This week I discuss SpaceX, and its Dragon rocket carrying American astronauts to the International Space Station for the first time in 9 years. The 20 year old company is a testament to the incredible iron will and absolute insanity of the most visionary capitalist alive -- Elon Musk. We walk through various attributes of the company and recent launch to derive lessons for the financial industry and the entrepreneurs rebuilding it.

The web of investment bank technology, there are 20 or more core vendors on which systems run. Adding Blockchain to the mix merely adds a 21st system, which is by design incompatible with everything else. Thus enterprise chain projects have been focusing on integration and proofs of concepts, not re-engineering the core. But we know how this plays out -- as it has over and over again across Fintech. Digitizing "unimportant" channels and hoping for them to succeed simply doesn't work. See JP Morgan giving up on Finn, or Northern Trust capitulating its pioneering idea into Broadridge, or any other number of examples from Bloomberg to LPL Financial. Even the struggles of Digital Asset could be used as an example of the danger of working oneself into an existing web of solutions, and trying to preserve their dependencies.

We are like the hungry at the all-you-can-eat buffet. In the beginning, there is not enough! Let's democratize access to food; to music; to transportation; to healthcare; to finance; to payments; to banking; to lending; to investing. The billions in institutional capital across universities, pensions, and sovereigns are delegated to smart portfolio managers. The day before yesterday, it was allocated by small cap stock pickers (hi Warren!). Yesterday, it was the alternative managers of hedge funds and private equity. Today, it is the trading machine and the venture capitalist. Tomorrow, it is the cryptographic artificial intelligence.

This week, we look at:

PwC estimating that $900 billion has been wasted on digital transformation projects for enterprise, meaning finance is vulnerable

Chime is worth $15 billion in the latest round of valuation, same as $200B+ depository bank Fifth Third, which is quite the achievement

Decentralized exchange Uniswap distributing 60% of its token to the community, flipping the ownership and value accrual model

As a thought experiment -- today, if you want to save for a house, you may create a financial plan in Betterment and wait for the portfolio to accrue. Tomorrow, you may bring cashflows to a housing protocol which intermediates property markets, and build your portfolio directly into your desired goal of buying a house. Your stated selection and articulation of that goal, by choosing the housing protocol, generates value on its own through rewards, participation, governance, and various interest rate products.

The fintech world is not taking the summer off. New developments are coming fast and furious, from fundraisings to product launches to government intervention.

Banking for brands startup Bond raised $32 million to capitalize on the exploding trend of B2B2C banking.

Samsung Money launched, leveraging SoFi’s infrastructure. As SoFi again seeks a national banking charter, they could become the de facto leader in this space.

Kabbage and Intuit launched small business bank accounts as extensions of their already deep relationships with SMBs.

And WhatsApp is trialing all sorts of financial services in India just as Chinese fintech super apps are being banned from the country.

Uber has entered finance! The end is nigh! The boogeyman is here!

Oh. So what's involved? There's a debit card and a "debit account" powered by Green Dot, the same bank that's behind Apple Pay's person to person service. That means that Uber isn't a bank, but is renting shelf space on one. There's a wallet that will be integrated into the Uber app, within the driver's experience. So tracking your earnings and spending will be a feature that is part of the app -- not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there's a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!

In this conversation, we chat with Rhett Roberts, the Co-Founder and CEO of LoanPro – a new breed of software company that is API-driven, cloud-native and easily scalable. Rhett and his co-founders created the company out of necessity when they ran an auto lending business as they could not find anything flexible enough to suit their own needs.

More specifically, we touch on all things around the lending industry, the auto lending industry and how everything there works, and of course, why LoanPro is such an awesome company, and so much more!

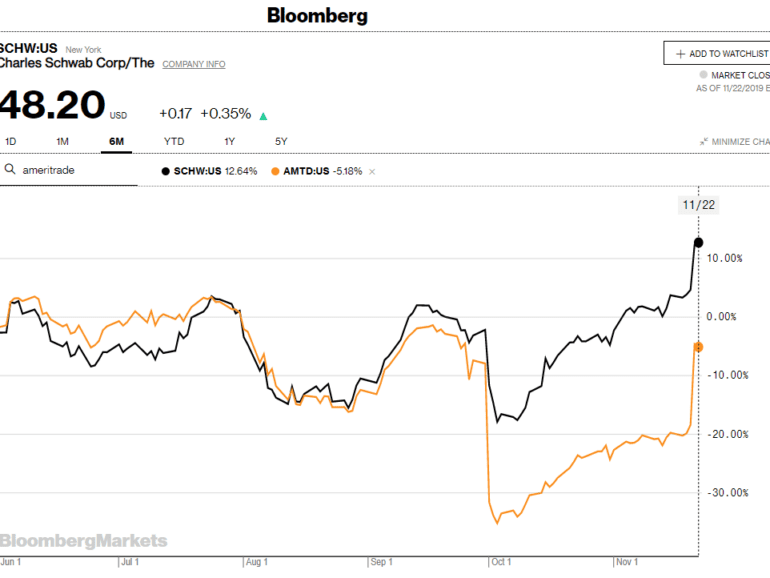

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

decentralized financedigital securities / STOdigital transformationenterprise blockchainexchanges / cap mkts

·In this conversation, we talk Ajit Tripathi, currently the Head of Institutional Business at Aave and a former colleague of mine at ConsenSys, about the path from traditional finance, to enterprise blockchain and “DLT” consulting, to full-on decentralized finance.

Thinking about how to connect these worlds and different available journeys? Or the timeless risks developing in tranched DeFi that look like mortgage-backed securities? We even touch on hegelian dialectics! Check out our great conversation.

EY Nexus for Banking Powered by MoneyLion unites two category leaders to help banks scale with integrated digital financial solutions.