The securitization market for marketplace loans has been increasing in recent years, in reviewing the State of the Securitization panel from LendIt USA 2016 we hear about the deals getting done, new risk retention requirements and what issues crop up when selling to investors.

Panelists covered the increase in rated securitizations from Moody's, Fitch and Kroll, noting the overall market is still small compared to auto or credit cards however it continues growing.

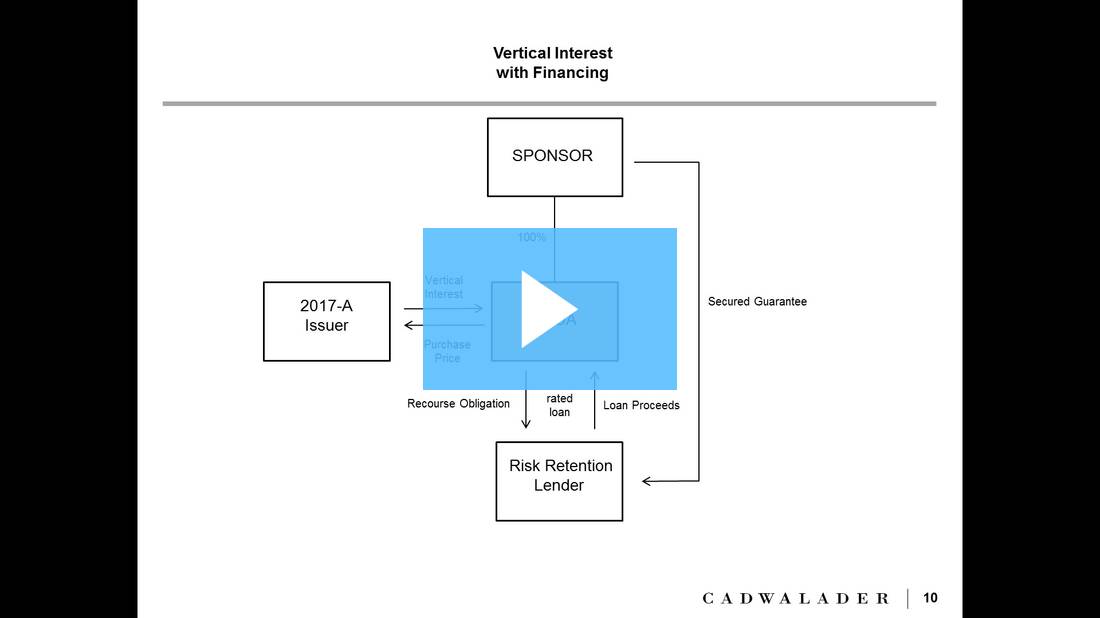

The new risk retention requirements will force sponsors to hold a residual of equity interests when in the past some were able to sell off 100%, though it would depend on the sponsor and the deal.

Common issues when selling deals

- Investors want to know how loans are underwritten, serviced and what does loan performance look like

- Length of performance history is a common theme, investors want to know how the asset performs as compared to credit card deals or auto securitizations

- Selling the deal in comparison to a similar asset helps to mitigate questions and analyze loss scenarios

- Investors want to see platforms retain risk

- True lender, Madden v. Midland, they want to avoid a deal that ends up being dragged through court, like many subprime mortgage securitizations

- Servicing needs to have capacity to make calls and get payments in, whether the servicing is in house or outsourced

To hear more about risk retention, please signup for our LendIt Forum scheduled for today at 2:00 PM EST. You can register here.

Check out the full video interview here: