On Thursday, Uber partnered with Mastercard, Marqeta, and Branch to power the Uber Pro Card. The card offers loyalty and payments to help drivers and carriers save on gas, fees, and expenses.

Andrew Macdonald, Senior Vice President of Mobility & Business Operations at Uber, said the card offers customized perks, including up to 10% cash back on gas and up to 12% on EV charging.

“At Uber, we are always looking for new ways to offer drivers and couriers more support on the road,” Macdonald said.

“The new Uber Pro Card will allow drivers and couriers to take home more of what they earn. Drivers and couriers will now have the ability to get more cash back on gas and EV charging and have their earnings automatically deposited to their accounts after each trip free of charge.”

The card brings an expansion to the Uber Pro driver loyalty program. Drivers level up to 10% cash back on gas purchases when they achieve “Diamond status.”

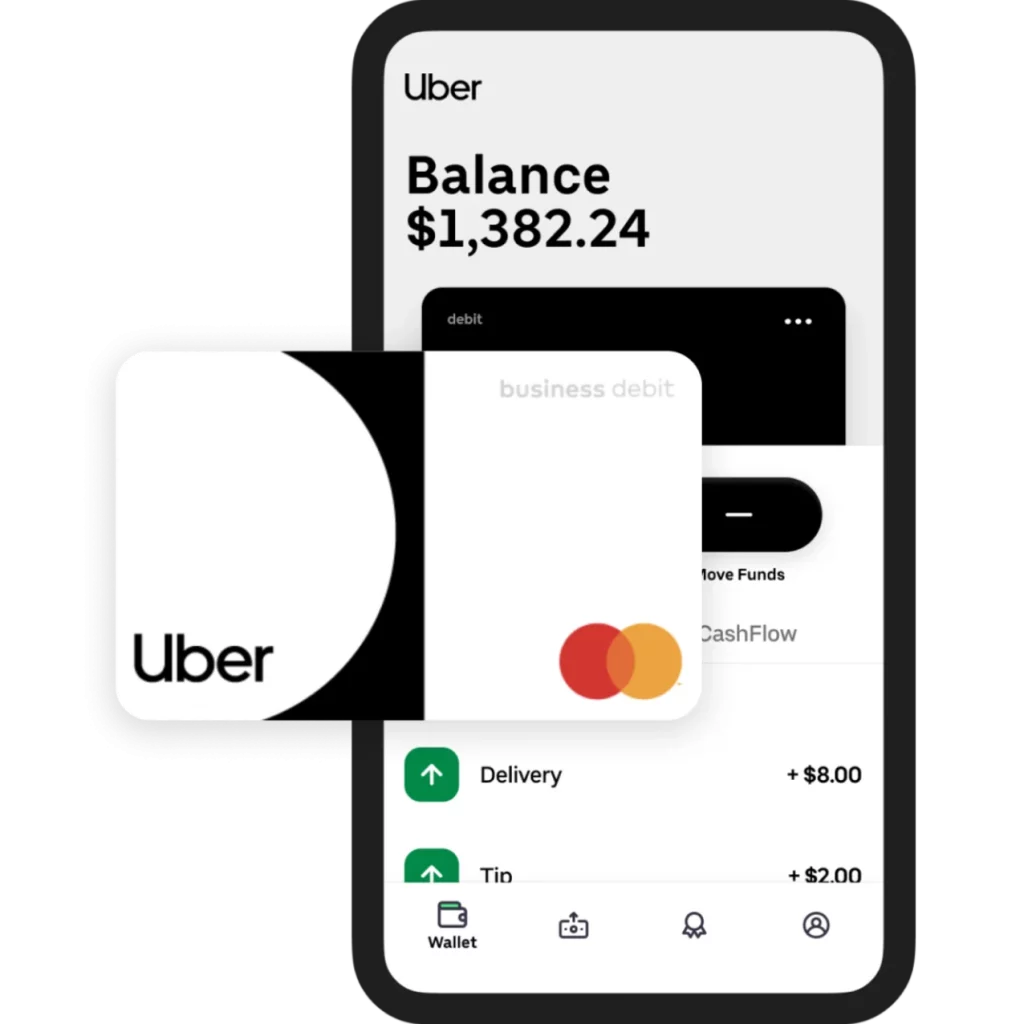

Branch business checking

The card also comes with a business checking account powered by Branch, designed to enable drivers and couriers to keep more of what they earn.

The firm said contractors who sign up automatically deposit their earnings into their accounts after every trip. In addition, the account has a “Backup Balance” feature that allows drivers and couriers to spot $150.

“Thanks to the benefits of modern card issuing, workers can access their earnings immediately, and with the growing use of new digital wallets and payments capabilities, can more easily manage their cash flow and better plan for their future,” Jason Gardner, Founder, and CEO of Marqeta said. “Uber is changing payment standards, and we’re thrilled to partner with Uber, Mastercard, and Branch to help them bring this vision to life.”

The new card also turns mobile wallets into a contactless payment source, so drivers and couriers can spend immediately. The company said they track earnings, transfer money to other bank accounts, earn rewards, and manage savings all through the new interface. Branch Founder & CEO Atif Siddiqi said real-time payments give Uber the edge in a competitive labor market.

“In today’s hyper-competitive labor market, Uber recognized the need to provide a dynamic, real-time payments experience that engages workers and drives greater loyalty,” Siddiqi said.

“We’re incredibly excited to partner with Uber, Marqeta, and Mastercard to create a modern banking solution that not only empowers drivers and couriers with greater flexibility, speed, and support but also meets their unique business needs — from free, fast access to their earnings after every trip to extensive cash back rewards.”

Built-in Mastercard business tools

The Uber Pro Card is a “Debit Mastercard BusinessCard” with built-in Mastercard tools to help manage cash flow, record keeping, and security. Sherri Haymond, EVP of Digital Partnerships at Mastercard, said the gig economy is critical to the economy.

“Drivers and couriers are critical to our economy, and they must have the financial tools and resources that make their lives easier,” Haymond said. “Bringing this new offering together in partnership with Uber, Marqeta, and Branch, we’ll be able to arm this segment with a dynamic and tailored product that not only meets their needs but exceeds their expectations.”

The Uber Pro Card will also offer Stride, the leading portable benefits platform for independent workers, enabling drivers and couriers to access simple, affordable coverage plans – from health to dental and vision. Mastercard and Stride partnered in 2020 to allow greater choice and appropriate benefits options to gig and independent workers.

Uber also recently announced other features, including Upfront Fares, which allows drivers to see how much they’ll earn and where they’re going before accepting a trip.