A replay is now available for LendIt's Marketplace Lending 101 forum which was held on Wednesday, January 18; Peter Renton from LendIt and Andrew Dix from Crowdfund Insider took questions from participants about the marketplace lending industry and discussed how to effectively invest in marketplace loans. You can view the webinar replay here:

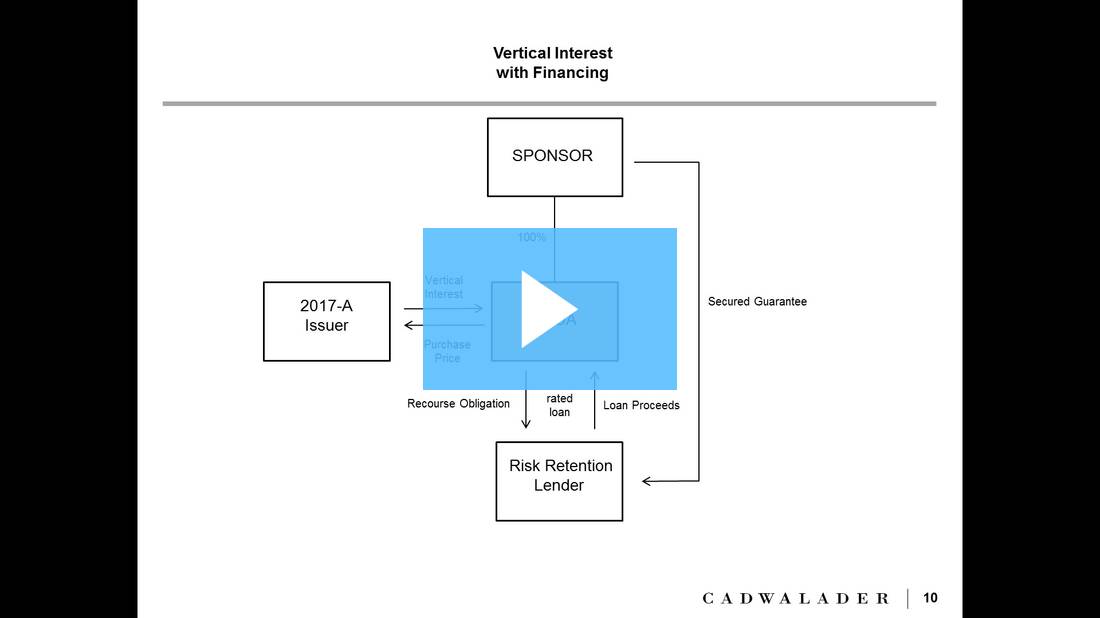

LendIt's most recent forum, Key Considerations for Risk Retention in Securitization, was held on Wednesday, January 11, 2017; the webinar provided insight on new risk retention regulations for securitization in effect beginning December 24, 2016; speakers provided insight on a range of securitization related topics including optimal risk retention structures, commercial considerations related to sponsors and requirements necessary for majority owned-affiliates; a replay of the webinar is now available.

LendIt will be hosting a forum today on risk retention in securitization at 2:00 PM EST; the forum will be held in conjunction with Cadwalader and Lending Times; speakers will provide insight on key factors to consider in choosing the optimal risk retention structure, commercial considerations related to sponsors including brand and investor relationships, requirements necessary to establish a majority owned-affiliate including the amount of equity that must be retained by the sponsor versus an investor and other related topics; register here and join the webinar today.

Securitization continues to be a key source of capital for many marketplace lenders; LendIt, in association with Cadwalader and Lending Times, will host a forum on Wednesday, January 11th at 2:00 PM EST; the webinar will focus on key factors to consider in choosing the optimal risk retention structure, commercial considerations related to sponsors including brand and investor relationships, requirements to establish a majority owned-affiliate including the amount of equity that must be retained by the sponsor versus an investor and more; register today.

Pepper Hamilton will be hosting a webinar on Tuesday, January 24 at 12:00 PM EST providing insight on the considerations for fintech companies interested in applying for the new fintech charter; topics will include fintech charter advantages, the application process, OCC requirements, OCC oversight and capital requirements; the panel will include Pepper Hamilton lawyers with OCC experience; participants can register here.

A replay is now available for LendIt's Key Considerations for Risk Retention in Securitization forum which was held on Wednesday, January 11, 2017; the webinar provided insight on new risk retention regulations for securitization in effect beginning December 24, 2016; speakers talked about a range of securitization related topics including optimal risk retention structures, commercial considerations related to sponsors and requirements necessary for majority owned affiliates.

LendIt will be hosting a LendIt Forum today featuring speakers Peter Renton from LendIt and Andrew Dix from Crowdfund Insider; participants can submit questions for the speakers to learn more about the evolution of the industry and how to effectively invest in marketplace loans; the forum will take place at 2:00 PM EST; register here and join the webinar today. Source

LendIt, in conjunction with Cadwalader and Lending Times, will host a forum on securitization this Wednesday, January 11th at 2:00 PM EST; the webinar will focus on key factors to consider in choosing the optimal risk retention structure, commercial considerations related to sponsors including brand and investor relationships, requirements necessary to establish a majority owned-affiliate including the amount of equity that must be retained by the sponsor versus an investor and other related topics; speakers include Philip Bartow of River North, Bruce Bloomingdale from Cadwalader, Wickersham and Taft, Rupert Chisholm from One William Street Capital, Abe Kahan of CommonBond, Dylan Schuler of CommonBond and Gregg Jubin from Cadwalader, Wickersham and Taft; learn more by registering here today.

LendIt Forum will be hosting Marketplace Lending 101 on January 18 at 2:00 PM EST; in 2016, marketplace lending reported some of the industry's best fixed income returns and loan investing accessibility is expected to continue with an estimated $1 trillion in marketplace loan originations by 2025; Peter Renton of Lend Academy and Andrew Dix from Crowdfund Insider will discuss the evolution of marketplace lending and answer questions from the audience about investing in marketplace lending loans. Source

[Editor’s note: This is a report from my Lend Academy partner and fellow LendIt co-founder, Jason Jones, who has been...