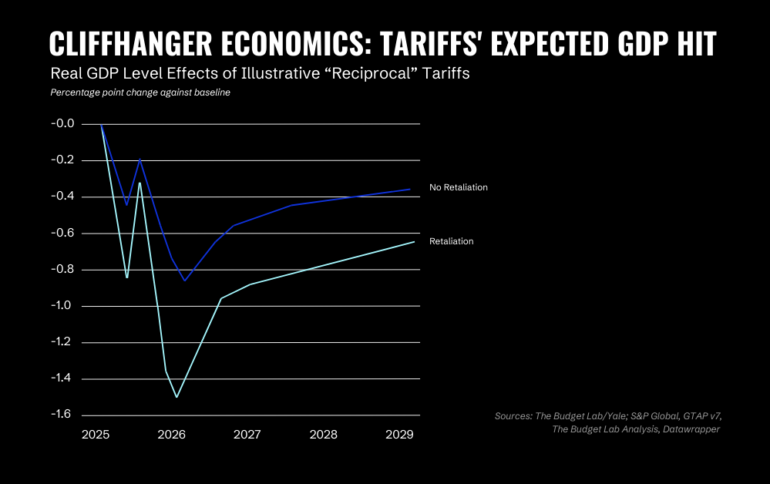

| At 12:01 AM ET on Tuesday, a U.S. tranche of 25% tariffs went into effect against Mexican and Canadian imports, and tariffs doubled against Chinese goods. Public market reactions were nearly instantaneous and universally grim: The S&P 500 lost all post-election gains, though stock markets rebounded somewhat on Wednesday following President Trump’s decreed temporary exceptions for the auto industry, suggesting (to some) that an all-out trade war may not fully materialize. An announcement this morning by Commerce Secretary Howard Lutnick that most Mexico/Canada tariffs will “likely” be suspended by another month will plausibly help market outlook as well. But applying a will-they-won’t-they ethos to macroeconomics and geopolitics complicates businesses’ ability to strategically plan for their future. Will this escalate, or is it all just brinkmanship? Stay tuned. The Editors |