So 2012 is in the books now and we can certainly say that it was the best year ever for the U.S. p2p lending industry. Total loan volume between Prosper and Lending Club in December was $103.7 million and for the year the total was $871.1 million. To put that in perspective in 2011 total loan volume was just $332.5 million, so this year we saw a 162% increase. Although the vast majority of that volume came from Lending Club as they went from strength to strength in 2012.

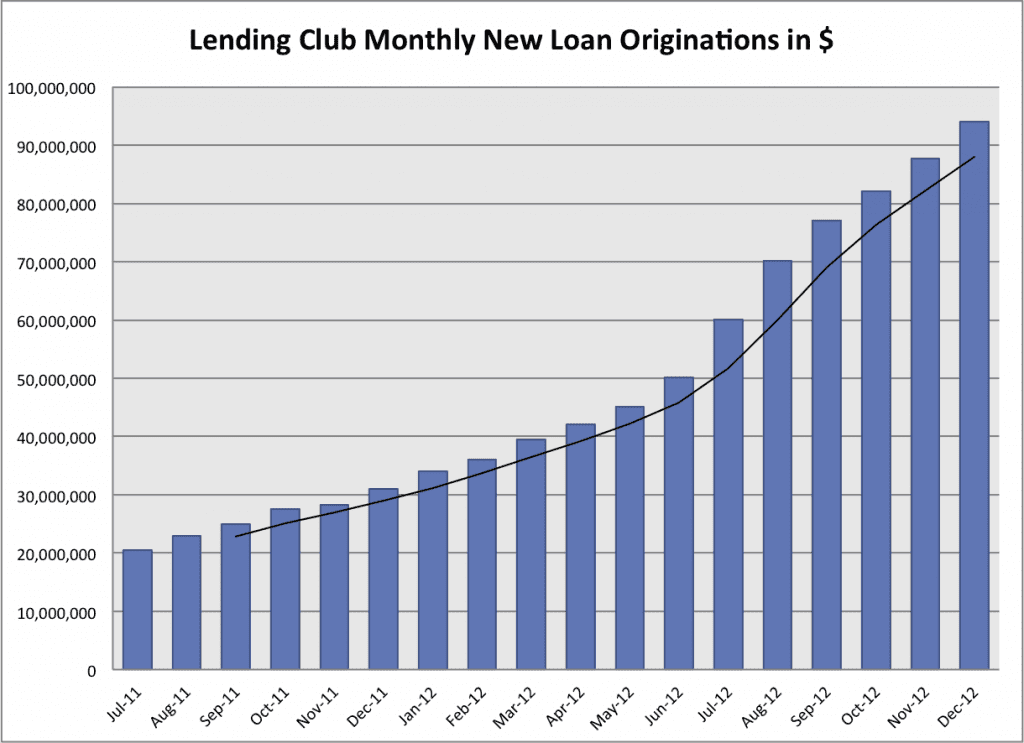

Lending Club Ends 2012 With $94 Million in Loans in December

Lending Club ended December like they have done every month this year, with record loan originations. The December total was $94.1 million and they ended the year with $714.7 million in total loans. There was only good news for Lending Club all year as every month of 2012 saw record loan originations.

Lending Club crossed $500 million in total loans in February and then the $1 billion mark in November. They finished the year with $1.178 billion in loans issued since they started in 2007, with $717.9 million of that total issued in 2012. This compares to just $257.4 million in total loans issued in 2011, a staggering 179% year over year increase.

If you dig into the numbers a little December was an unusual month for Lending Club. Total number of loans originated was actually down this month for the first time since February. In fact, Lending Club issued more loans in September (6,087) than they did in December (6,066). But thanks to the highest ever average loan size of $15,511 they still easily managed a record month. It will be interesting to see if that trend continues into 2013 but that average was well above the previous record monthly average of $14,196 set in February.

Below is the Lending Club 18-month chart. The black line is the three-month moving average.

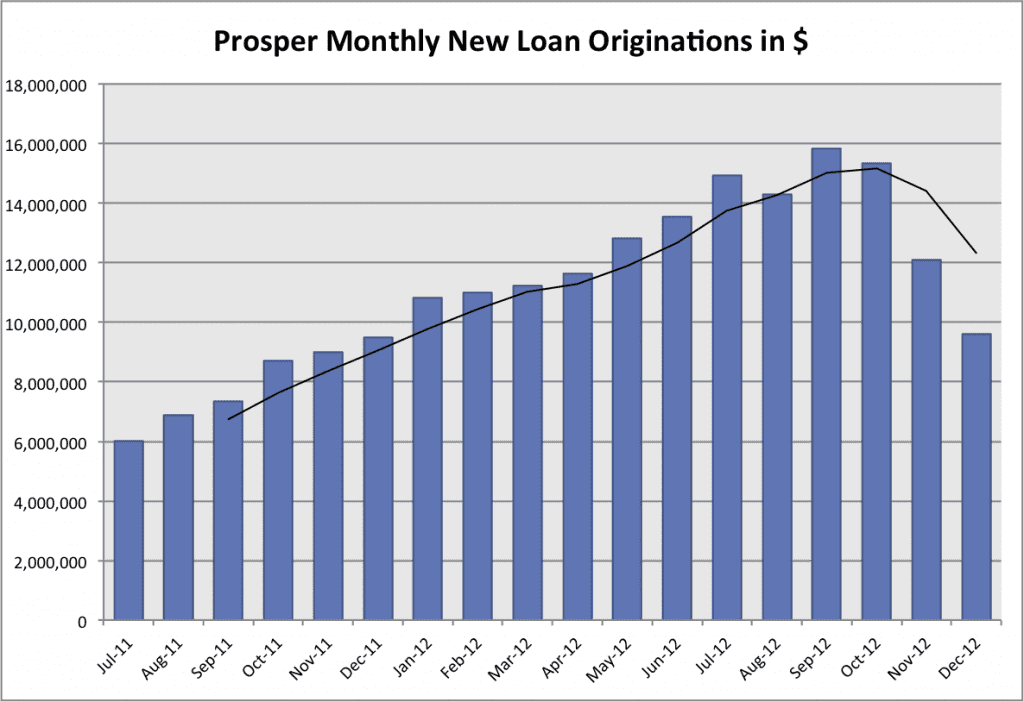

Prosper Has Their Worst Month of 2012 in December

December was a month that Prosper would rather soon forget. With just $9.6 million in new loans it was the worst month of the year for Prosper and the third consecutive month of significant volume declines. Two of the top three Prosper institutional investors, Worth-Blanket2 and MI2 had no lending activity whatsoever in December according to Prosper Stats and the number two investor Index_Plus had a lower than average month investing.

What made matters worse in December was the problem that Prosper investors encountered the week before Christmas. For several days no payments were credited to investor accounts due to a software problem. It has now been resolved but it left some investors feeling a bit disillusioned and it certainly didn’t help Prosper’s loan volume this month. You can follow the conversation about this issue on the forum.

When you look at 2012 as a whole Prosper’s numbers look much better. They originated a total of $153.2 million up over 100% from 2011 when their total was $75.1 million. If Prosper can rebound from their bad fourth quarter and have a really good first quarter of 2013 most investors will forgive and forget. But they need to start out the year strong.

I had a conversation with senior management at Prosper last week and while they are disappointed with their performance in December they did say that January will come with some more positive news for Prosper. Part of this news will be the fact that the SEC has approved the Prosper Funding LLC registration, their bankruptcy remote vehicle. This became effective on December 27th and I will have a more detailed write-up about it later this week.

Below is the 18-month chart for Prosper, as you can see the downward trend has become steep in the last quarter.