Lending Club and Prosper have both been around over 10 years now. A lot has changed since both companies were...

Last week the Federal Reserve of Cleveland released a report titled Three Myths About Peer-to-Peer Loans that had some pretty...

Prosper recently published their third quarter results; the company grew originations 6% from the previous quarter to $821 million; reported a net loss of $26.9 million largely due to non-cash charges related to warrants as part of the consortium deal announced this year. Source

Prosper CEO David Kimball spoke at a conference last week stating, “Our main concern… it’s always liquidity, and I think most people in this room understand that the best way to get to liquidity is to have a lot of different options. And so I think you’ll see our toolkit expand [in 2018] versus where it is now.” Kimball also spoke about the challenges the company has had to overcome and the recent successes for the company including Prosper’s three securitizations and becoming cash flow positive. Source

A little over a year ago Goldman Sachs launched their consumer lending platform Marcus as part of a digital strategy...

Lend Academy looks at 10 years of data from Lending Club and Prosper; shares data on returns over the time period and where current returns are trending. Source

There has been a shift in focus at the large online lending companies over the last year and a half...

Every quarter I share my marketplace lending investment returns with the world. I started doing this back in 2011 with...

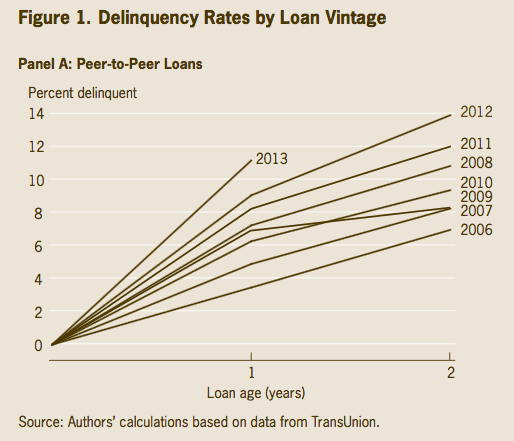

The Financial Times reviews company and loan performance at various online lenders; shares that Shanda Group bought more shares of LendingClub after forecasts were adjusted last week; LendingClub also recently stopped making F & G grade loans available to investors; broadly, delinquency rates have increased across online lenders; valuations of other companies such as Earnest and Prosper have also been affected. Source

Continuing their strategy of moving to balance sheet lending platforms the fund sold their entire holding in Prosper marketplace loans; the holding amounted to 4.1 percent of the company’s net asset value or NAV as of October 31st; the company also said they were able to reinvest all the process form the Prosper sale into balance sheet investments and have increased their balance sheet exposure to 79 percent of the fund. Source.