In the United States investment opportunities in marketplace lending have long been limited to US based platforms for individual investors. However, one platform has set out to change that with their global approach to the marketplace lending industry. Bondora, an Estonian based lender was the first to announce in October, 2015 that accredited investors can access their marketplace from the United States, Canada, Mexico, Brazil, India, Hong Kong, Switzerland, India, Singapore, South Korea, Japan, India and Australia.

With the exception of the less-regulated Bitcoin lenders, this is the first marketplace lender to go global with their investor pool. I had the chance to talk with Pärtel Tomberg, co-founder at Bondora to learn more about this news. In addition, Peter created an account so we could dig into the improved investment experience from an investors perspective. When I talked to Pärtel he said that lending beyond borders was the vision with Bondora from day one.

Over the last year Bondora has setup a structure that allowed retail and institutions to invest side by side. The structure is close to that of both Lending Club and Prosper, but they do not have a partner bank since Bondora possesses all of the necessary lending licenses in the countries they operate. As they look to expand they may need banking licenses and at at that point they may work with a partner bank or apply for a banking license themselves.

There are many things that make investing in an overseas marketplace lender appealing. Investors are able to benefit from higher yield opportunities that may not exist in their home country. Bondora currently offers loans in three countries: Spain, Finland and Estonia. Each country has their own APR ceiling or no APR ceiling at all in the case of Spain. Pärtel noted that by bringing in investors from all over the world they have a large capital supply to fund the loans. They benefit with this global approach since a German investor may behave differently than a British or Dutch investor. This helps them fund a broad mix of loans. He believes with this approach every risk segment will find an investor. When we spoke in late September he stated that they were constrained by capital and so opening up to investors overseas could help alleviate this problem.

You’ll notice as we look at the statistics and the Bondora platform that these interest rates are extremely high. However, Pärtel noted there is a lack of competition in these markets which is where Bondora can come in and offer better rates to the borrower compared to a bank or a payday lender. He noted in Finland that one bank controls 85% of unsecured lending. With these higher interest rates they are able to offer yields twice as high as other European platforms by investing in near prime and prime borrowers.

Bondora Statistics

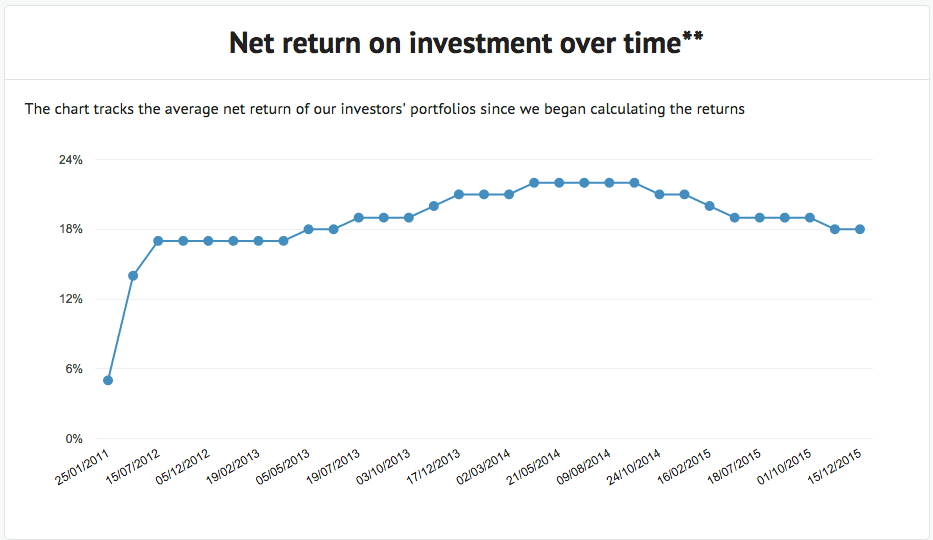

Bondora has a statistics page similar to that of Lending Club. Since 2009, the Bondora platform has funded 47m € in loans. They originated over 1.5m € in November, 2015. Ninety-three percent of investors who invest more than 10,000 € have earned more than a 10% return. The average annualized net return on investment is 18.32%. Below is a historical chart of average net returns over time.

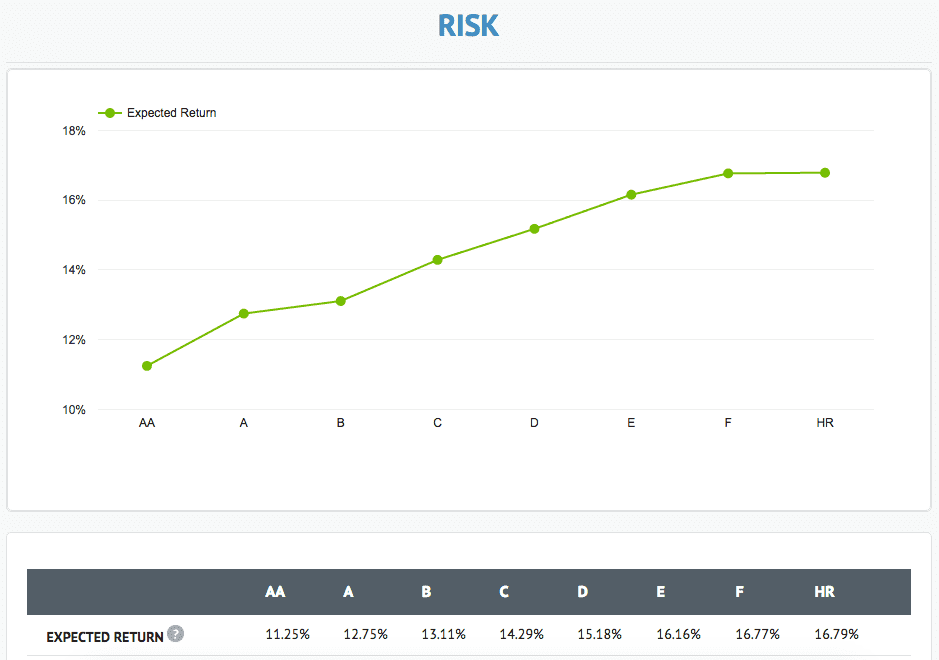

Bondora grades loans similar to Prosper albeit with higher interest rates with grades ranging from AA to HR. Note that the best loan grade (AA) has an expected return of over 10%. The average interest rate is 28.56% with an average loan amount of 2,346 €.

Investing on Bondora

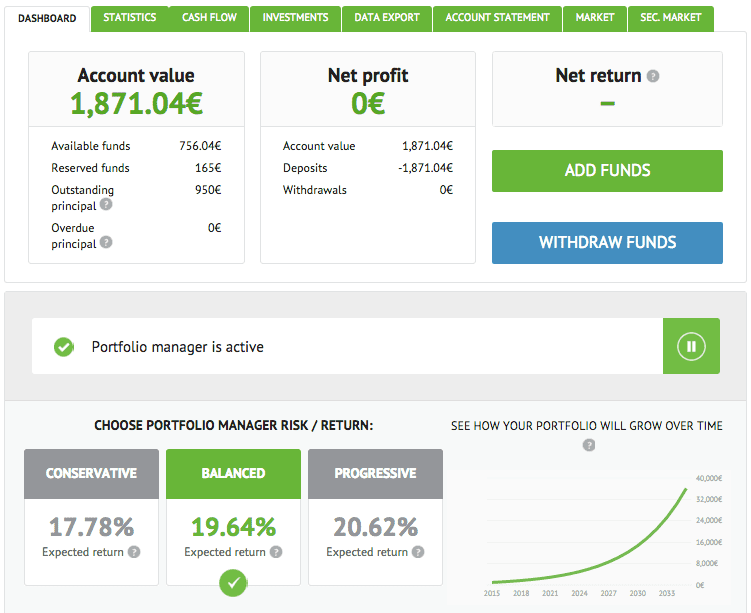

Peter has enabled Bondora’s portfolio manager which is a passive approach to investing. He has chosen the balanced option which shows a projected return of 19.64%. For active or advanced investors, Bondora offers an API to run their own investment models as well as a secondary market. It should be noted that Peter only opened this account a couple of weeks ago so his initial investment of $2,000 (converted to 1,871 €) is still being deployed.

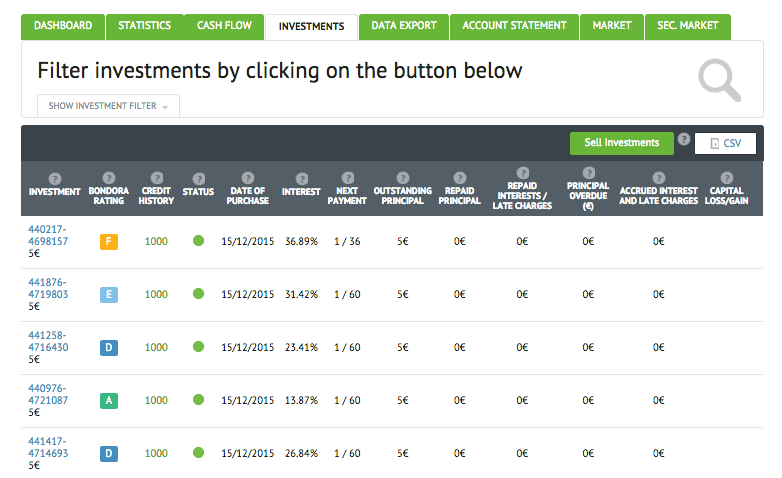

Below is a screenshot of investments that have been made with 5€ being invested in each loan.

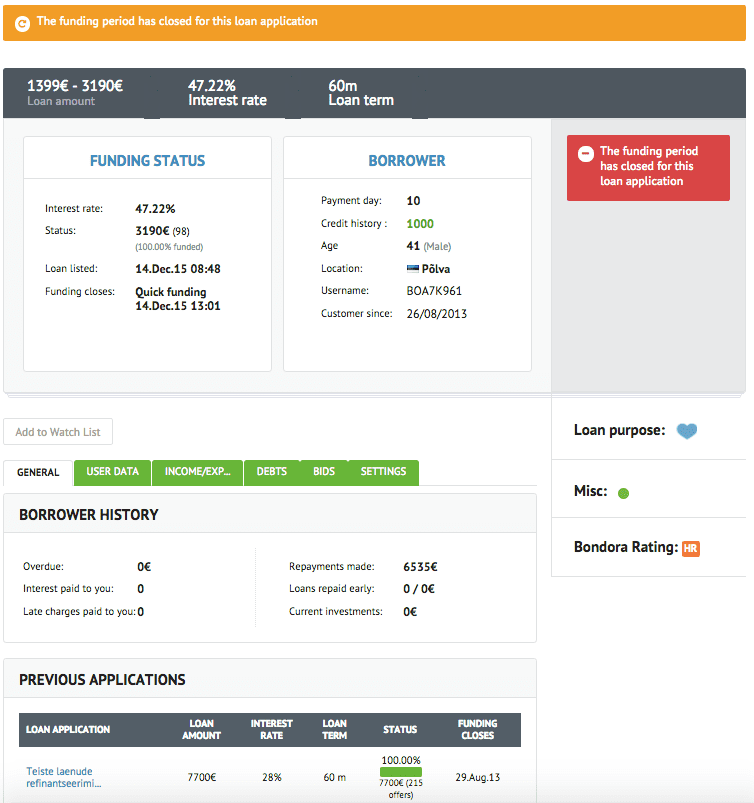

You can view more data on the loan by clicking on it. Below is an example of a loan that carries an interest rate of 47.22%. You can see that the borrower has already taken out a Bondora loan. Each tab details more information on the borrower.

Conclusion

Bondora is the first to take a global approach for investors in marketplace lending and as they prove out the model long term it could be one that other platforms replicate as well. Not only does this offer diversification to investors all over the world, but Bondora now has a much larger pool of investors to fund the loans. They are certainly one to keep an eye on especially for investors seeking higher yield. After reviewing the Bondora platform it’s clear that they have carefully thought through the investment experience.

Disclaimer: None of this information should be considered investment advice. You should consider your own situation and risk tolerance before making investment decisions.