What a great month for the two leading p2p lenders. Combined they issued $160.4 million in new loans. This is a staggering 199% more than the total both companies issued in April 2012. We are used to seeing these record months from Lending Club but April was a huge month for Prosper as well. They passed $20 million for the first time and in just two month their loan volume is up 125%. Clearly the new management team has been driving growth.

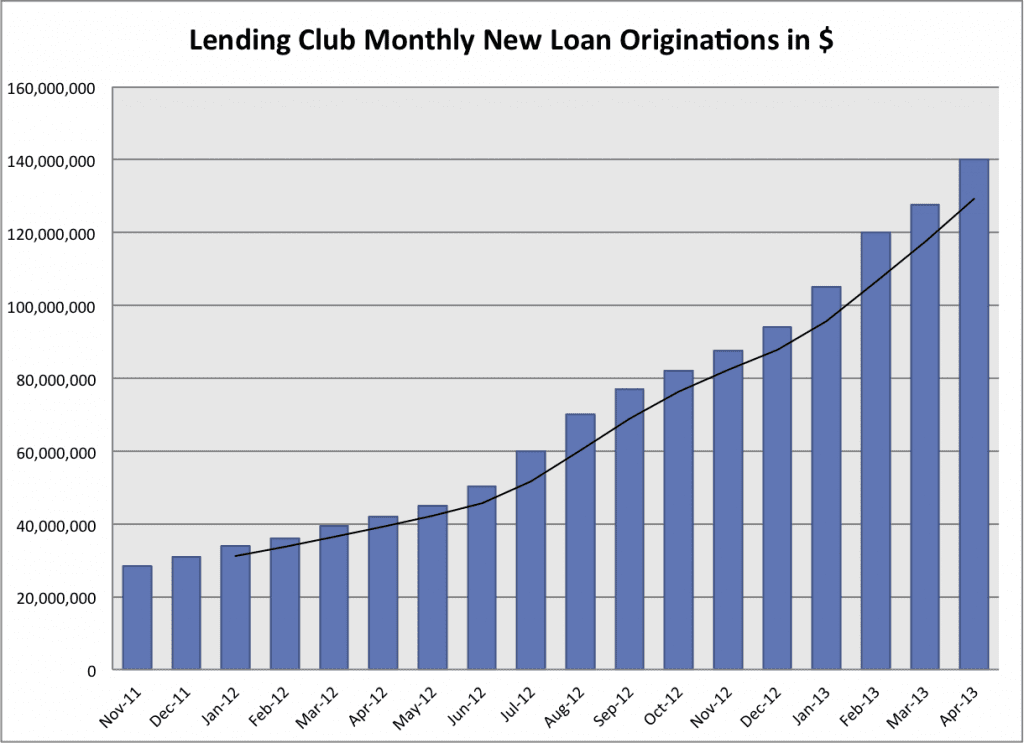

Lending Club Issues $140.1 Million in New Loans

April was an interesting month at Lending Club. Investor demand was so great that they could not keep the loans on their platform. Despite issuing a record $140.1 million in new loans the number of loans available for investors at any one time hovered between 100 and 200 for most of the month. In fact a couple of times this month I noticed available loans slip below 100 which is the first time I have seen that since I started investing in 2009.

It was a bit deceptive to the casual observer and I had several emails from readers saying that the volume at Lending Club was way down. In the big picture nothing could be further from the truth. They issued 9,418 loans in April or 428 every working day. That is a huge increase in the number of loans, it is almost triple the number that were issued one year ago.

You may have missed it but Lending Club published an official blog post earlier this month about this huge surge in investor demand and what they intend to do about it. The growth doesn’t look like stopping any time soon. Below is their always impressive 18-month chart that shows their three-month moving average (the black line) heading straight up.

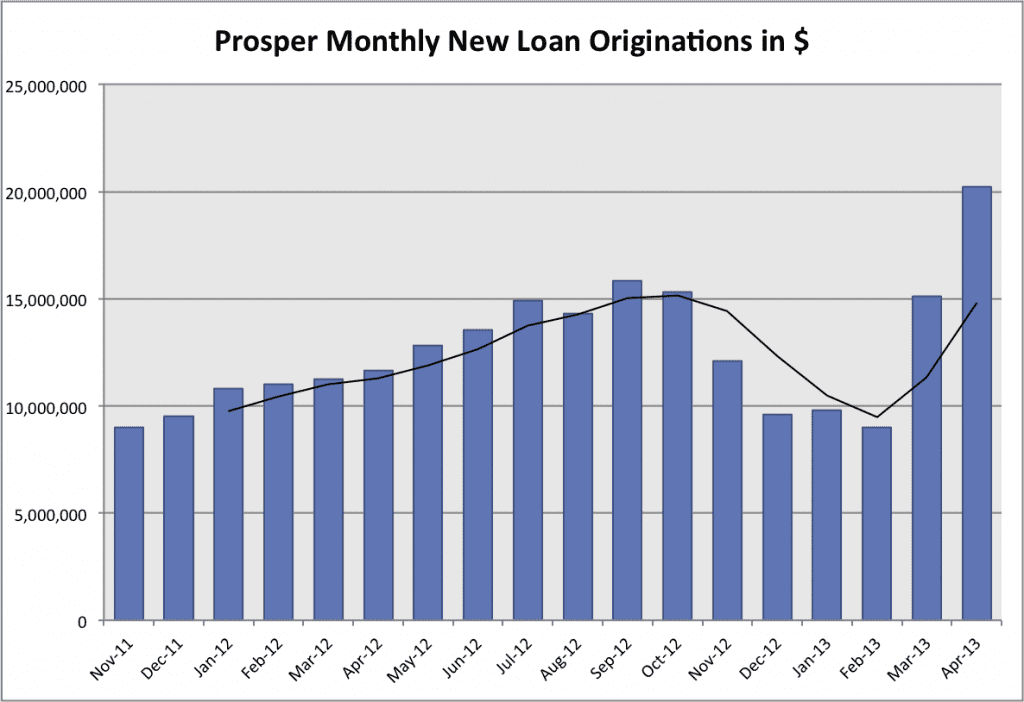

Prosper Has a Record Month With $20.2 Million in New Loans

[Update: As this post was being published there was a new update on Prosper’s blog from president Aaron Vermut. I recommend everyone read that for a more complete picture of what has been happening at Prosper this month.]

Prosper is also on an impressive run as far as loan volume goes. Back in February they issued a paltry $9 million in new loans but since then they have been on a tear. So much so, that in April they were up 125% in just the last two months.

The average loan amount at Prosper also continues its steady rise. After hovering between $7,000 and $8,500 for all of 2012 since the management change in January the average loan amount has increased every month. In April it stood at $10,277 as Prosper issued 1,969 loans. I expect this number will continue to rise to probably become more in line with Lending Club’s average loan size of around $15,000.

One of the interesting things I noticed this month is that the average interest rate on loans at Prosper has started to drop. I noticed there have been more A-grade loans than usual and less of the D, E and HR loans that I like to invest in. In fact, today when I checked there were no loans whatsoever below a C-grade. This explains why my cash balance has been building up this month. This seems like a temporary blip but will be interesting to monitor going forward.

Below is their 18-month loan volume chart. The three-month moving average is trending back up again nicely.