Following the SVB crisis, already precarious Credit Suisse has struggled to hold the confidence of investors. UBS has agreed to acquire.

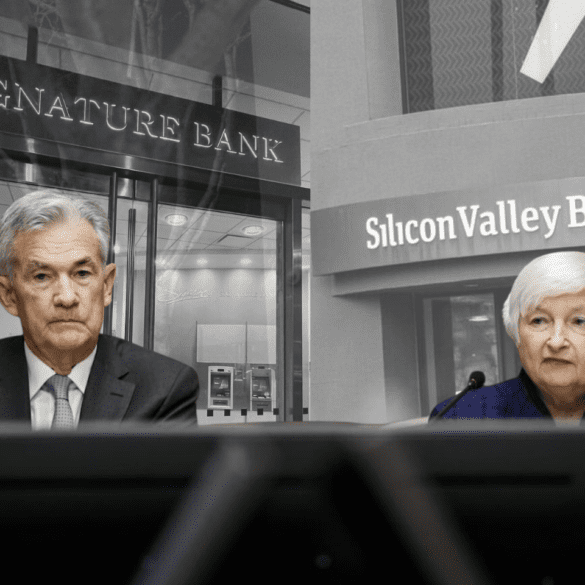

Over the weekend regulators raced to find a resolution for the waves made by SVB's demise. Failure of the financial system may be adverted.

The Silicon Valley Bank collapse highlighted the importance of a little-discussed but key feature of healthy banks and fintechs - backup servicing.

We will be live-updating the Silicon Valley Bank crisis story as new developments emerge through the weekend.

As the dust settles after the SVB fall, leaders are looking at ways forward. Many think fintech might have the upper hand.

Could AI have prevented the SVB crisis? Maybe not completely, but consumer sentiment analysis could have dramatically reduced its impact.

Will this be enough to break the spiralling loss of confidence in the banking system?

·

Senate Committee remained unconvinced by Greg Becker's apology citing multiple warnings and increased paychecks as risks mounted.

The VC and startup community are tentatively settling into an optimistic action plan after SVBs failure. SVB Capital is still on the table.

First Citizens Bank has acquired part of the failed SVB, announced the FDIC yesterday.