OnDeck had some pretty interesting updates in their earnings release which took place earlier today. CEO Noah Breslow shared that the company has decided to pursue a bank charter which will enable the company to offer their small business customers a wider range of products. OnDeck has been studying their options for some time and felt that the timing was right. While OnDeck didn’t want to divulge their vision or timing for what the company may offer they did mention that the bank charter would be accomplished through a transaction or a de novo bank application.

To date, OnDeck has operated as a non-bank lending institutions, but they believe the opportunity is much bigger, even mentioning “digital banking for small businesses” as well as increasing product and services both in lending and non-lending on the call. There will also be benefits as it relates to funding. While this may be a costly endeavor they believe the benefits outweigh the costs. At this point this announcement leaves a lot to the imagination but it alludes to a number of interesting opportunities for OnDeck in how their business could transform.

OnDeck also shared plans for a $50 million stock repurchase program noting that even with the investment they will still have capital for further growth and a buffer against economic uncertainty.

Probably the biggest shock was that Chase is concluding their partnership with OnDeck. When this partnership was announced it created quite the buzz in the fintech community. To be working with Chase was a huge vote of confidence for OnDeck and I too thought it would radically change OnDeck’s business.

Chase will stop originating loans through OnDeck and OnDeck will continue to service the loans for two years. Breslow stated that the decision on Chase’s side was due to a change in strategic priorities and spanned more than just their small business lending plans. This decision makes one think about the long term plans of the bank as perhaps they look to build their own technology platform.

Despite the bad news with Chase, we learned that the pipeline has never been stronger with OnDeck’s ODX offering and that they are making progress in converting new customers. We should hear more announcements before year end.

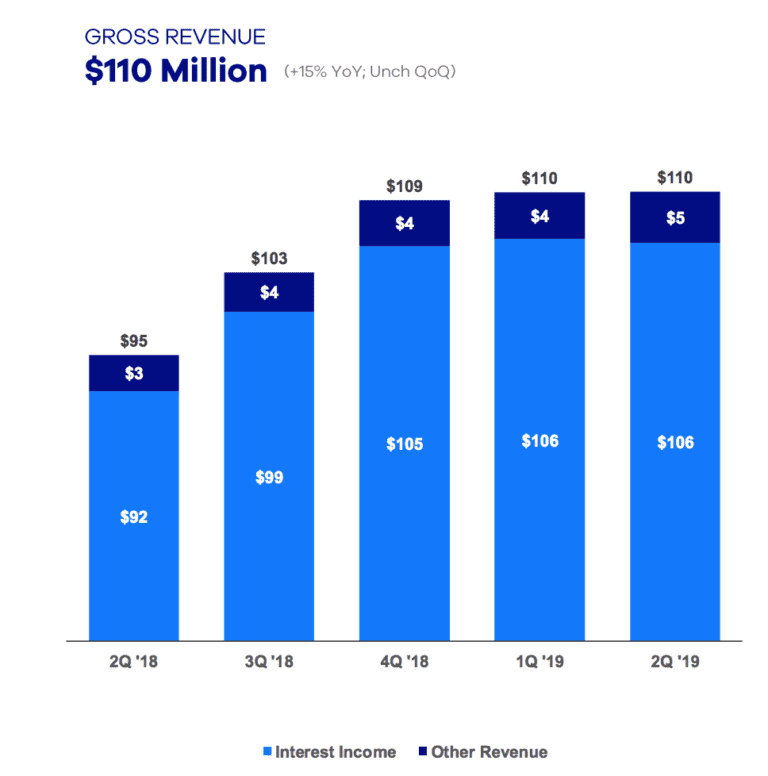

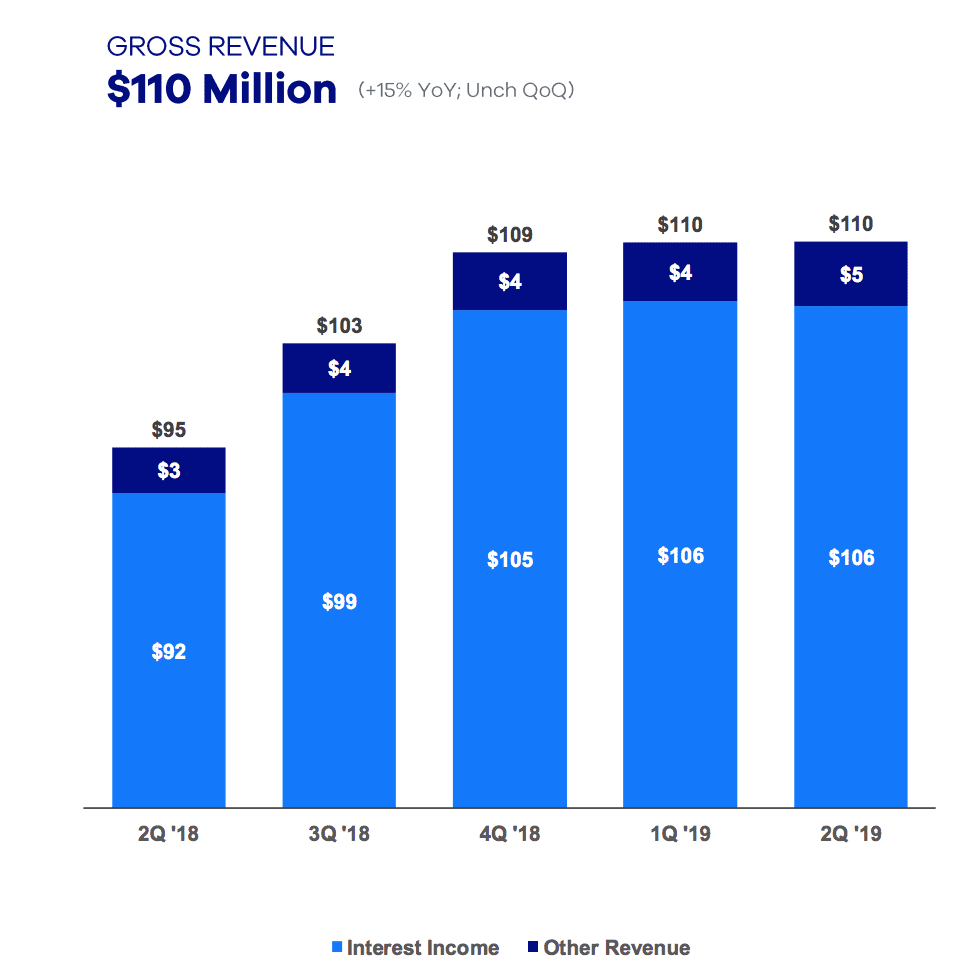

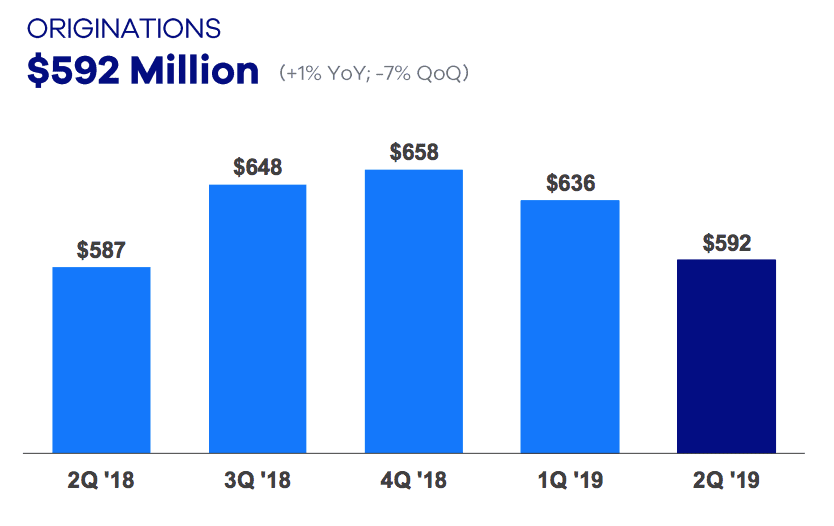

In the quarter OnDeck also closed the transaction with Evolocity to combine their Canadian operations. Moving on to financials in Q2 2019, net income was $4.3 million compared to $5.6 million from the prior year period and $5.7 million in Q1 2019. Gross revenues were $110.2 million and originations were $592 million in what is typical for the second quarter.

You can view OnDeck’s Q2 earnings press release here.

Conclusion

It’s hard to sugarcoat losing the largest bank in the US as a client. Since the relationship was announced many have been looking to get a better understanding of the traction of the partnership. Now we have an understanding of perhaps why we never got the details. Since the Chase partnership was announced OnDeck created a new division called ODX to house this part of the business and signed up PNC on their ODX platform. There is clearly still opportunity in the ODX business but going forward OnDeck is going to have to work harder to prove the model out to their investors.