[Editor’s note: This is a guest post from James Alexander, an experienced marketplace lending executive who has been following this industry for many years. See the end of this post for a more complete bio.]

In 1998 a small Internet banking site called X.com made the bold decision to focus on its payments business. A few years later—renamed PayPal—this company encompassed over 100 million active users. Today, the disruption of financial services promises to be more dramatic and far-reaching.

Financial technology (FinTech) represents nothing short of revolutionary change, encompassing payments, next generation advisors and lending. Investments into FinTech startups recently quadrupled, growing to over ~$12 billion in 2014 from ~$3 billion in 2013. It appears 2015 is on track to dwarf the previous year, according to CB Insights, which charts more than 1,300 transactions in the sector since 2008.

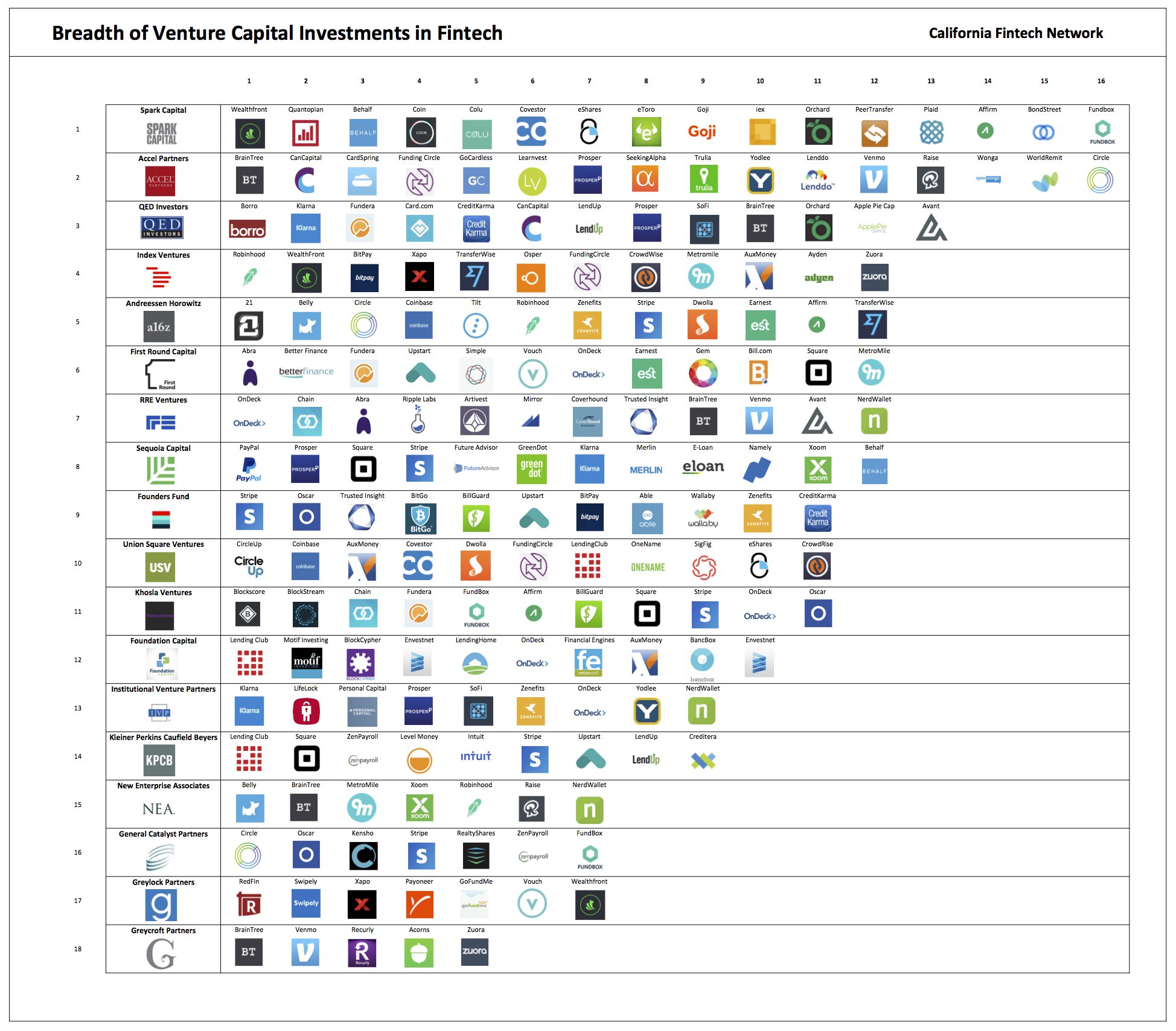

Source: California Fintech Network (click the image above to see at full size)

In this research complied by California Fintech Network, the proliferation of investments across FinTech by leading venture firms is affirmed. What is more interest is the breadth of investments, which confirms disruption across multiple business lines of banks. The most active VCs in this space average over 10 FinTech investments, among analysis in this table of the top 18 most active FinTechVCs (by number of deals).

Other notable FinTech VCs include SF Capital, Ribbit, NYCA Partners, Social Leverage and Core VC.

Smart Money

According to Silicon Valley Bank, over 68% of recent FinTech deal activity is at Seed or Series A. Deal size at the Angel / Seed stage is ~$1 million and ~$6 million at Series A. Global FinTech investments are averaging $50 million valuation. This high percentage of early stage investments reveals that FinTech is still viewed as new and growing sector for venture investors.

Backing FinTech

Many venture investors used lending as a gateway into the sector, starting with pioneers such as Lending Club and Prosper. But VCs have not stopped there. The capital is now flowing across the financial services sector, including personal finance, small business, capital markets, payments and insurance.

On the technology side, the underlying infrastructure is shifting with the advent of blockchain and cloud-based solutions. Indeed, the barriers that have previously protected the incumbent financial services firms are tumbling down.

Maybe what the VCs see, despite concerns about unit economics of early FinTech platforms—notably the public ones—is the banking industry will continue to face disruptions from FinTech entrants. The real benefit will be to the consumer and the overall efficiency of financial services. The bottom line: the banking industry is fundamentally changing, and the VCs know this.

Finding an Exit

As yet, the exits for venture investors in FinTech have been limited. However the pace of this activity is sure to increase as the earlier-stage companies reach scale.

Following are some notable exits in the FinTech sector over the past two years.

Lending

- OnDeck Capital, which went public in December 2014 in an IPO that raised $200 million

- Lending Club: Sold a total of 66.7 million shares at the IPO price of $15, raising just over $1 billion.

Next Generation Financial Advisory Platforms

- Northwestern Mutual acquires LearnVest. Terms undisclosed and sources say ~$250 million in cash.

- Future Advisor. Blackrock acquired for undisclosed amount and sources say ~$150 million in cash.

Payments

- Simple was bought by BBVA.

- Lemon was bought by Lifelock.

Financial Data

- Envestnet agreed to buy data aggregator and technology company Yodlee for nearly $590 million. Yodel went public on Oct 2, 2014.

James Alexander has been dedicated to marketplace lending since 2010, initially through his executive role at Prosper and thereafter working with Lending Club, enabling access to lending capital. James was the creator of the first institutional P2P fund strategy at Colchis Capital, which has purchased nearly $2 Billion of marketplace loans (as of 4Q15).