I have been following the developments of Decentralized Finance (DeFi) this year with great interest.

This has mainly involved reading, listening to podcasts, and the occasional investment. I have invested in a few tokens through my Metamask wallet but have not delved deeply into any of these projects until now.

When I learned about Klima DAO on the Bankless podcast last month I was intrigued. Here was a project focused on addressing climate change in a new way, by creating a DeFi token that is backed by real-world carbon offsets. Buying carbon offsets has become a popular way for organizations and individuals to mitigate their carbon emissions, thereby reducing their overall carbon footprint. This typically involves buying into projects that reduce carbon emissions such as tree planting programs, renewable energy projects, and direct carbon capture.

What Klima DAO has done is create a system that locks in these carbon offsets, called Base Carbon Tonnes (BCT) in this case. Every Klima that is minted locks in a BCT in the Klima DAO treasury thereby taking the offset off the market. That will have the effect of removing carbon supply and will potentially make the remaining supply more valuable. You can read more about it here and why they chose this as a solution.

The more I researched this project the more I became intrigued. Here was a DeFi project that was good for the planet and had the potential to be financially rewarding as well. So, I decided to participate in the launch last Monday (October 18). This involved quite a bit of learning as the launch was taking place on Polygon, a Layer 2 protocol that I had never used.

What is a Layer 2 Protocol and why use it?

Most DeFi projects have been built on Ethereum, which is a so-called layer-1 protocol. Bitcoin and Litecoin are also examples of layer-1 protocols, they are the original building blocks of the blockchain world. But the problem with layer-1 protocols is that they have trouble scaling and they are energy-intensive. As a project that is looking to make the planet a greener place, there is no way they could have credibly launched on a layer-1 protocol.

Think of a layer-2 protocol as sitting on top of the layer-1 protocol, doing most of the calculations and transactions without the need to write everything out to layer-1. With Ethereum becoming so popular for building applications there has been network congestion that led to slow response times and high fees, known as gas fees. There is much more to it and if you want to go deeper here is a good place to start.

Polygon is an example of a layer-2 protocol and was what Klima chose for their project. This meant I had to get money into Polygon to participate in the launch. Thankfully, this was relatively easy as I could connect my Metamask wallet to the Polygon wallet directly. Once you are logged in to your Metamask wallet it connects with one click.

The Klima Launch

I missed all the pre-launch activity for Klima where early adopters obtained aKLIMA and alKLIMA that could be swapped for KLIMA at launch. But I had to figure out how to get money into my Polygon wallet. I sold a couple of DeFi tokens (paying way too much in gas fees because they were on layer-1) and also sent a little ETH from my Coinbase wallet.

The best way to buy KLIMA tokens at launch was via USDC (a stablecoin) tokens on Polygon. So, once I had ETH in my Polygon wallet I could swap them out for USDC using SushiSwap. You need MATIC tokens to trade on Polygon but the cost of layer-2 transactions is literally less than 0.1% of the cost of Ethereum gas fees.

So, I had my 5,000 USDC ready to go for the launch which was scheduled for 4 p.m. ET (8 p.m. UTC) last Monday. They had some initial hiccups but I was following along on the Klima Discord so I knew what was happening. I had SushiSwap loaded up ready to go and after the 90-minute delay, I was able to execute the first of two trades on Polygon swapping out USDC for KLIMA tokens. I did my first trade within the first 30 seconds and then waited 24 hours to do the next trade, then I became the proud owner of just under three KLIMA tokens. And that number is growing thanks to staking.

Staking to earn more KLIMA

If you have spent any time in the DeFi world you will know that there are many people out for a quick buck where yield farming can bring high short-term returns. These people are not good for the long-term viability of a project so to counteract the speculators, projects like KLIMA offer staking. This is where you provide your KLIMA as collateral and as a reward you earn more KLIMA. And the rewards can be substantial.

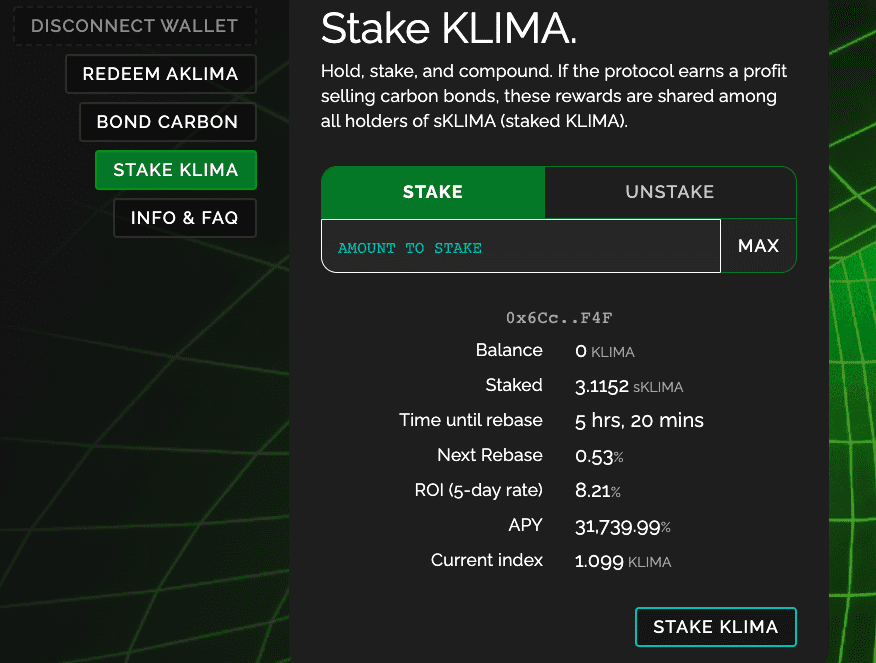

As you can see from the graphic my KLIMA balance is 3.1152 sKLIMA (staked KLIMA) right now even though I started with just under three tokens less than a week ago. To encourage people to stake their KLIMA they offer very high initial rewards. As an annual percentage, this is more than 30,000% APY right now although that number is dropping. Every eight hours, I receive more tokens and on the next drop, I will earn 0.53% of my entire balance as a reward. This can compound really quickly.

A long-term climate play

I am not interested in the quick financial gain here. As of this writing, Coinmarketcap has the price of KLIMA at just over $3,300. In my initial trade, I paid $1,350 per KLIMA and the latter trade $1,980. So, I have already made a nice initial return on paper.

But I am a believer in this project and therefore a long-term investor. I intend to hold my KLIMA for the foreseeable future. I realize this is a speculative investment and it could all go to zero one day and I am comfortable taking that risk. There is also the possibility that KLIMA takes off and becomes the basis for a new carbon economy.

A DeFi education

I enjoyed learning the DeFi ropes to participate in this project. I am still by no means an expert but I know a great deal more than I did a month ago.

This is the thing with DeFi. The best way to learn is by diving in. In some ways, this is still the wild west and the user experience can be a real barrier to entry. It took me 4-5 hours of playing around before I could figure out how to participate. These apps are decentralized, there is no KYC and there is no centralized location where you can transfer money from a bank account or credit card. You can have to participate through a crypto wallet.

Thankfully, there are many people willing to help and the KLIMA discord community was a wealth of information. I learned about bonding, slippage, GWEI, Olympus, OHM, BCT and so much more. They are a very patient community (for the most part) and answered the same beginner questions over and over to newbies like me.

Now the Klima project has launched I will be paying attention to new developments. No one knows what will happen with Klima or with DeFi in general but as a fintech enthusiast, I encourage you to dive in and learn. DeFi could well be the framework for the future of finance.