The stablecoin revolution isn’t coming, it’s already here. And if you’re in banking or fintech, you should be paying attention. Right now.

Just last month, we witnessed what can only be described as a watershed moment for stablecoins. Stripe announced stablecoin financial accounts in 101 countries, Visa and Mastercard rolled out products allowing consumers to spend stablecoin balances via card swipes, and Circle just completed a blockbuster IPO. Meanwhile, America’s biggest banks, JPMorgan, Bank of America, Wells Fargo, and Citigroup, are reportedly exploring a jointly operated, fully fiat-backed stablecoin.

This isn’t about crypto anymore. This is about the future of money movement.

The Numbers Don’t Lie

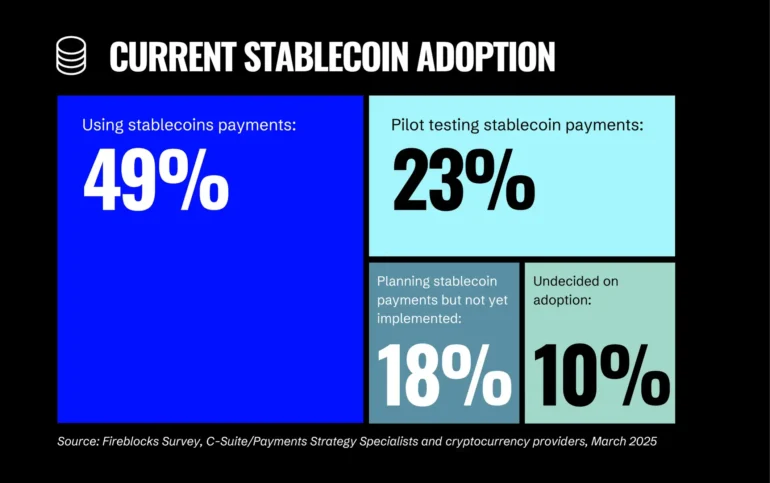

Let me share some data that should grab your attention. According to Fireblocks’ latest State of Stablecoins report, stablecoins now account for nearly half of all transaction volume on their platform. That’s 35 million transactions every month, processing 15% of global stablecoin volume. And here’s the kicker: 90% of payment providers and banks surveyed are taking action on stablecoins today.

These aren’t pilot programs collecting dust. These are production systems moving real money for real businesses.

Take Circle’s USDC, which is processing over $1 trillion in transaction volume a month. That’s not a typo. Or consider that companies like SpaceX are using stablecoins to collect payments for Starlink services globally. And we just heard that Uber is looking at stablecoins as a way to move money globally. This is happening at scale, right now.

Speed Matters More Than Savings

Here’s something that might surprise you: when financial institutions talk about stablecoins, they’re not primarily focused on cost savings. According to the Fireblocks survey, 48% cite speed as the top benefit, while cost savings ranks dead last at 30%.

This makes perfect sense when you think about it. Traditional cross-border payments can take days or sometimes weeks to settle via SWIFT. Stablecoins settle in seconds, 24/7. For a business trying to manage global cash flow or a consumer sending remittances, that speed difference is transformational.

The real value proposition isn’t about being cheaper, it’s about being better. Stablecoins offer instant settlement, programmability, and global reach without the correspondent banking maze. They’re building a layer above existing payment rails, just like the internet created a layer above telecommunications infrastructure (hat tip to Simon Taylor for that).

Regulation Is No Longer the Barrier

Two years ago, 80% of financial institutions cited regulation as a barrier to stablecoin adoption. Today, fewer than 1 in 5 say the same thing. What changed?

The GENIUS Act, which has passed key procedural steps in the Senate and appears headed for passage, provides the regulatory clarity the industry has been waiting for. This legislation creates a bespoke framework for stablecoin issuers, not quite banking regulation, but far from the Wild West.

Under the GENIUS Act, stablecoin reserves must be segregated from general assets, backed 1:1 by cash or short-term treasuries, and subject to specific compliance requirements. The OCC gets primary supervisory authority, streamlining oversight while maintaining safety and soundness.

This isn’t just policy, it’s the foundation for institutional adoption at scale.

Payments and More

While traditional banks debate strategy, the market is moving. As I mentioned, Stripe’s stablecoin products now support 101 countries, up from 46 previously. Coinbase launched x402, a new standard for API-based stablecoin payments that enables atomic transactions between apps and AI agents. MoneyGram introduced programmable stablecoin ramps in 170+ countries.

But this is about more than payments. At the recent Stablecon event in New York City, an executive from Circle said that thinking about stablecoins as just a new form of payment “would be like saying that the internet is a better version of the fax machine.” With new infrastructure, we can do new things.

The message is clear: the new era of money is upon us.

Infrastructure Is Ready

Gone are the days when stablecoin adoption required building everything from scratch. Today, Fireblocks reports that 86% of surveyed firms said their infrastructure is ready for stablecoin adoption. Companies like BVNK, Bridge (acquired by Stripe), and dozens of others provide enterprise-grade APIs that connect stablecoins to existing banking infrastructure.

For banks, this means stablecoins can be integrated into existing treasury workflows without wholesale system replacements. For fintechs, it means accessing global payment capabilities that would otherwise require years of correspondent banking relationship building.

Regional Momentum Is Building

The adoption patterns vary by region, but the direction is consistent everywhere. These stats are, again, from the Fireblocks report:

Latin America leads in real-world implementation, with 71% using stablecoins for cross-border payments. The region’s combination of currency instability and remittance needs makes stablecoins a natural fit.

Asia focuses on market expansion, with 49% saying stablecoins enable access to new markets. The region’s massive e-commerce and export businesses are driving B2B adoption.

North America shows 88% viewing upcoming stablecoin regulations as a green light rather than a barrier. The regulatory clarity is unlocking institutional adoption.

Europe emphasizes security and compliance, with MiCA providing the clearest regulatory framework globally. 37% of European firms cite competitive pressure as their top stablecoin adoption driver, more than any other region.

Three Strategic Paths Forward

Based on what I’m seeing in the market, financial institutions have three viable approaches:

1. Direct Issuance – Like Société Générale, which will become the first major bank to issue a dollar stablecoin on a public blockchain, or the potential consortium of major US banks. This provides maximum control but requires significant compliance and operational investment.

2. Infrastructure Partnership – Partner with stablecoin issuers or infrastructure providers to offer stablecoin services without becoming an issuer. This balances capability with risk management.

3. Integration Strategy – Integrate stablecoin capabilities into existing products, think stablecoin-linked cards or treasury management solutions. This approach builds familiarity while maintaining traditional banking relationships.

The Risk of Waiting

Every day spent on the sidelines is a day competitors gain ground. Circle’s IPO signals that stablecoin companies are moving toward traditional capital markets. Stripe’s acquisition of Bridge for over $1 billion demonstrates the strategic value of stablecoin infrastructure.

Meanwhile, the underlying technology continues to improve. Programmable compliance, automated liquidity management, and AI-driven transaction monitoring are making stablecoins more enterprise-ready every quarter.

Defining the Next Decade

I’ve been covering fintech innovation for over a decade, and I don’t think I have ever seen a technology move from the sidelines to the mainstream so quickly. Stablecoins are fundamentally different from other crypto assets because they solve real problems in traditional finance: settlement speed, global reach, and programmability.

The banks and fintechs that embrace stablecoins today will define the next decade of financial services. Those that wait will find themselves paying premium prices to rent capabilities they could have built themselves.

The GENIUS Act will provide regulatory clarity. The infrastructure is mature. Customer demand is accelerating. The only question is whether you’ll lead this transformation or follow it.

The time for pilots is over. The time for production deployment is now.