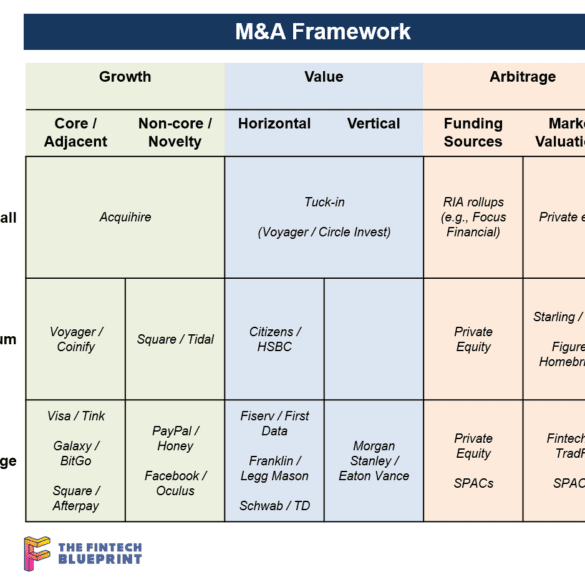

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

In this conversation, we talk with Anne Boden, the CEO of Starling Bank. Starling has just turned profitable, and reached several significant milestones in terms of 1.8 million clients, $4 billion in deposits, and $1.5 billion of lending.

That is quite meaningfully ahead of our model, and probably ahead of everyone’s model, of where neobanks would be in 2020. While COVID has accelerated the digital lifestyle, Anne credits deeper demographic, technology, and cultural insights and choices she has made in building Starling for success.

This week, we look at:

The financial model behind Monzo, and comparisons to Revolut and Starling

How the Eastern super apps inspired the marketplace model, and why that success is hard for neobanks to replicate

Paths from losing $100 million per year to break-even and enabling digital assets and other financial products

Facebook Financial forming to take over payments and commerce

If you are in finance and only looking at banks, you are missing out on the real change agents. Here's some cross-industry action that we will unpack this week.

Amazon selected Goldman Sachs to be the lender of choice for small business loans. TikTok maker ByteDance is working with a Singaporean business family to get a financial license. And small business bank Starling is integrating Slack, energy switching service Bionic, and health insurance provider Equipsme into their marketplace. And we might as well talk about the Plaid Exchange launch, and end on the computational economy of Ethereum.

The strategic partnership is intended to increase funds available to smaller firms during the current pandemic; Starling is lending via...

The fintech industry is coming up on the tipping point of funding, revenue generation, and user acquisition to rival traditional finance with $20 billion in YTD fintech financing, the several SPACs, and Visa’s $2B Tink purchased. Defensive barriers have eroded.

Let’s take a moment to compare capital. While it is not the money that wins markets, it is the transformation function of that money into novel business assets that does. And while the large banks have a massive incumbent advantage with (1) installed customers and assets, and (2) financial regulatory integration (or capture, depending on your vantage point), there is a real question on whether a $1 generates more value inside of an existing bank, or outside of an existing bank — even when it is aimed at the same financial problem.

Here are the most read news stories from our daily newsletter today: OCC chief expects SWIFT-like bank-to-blockchain connections in 3...

In this conversation, we break down recently published annual reports from Revolut, Starling and Monzo, three of the leading European digital banks. There are some fascinating insights to be drawn from the documents, especially in the context of the broader global fintech market. This is rich subject matter, and we surely didn’t cover everything.

Tide is reportedly in discussions for a new funding round totaling hundreds of millions of pounds according to reporting from...

Businesses across Europe have reported vastly different experiences in their efforts to secure the financial support promised by their respective...