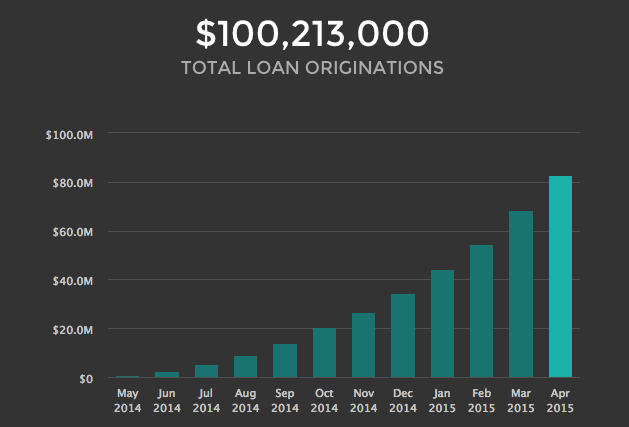

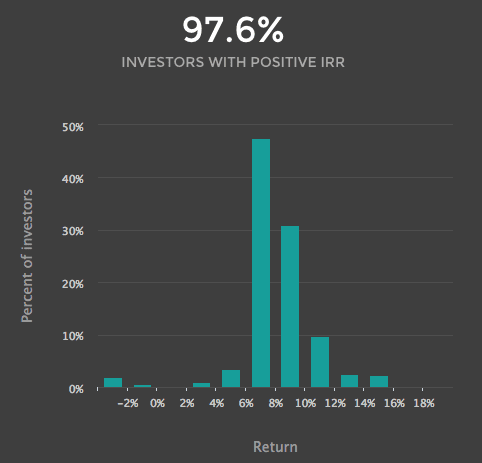

Upstart is a relatively new player in the marketplace lending industry and was founded in 2012. Since they began originating loans in May 2014, they have issued over $100 million across 7,000 loans, which makes them one of the up and comers in this industry. They focus on borrowers who are millennials that tend to have a thinner credit file, but might be otherwise a good candidate for a loan.

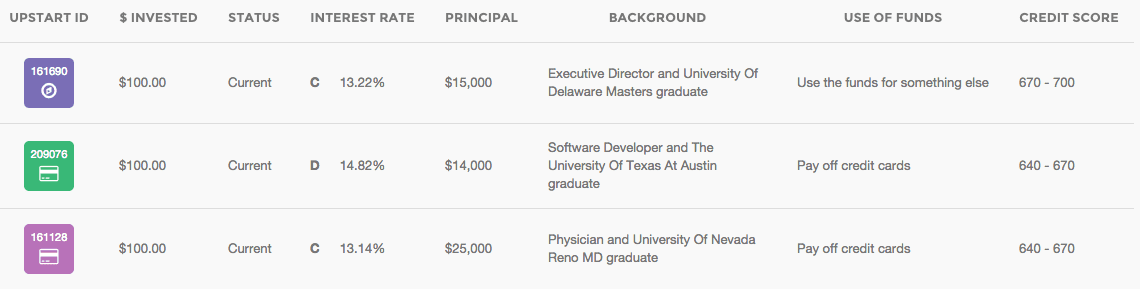

They look at other aspects beyond traditional credit data such as employability, earning potential and education. Nearly 97% of borrowers from Upstart are college graduates and 71% of them select refinancing credit cards as the purpose of the loan. The average income is near $100,000 and the average FICO is 692. In this post, we’ll focus on the investor side of the equation and take a look at the investor portal and metrics offered by Upstart.

To invest with Upstart, you must be an accredited investor. This means a net worth of $1 million, excluding your home or an income of $200,000 or more in the last two years. Since you must be an accredited investor, they are open for investing in all states as they only are subject to federal securities regulations.

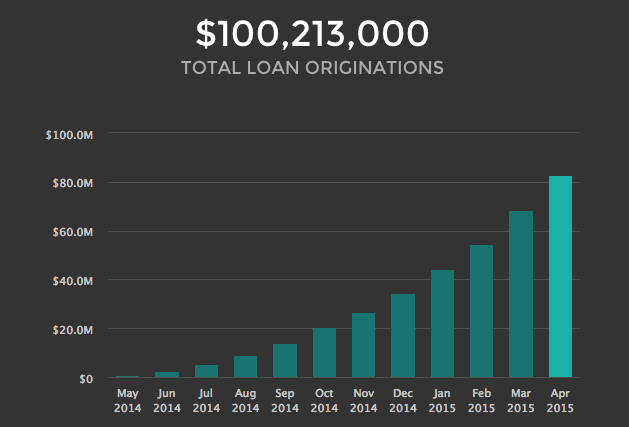

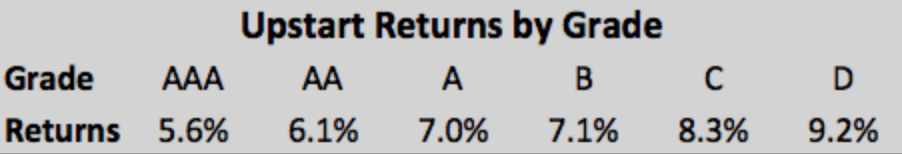

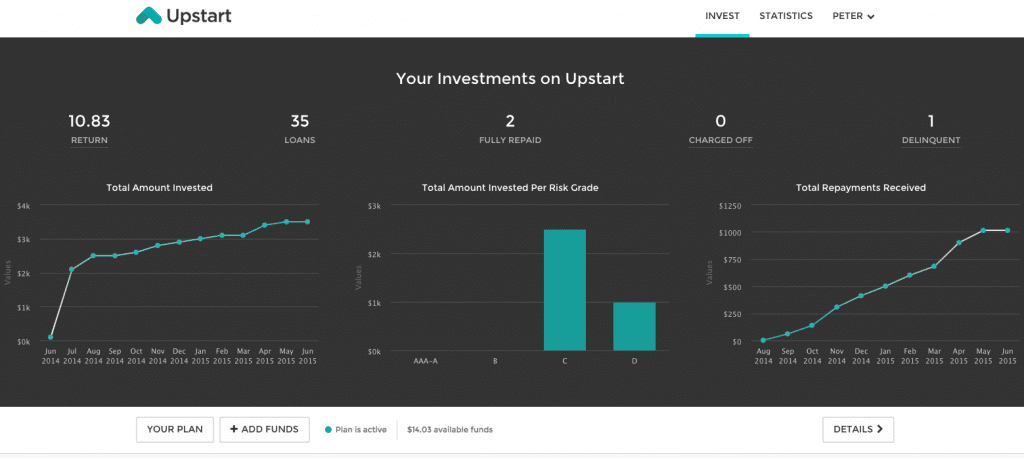

Peter has been investing since mid 2014 in Upstart loans and the screenshots included in this post are from his account. According to the Upstart account dashboard, investors are earning an average 7.4% return across all grades with 97.6% of investors earning a positive IRR. Investors earn on average between 5.6% and 9.2% across all loan grades.

The majority of investors are earning between 6% and 10% but some investors are earning over 10% as shown in the distribution of returns chart below.

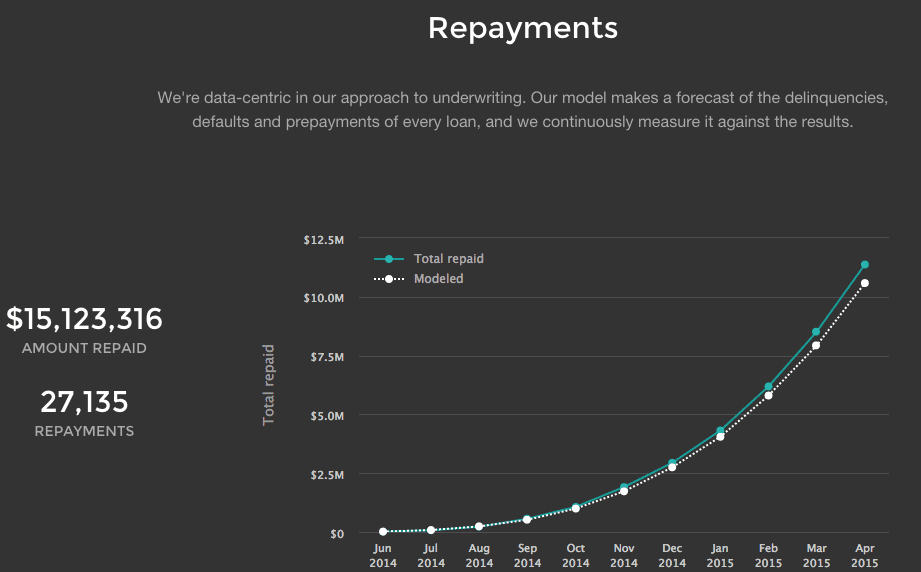

Upstart also provides a repayment graph as part of their statistics page, which includes their underwriting model that forecasts delinquencies, defaults and prepayments. As shown below, the total amount repaid is currently trending higher than what is modeled.

Upstart operates a little differently than Prosper or Lending Club. The first major difference is that they do not charge any investor fees, which means they make money solely on the origination fee of the borrower. In addition, should a borrower default, Upstart will refund the origination fees to investors in the loan. This means that Upstart does not profit from a loan that defaults.

Upstart is also moving away from the ability to cherry pick loans. Although they list several additional filter criteria, there is a disclaimer on the site stating that going forward, they are no longer supporting additional filters. This is a big shift and one that will not appeal to many Lend Academy readers. In some ways it is a reflection on the amount of investor dollars flowing in to these platforms – they don’t need to be courting investors like they would have done in years past.

Having said that, it is interesting however to look at some of the filters they used to offer including: college GPA, degree, SAT/ACT percentile and major. It is clear that Upstart is targeting a far different demographic than the likes of Lending Club and Prosper.

The one filter you will be able to adjust is the risk grade from AAA to D and after that, your investment is completely automated. Peter has invested $2,500 in C grade loans and $1000 in D grade notes. Once you invest in loans, they are listed in your account as shown below.

Upstart Performance

Upstart has taken a different approach to Prosper and Lending Club. What you see below are the statistics you see when you login to your account. Note that there is no account total. In fact, the only way to see your account total is to look at the monthly statements. Peter’s account shows an annualized IRR of 10.83%, far above the average on the platform of 7.4% due to investing in the higher risk grades of C and D.

With total originations crossing $100 million in one year, it’s clear that Upstart has found a great niche. Not only have they differentiated themselves on the borrower side from Prosper and Lending Club, but they have also taken a different approach in managing the investor experience. Investor performance looks promising, but the true test will be as the notes begin to age and investor accounts become more mature.