It was only a month ago that we covered Yieldstreet’s partnership with Citi, allowing YieldStreet investors to have access to private credit investments typically reserved for institutional investors. Today, YieldStreet announced a partnership with the world’s biggest asset manager, BlackRock. The partnership is specifically with BlackRock’s Global Fixed Income Group. In the past YieldStreet investors have had to invest in individual deals spanning unique assets from shipping containers to litigation finance.

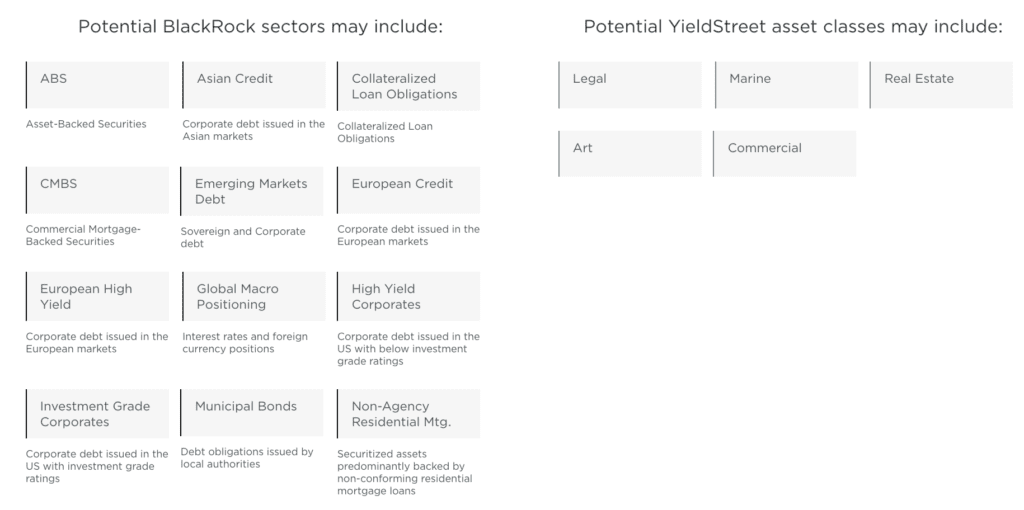

YieldStreet has now created the YieldStreet Prism Fund, a closed-end fund which includes YieldStreet investments alongside corporate and sovereign debt managed by BlackRock. This will be welcome news to investors who are already familiar with YieldStreet, looking for an easier way to access a diversified set of investments. According to the landing page, the fund targets a 7% distribution rate (dividends paid quarterly) and requires a $20,000 minimum investment. There is an option for limited liquidity within approximately 15 months and management fees are set at 1.5%. The below screenshot gives you an idea of some of the asset types that are included.

In a video the YieldStreet founders shared that they issued request for proposals to several industry titans and landed on BlackRock. YieldStreet noted that they chose BlackRock due to their expertise, being the largest asset manager with over $7 trillion under management and their global presence, which will help source new deals across the globe. According to CNBC, BlackRock spent 18 months vetting YieldStreet.

As part of the CNBC feature co-founder Michael Weisz shared:

It’s a fund that’s not designed to be aggressive, it’s for passive income…It’s a fund where you’re getting access to some of the best management talent that exists in the credit space.

Like YieldStreet’s current offerings it is only available to accredited investors, those who earn over $200,000 or have a net worth excluding their house of over $1 million. YieldStreet currently has 200,000+ investors on their platform and according to the co-founders has not lost principal on any investment.

Conclusion

While we have been familiar with YieldStreet for a long time (See Peter Renton’s returns where YieldStreet is featured quarterly), this news alongside the Citi partnership is going to raise awareness significantly for YieldStreet. They have quickly become a leader when it comes to alternative assets and it will be interesting to see how returns track over time now that there is transparency into these assets.