Your Juno is a financial education platform for women and non-binary people focusing on millennials and Gen Z.

The aim is to make financial literacy universal for those who need it the most.

Founded in 2020 by sisters Alexia and Margot de Broglie, Your Juno aims to put women at the heart of finance.

They just completed their first round of funding and raised $2.2 million from mostly women investors. They are now focusing on building out the content so that Your Juno can become the one resource for financial education on any topic.

How it started

“The name Juno comes from the goddess of Money, Juno Moneta. Money was named after her (a woman), so we thought it’d be a good wink to bring us back to those times,” co-founder Margot de Broglie explains.

The goddess Juno Moneta was an epithet of Juno, and, as a result, money in ancient Rome was coined based on her name. The word “moneta” (from which the words “money” and “monetize” are derived). In several modern languages, including Russian and Italian, moneta (Spanish moneda) is the word for “coin,” according to Peter Aicher, who wrote Rome Alive: A Source-Guide to the Ancient City Volume I.

The app was created during the pandemic, as they found the topic of investing became hugely popular amongst their friends.

“We quickly noticed that our conversations with our male and female friends were very different. Most guys had clear portfolio strategies, whereas most of our female friends kept their money in savings, feeling like they didn’t know enough.”

After hosting a mini-course with friends and their network, the founders saw there was some appetite for trustworthy and engaging financial education.

“We want to encourage people to learn and embrace financials as an integral element of their ‘adulting.’ We are still astonished that many of these essential tools are not incorporated into education at a secondary or tertiary level.”

Why women?

“It may seem radical to build something for women specifically, but we need to realize that so far, the fintech industry has mainly been built by men for men. And while that may or may not be a conscious effort from leadership, it’s undoubtedly a byproduct of a systemic lack of diversity throughout the technology sector.”

“Women make up just 30% of fintech staff, and that picture gets even worse when you get to leadership. Just 1.1% of funding went to women-led businesses in 2021, worse than 2020, according to Atomico. This trickles down into the user base of these products: If you look at investment platforms, women only make up 24% of app users. It gets even worse with crypto. Women are only 7% of crypto holders, so instead of that gap becoming smaller with new financial innovation, it is becoming bigger”, De Broglie explains.

Moreover, a report by Ernest and Young shows that women’s capital and income are growing faster than ever.

Powerful demographic, economic and technological changes increase women’s financial strength and independence.

Women may soon control most U.S. household wealth. Due to this power and the relative complexity of their financial lives, women present a massive opportunity for the financial industry.

Despite this, most do not place much emphasis on gender segmentation. It is hardly surprising that many female investors feel unwelcomed and even alienated by the investment industry.

Related:

The study also showed that women commonly use terms such as “unwelcoming,” “patronizing,” “male-dominated,” and “full of jargon” to describe the wealth management and financial industry more broadly.

Globally, 67% of female investors feel their wealth manager or private banker misunderstands their goals or cannot empathize with their lifestyle. In some key markets, such as the UK, China (Mainland), Singapore, and Hong Kong, the number is even higher.

Thus there is a gap for a financial literacy app specifically targetting women.

De Broglie says, “the earlier someone starts to build solid financial habits, the larger its impact on their lives. For example, we see this with investing, where time in the market has the largest impact on returns. The same goes for salary negotiations – if you start negotiating your salaries from your first job, this sets the baseline for any future salary and can compound life-changing salary differences. That’s why we focus specifically on millennials and Gen Z, to support them in building those financial foundations early on.”

Financial products

According to the Ernest and Young report, women have distinctive and complex preferences.

Women are more financially powerful than ever and may even account for most personal wealth in some markets.

Yet there are few tailored experiences and financial investing and saving products for women that acknowledge their formal and informal goals and soft preferences.

Consequently, one might wonder if education alone is enough. Financial inclusion may also need to focus on creating financial products and services that cater to women, and having one space for it all could create more inclusion.

However, De Broglie explains, “at the moment, the focus is solely on providing unbiased financial education. This allows us to have our user’s best interest at heart, without aiming to sell them a financial product at the same time.”

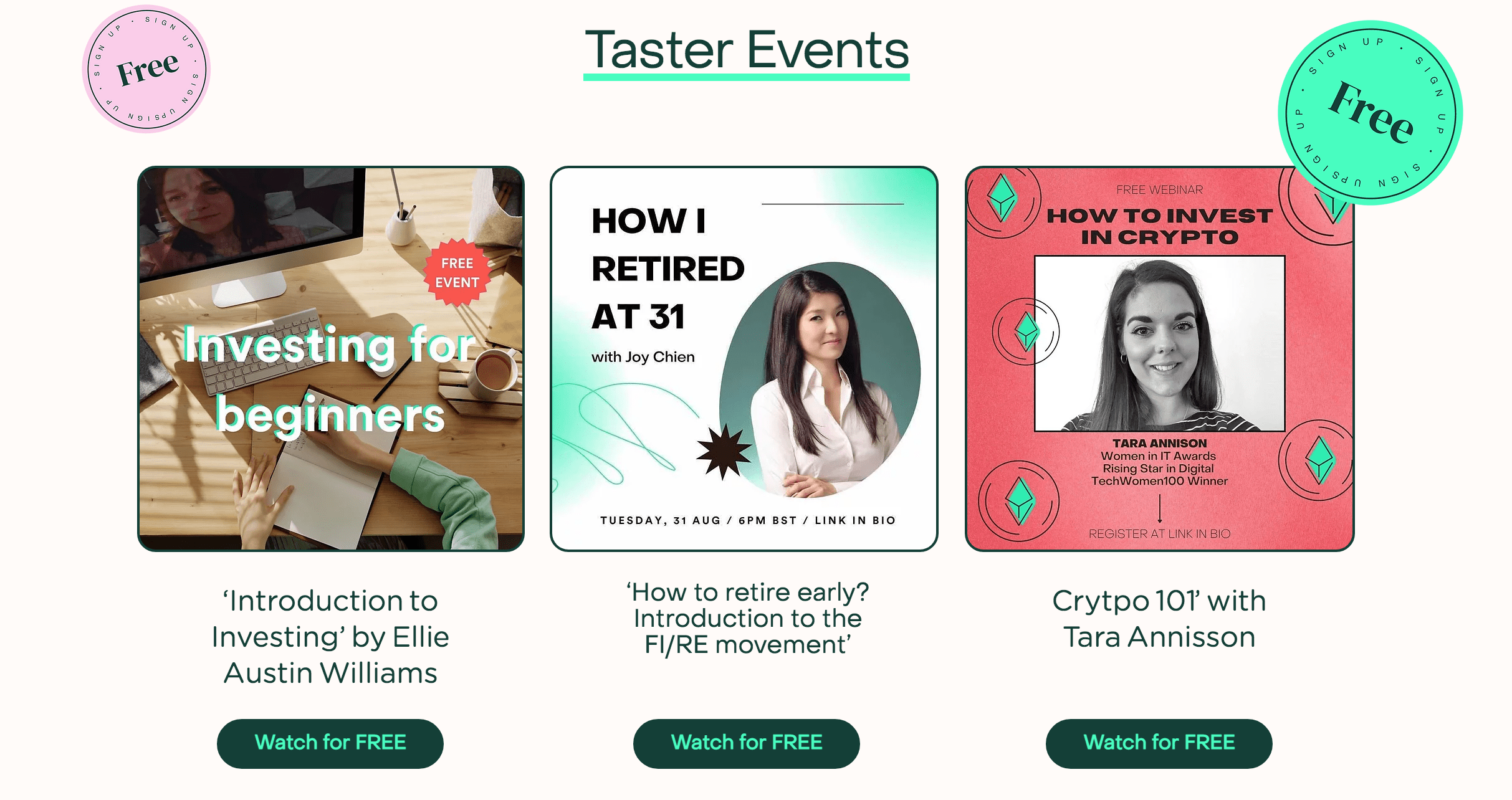

Your Juno also hosts talks such as ‘Investing for Beginners, Crytpo 101’ and more, and they work with their community online to develop future content and have a growing social media presence with nearly 18,000 followers across their social media platforms, making it clear this is an integral part of their strategy. “Social media plays a large role in normalizing financial conversations – more than half of Gen Z now turn to TikTok for financial advice.”

‘Where finance meets feminism’

“Knowledge = power. We give women the confidence, clarity, and control to take charge of their financial future. This has a ripple effect not only in their own lives but also in society. Women are known to have a larger societal impact on their women: they give more to philanthropy, care more about ethical investing, and cast a vote with their money. Overall, everyone will benefit from women having more money, De Broglie exemplifies.”

You can download the Your Juno app from Apple and Android stores.