WeChat Pay will begin rolling out a credit rating for their 600 million users; the credit rating uses AI to...

The Chinese tech giant Tencent has purchased a 5% stake in Afterpay worth A$390 million (US$252 million) according to the...

I look at the boundaries that Telegram and EOS have crashed into in the US with recent SEC actions and lawsuits, and the melting of Facebook Libra. There have been a number of interesting regulatory moves recently, and the positive headlines of 2017 have become the negative headlines of 2019. How does SEC jurisdiction reach foreign institutional investors? We also touch on the $1.5 billion NBA distribution deal now on the fence in China, and how US companies are under the speech jurisdiction of a foreign nation. How does China reach American protected speech? Through pressure, boycott, and economics.

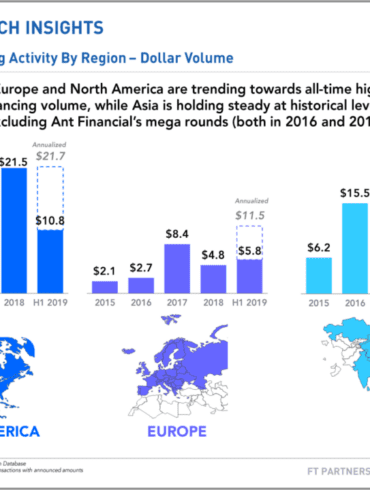

Fintech is expensive. Fintech is everywhere. If you are a thinking about starting a financial services company, and it does not have technology at its core -- don't. You will lose to someone similarly positioned building a more augmented business. Fintech is the global competition for regulation, talent, and macroeconomic supremacy. Fintech is the trade war between the US and China. Fintech is Facebook and Amazon. Fintech is the next bubble to burst. Fintech has burst already.

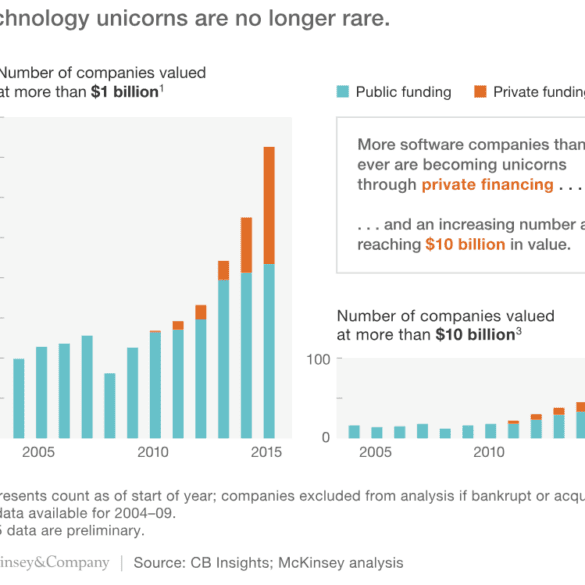

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

Both Tencent and SoftBank have invested in the company called Ualá which is seeing massive growth during the coronavirus crisis;...

French based payments app Lydia has raised a $45mn series B round led by Tencent with existing investors CNP Assurances,...

I examine how $6.4 billion real estate brokerage Compass stacks up against the digital wealth and lending companies with a similar go-to-market strategy, and provide some ideas as to why it is successful. Compelling questions also emerge when looking on how technologies like AR/VR are commoditizing the property brokerage experience. Compass, a residential real estate startup that built out a platform for brokers -- proprietary and external -- and has recently raised $370 million at a $6.4 billion valuation. I found the language and positioning sort of eery, in how similar it was to the story in industries I closely follow. It even bought a CRM earlier this year, not unlike AdvisorEngine buying Junxure, or Salesforce getting into financial verticals. What I did find unusual, was the absolutely massive valuation.

HSBC has launched a digital wallet in Hong Kong that targets startups and other small businesses; the bank said they...

Hong Kong has approved 4 more digital banking licenses for Tencent, Alibaba, Xiaomi and Ping An; the approvals are sure...