When I meet people at conferences one of things I hear most often is how much everyone likes the fact that I share...

Put this in the “better late than never” department. Yes, I know it is late July and I am only...

Happy Halloween everyone. October is in the books and there is nothing spooky about the results from Lending Club and...

Review Summary: Possibly the most vibrant of the social lending communities (now at over $100 million in loans funded), Prosper...

Lending Club has come blasting out of the gate in 2013. They have started the year with the first ever...

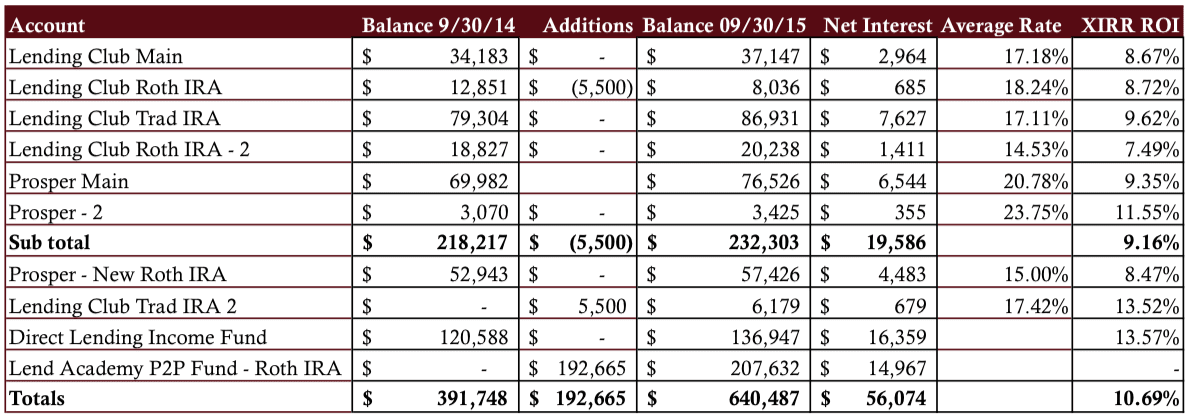

We often get emails from readers asking about the current state of investing with Lending Club or Prosper. Many investors...

Prosper tightened its credit underwriting in July resulting in a shift toward lower risk loans; the changes caused a total portfolio coupon decrease of 45 basis points and a return estimate decrease of 26 basis points; reported lower charge-off levels from 2016H2 loans and higher delinquencies from loans issued in 2016 and 2017; C-rated loans accounted for the greatest portion of the total portfolio at 31.54%; estimated weighted average return for the month was 7.75%. Source

photo © 2009 Shun T | more info (via: Wylio)I first started out with peer to peer lending back in...

May will certainly go down as a milestone month for the U.S. p2p lending industry. We had the much talked...

March was a great month for Lending Club and Prosper any way you slice it. Together the two leading p2p...