According to TransUnion data, the fraud attempt rate decreased by 22.6% globally in the first quarter compared to Q1 last year.

The firm said that the insight came from billions of transactions on more than 40,000 websites and apps that use their TruValidate product.

The data on fraud attempts is the change in the percentage of applications flagged as “denied” or “reviewed” by the TruValidate, compared to the total applications received.

The service enables companies to check consumers for fraud and assess risk confidentially, according to the site.

“Sophisticated fraudsters pressure test which industries have ramped up fraud prevention measures and, as a result, turn to new industries if efforts are being thwarted. We observed fraudsters look for new opportunities,” Shai Cohen, SVP of global fraud solutions, said.

“It is paramount that during the dip, companies focus on optimizing the customer experience.”

Suspected digital fraud attempts shift to new industries

Notably, financial services saw the furthest drop in fraud attempts in Q1, while insurance saw the most significant increase globally.

| Industry | Fraud Rate Change from Q1 2021 to Q1 2022 |

|---|---|

| Insurance | +134.5% |

| Gambling | +50.1% |

| Logistics | +42.7% |

| Travel and Leisure | +13.3% |

| Gaming | +6.9% |

| Communities (online dating, forums, etc.) | -6.1% |

| Retail | -7.6% |

| Telecommunications | -20.4% |

| Financial Services | -63.6% |

According to TransUnion’s Consumer Pulse Study, consumers feel targeted less by digital fraud.

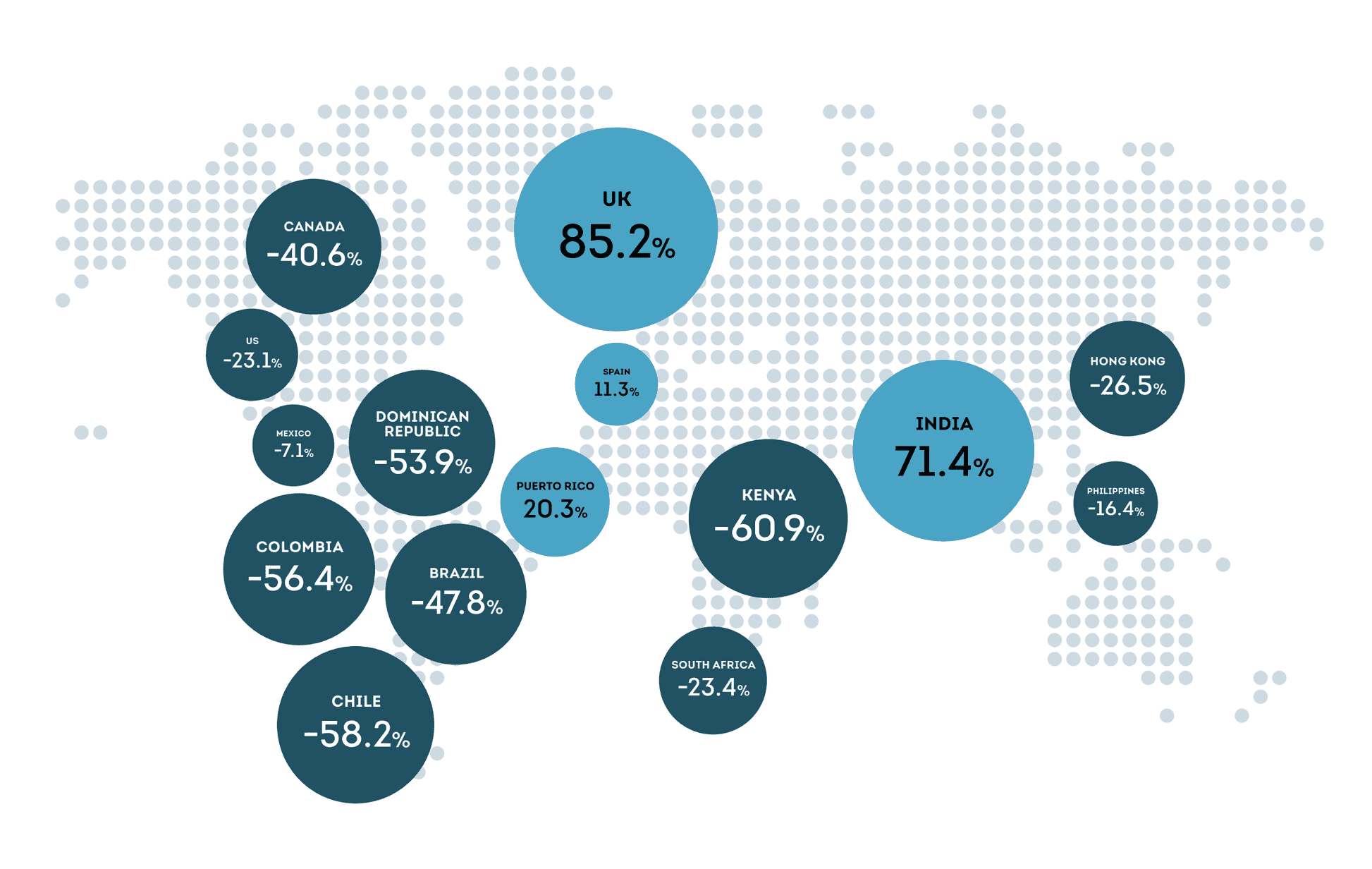

The survey of 10,391 adults in select countries and regions globally from Feb. 7-23, 2022, determined that only 36% were targeted by digital fraud in the last three months compared to 38% in Q4 2021.

The overall rate of suspected fraud originating from the U.S. decreased by 23.1% from Q1 2021 to Q1 2022 across all industries.

The financial services industry saw the most significant decrease in the suspected digital fraud attempts: it decreased by more than half.

Organizations can focus on the good

“As fraud rates stabilize during a period when fraudsters are searching for new vulnerabilities, many organizations have shifted their focus to identifying more of the good customers and transactions to increase revenue and customer lifetime value,” Sean Donnelly, SVP of GTM fraud solutions, said.

“By reducing false positives, false declines, and manual review rates, organizations can dramatically improve the customer experience through trusted connections while still keeping the fraudsters at bay.”

While financial fraud was lower this quarter, logistics fraud was rising. The logistics industry was impacted by shipping fraud, like spoofed addresses or when a seller receives payment for goods or services but never ships to the buyer.

The gaming industry saw the second-largest increase in the rate of suspected digital fraud in Q1 2022, growing 27.2% year over year.