LendingRobot and NSR Invest are robo-advisors in marketplace lending; the firms have now merged to become the largest robo-advisor in the space; Lend Academy discusses the history of each company and the reasoning behind the merger; discusses the unique aspects of each offering and what the go forward plan is for the merged company. Source

When it comes to investing in the marketplace lending space, many individual investors have relied on various tools to help...

Building on the success of the LendingRobot Series Fund announced in January 2017, LendingRobot has launched LendingRobot Professional; the product has new advisor-focused features and functionality and can be optimized by advisors for multiple clients; it has an advisor minimum of $250,000. Source

LendingRobot is launching a new fund for accredited high net worth investors and using a basket of new technologies to automate management of the fund; LendingRobot plans to use automated portfolio algorithms and automated platform investing to manage the fund; it will also use blockchain for fund reporting and fund auditing; Kadhim Shubber of Financial Times shares information on recent Lending Club performance as well as thoughts from UK-based fund P2PGI. Source

LendingRobot is planning to offer its clients a new marketplace lending credit fund with blockchain automated fund reporting; algorithms will automate investors' fund preferences into one of four options based on risk tolerance and investment horizons; the fund offering will add to the company's current business which allows customers to invest in multiple loan platforms from a single account. Source

Merger will result in the largest robo-advisor in marketplace lending; the companies will operate separately for now but the company aims to take the best of both platforms; the funds offered will be streamlined with the LendingRobot Series fund being the focus going forward; Bo Brustkern, co-founder and CEO of NSR Invest, will be leading the new entity with Emmanuel Marot, co-founder and CEO of LendingRobot, acting as a special advisor; the new entity will have $150 million in assets under management with over 8,000 clients. Source

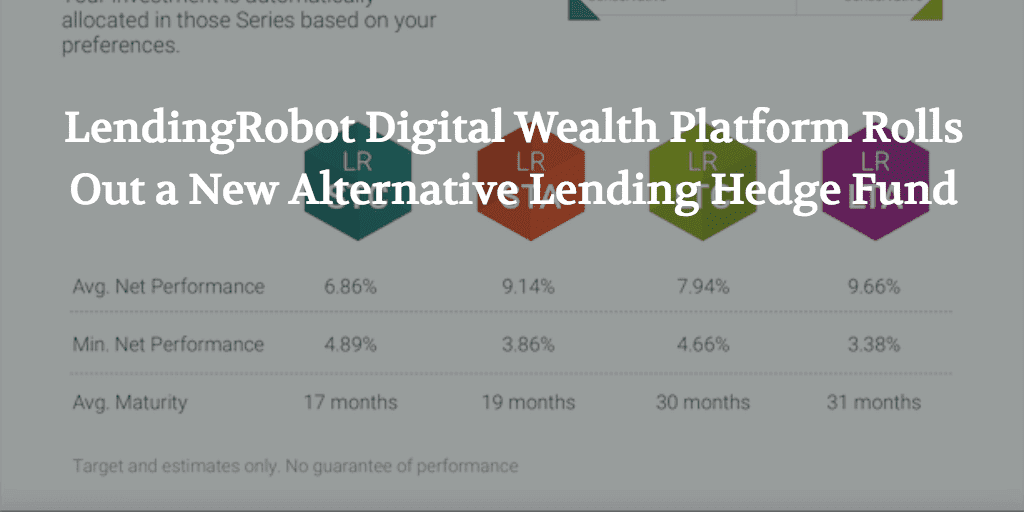

LendingRobot shares returns for the second quarter; aggregated return for the LendingRobot series was 2.7% year to date; there are currently four risk-based funds in the series ranging from short term conservative to long term aggressive; loans included in the funds are from Lending Club, Prosper, Funding Circle and Lending Home; the series funds are available to accredited investors for investment. Source

LendingRobot has announced the launch of a new alternative lending hedge fund; Lend Academy provides details in their article; the new fund will add to the service offerings at LendingRobot which currently include aggregated marketplace lending investment accounts for both retail investors and financial advisors; the new LendingRobot Series fund will invest in online loan origination platforms and offer multiple strategies for investors with expected net returns ranging from 6.86% to 9.66%; the fund is only open to accredited investors and requires a minimum investment of $100,000; it has a 1% management fee with fund expenses of up to 0.59%. Source

Today LendingRobot launched a new alternative lending hedge fund called LendingRobot Series to add to its suite of products. This...

LendingRobot has filed a Form D with the Securities and Exchange Commission indicating its plans for a pooled investment fund; the investing platform currently provides investment accounts that allow customers to invest in marketplace loans from direct lenders through the platform; the new fund provides a pooled fund investment option for investors; the minimum investment is $100,000. Source