reserve banks says 35 percent of small business owners who received loans from fintech...

According to new data from the Federal Reserve mobile payments have seen a big growth among consumers but fraud has also risen; the shorter clearing period looks to have opened banks on the Zelle network to more potential for fraudulent transactions; Zelle has been using multi-layer and multi-factor authentication during the enrollment process; as banks look to innovate to suit their customer needs they are also looking at newer ways to protect themselves against threats that are evolving just as quick. Source.

A week ago I wrote about the Cleveland Fed report on “p2p lending”. I use that term in quotes because...

The Federal Reserve has released a report titled "Small Business Credit Survey Report on Startup Firms" with findings based on the 2016 Small Business Credit Survey which surveyed companies less than five years old with more than one and fewer than 500 employees; findings show that these companies face greater funding challenges than mature companies; report compares financing statistics of startups and mature companies; also reports on sources of funds noting that medium to high credit risk startups were more likely to apply for loans from online lenders and only 11% of low credit risk startups sought online loan financing. Source

Last week the New York Federal Reserve President, William Dudley, gave a briefing on household debt with a particular focus...