While the future of payments is digital, Gnosis Pay co-founder and CEO Marcos Nunes said that leaves plenty of room for consumer choice.

This week, we put on the Goldman hat and go shopping for companies. We buy a little bit of Folio and sell some Motif. We look at Personal Capital and the $1 billion it wants for its $12 billion of assets. We examine the private markets with Addepar / iCapital and SharesPost / Forge, and then move over to the banking sector. Should we buy Wells Fargo, as rumored, or some digital wallet apps? Read on for how to acquire a best-in-class Fintech.

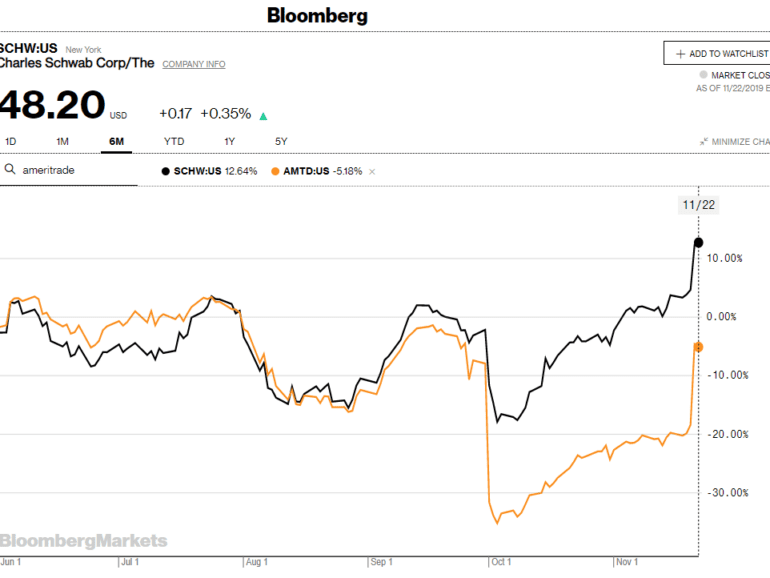

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

artificial intelligencebig techdigital transformationenterprise blockchainidentity and privacyIndiaregulation & compliancetelecom & infrastructure

·This week, we look at:

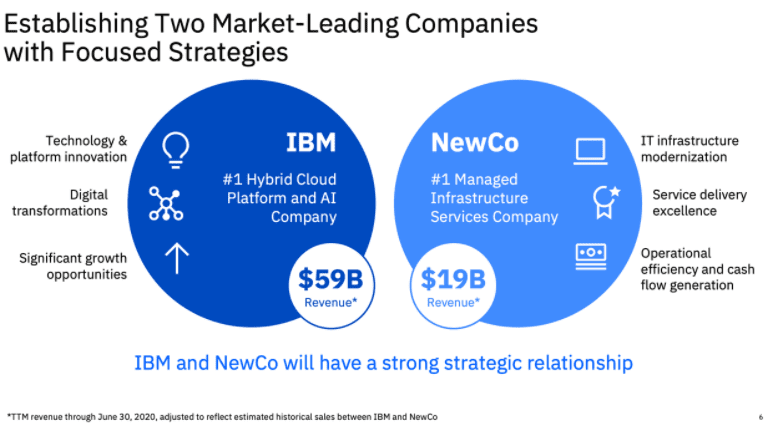

IBM spinning out its managed services division with $18 billion of revenue in order to focus on hybrid cloud and digital transformation

Reliance Jio, the Indian mobile telecom provider with 400 million users, contemplating financial services with backing from Google and Facebook

The role that technology infrastructure plays in the delivery of financial services

JP Morgan just shut down its neobank competitor Finn, targeted at Millennials in a smartphone app wrapper. Several other traditional banking incumbents have similar efforts, from Wells Fargo's Greenhouse, Citizens Bank's Citizens Access, MUFG's PurePoint and Midwest BankCentre's Rising Bank, as well as most of the Europeans (e.g., RBS competition to Starling called Mettle). These banks have every advantage -- from product infrastructure, to balance sheet, to regulatory licenses, to physical footprint, to relationships with the older generation. So how is it that players like Chime, MoneyLion, Revolut, and N26 are all able to get millions of happy users and the incumbents are failing?

The tech companies will become the storefront to absolutely everything.

There is no Internet, there is only Google.

There is no commerce, there is only Amazon.

There is no finance, there is only WeChat / Tencent?

I don't know about you, but I cannot pay for anything in cash in London anymore. COVID has made the city go cashless. For China, QR codes have long replaced the need for paper money. And if there is no cash, what is the point of ATMs, and ATM fees, and bank branches, and bank branch staff? Financial firms no longer need to be the place where you shop for financial product.

EY Nexus for Banking Powered by MoneyLion unites two category leaders to help banks scale with integrated digital financial solutions.

Anyone watching Fintech over the last decade has recognized an increasing shift of power from product manufacturers to the platforms where those products are sold. In the case of Amazon, Google, and Facebook -- finance is just a feature among thousands of others. I've made this point since 2017, when Amazon launched lending into its platform. Brett King has been a bit more generous in the categorization, calling the shift "embedded banking". This means that banking products are built into you life's journey, not accessed in a separate customer center location. The financial API trend is a tangible symptom of this vector.

As B2B payment technology catches up to other areas of fintech, TreviPay CEO Brandon Spear said exciting trends are emerging. In late 2023, TreviPay released the B2B Buyers Payments Preference Study. It updates similar research conducted in 2019.

In this discussion, we explore ways that Stripe — arguably the best American fintech company full-stop, although who would want to mess with Square — could be entering the crypto space. We consider approaches similar to the payment onramps, then discuss the underlying market structure powering those experiences, and highlight more generally the role of gateways relative to protocols. We touch on the role of custodians, banks, and wallets, as well as Square’s attempt, the tbDEX, where KYC/AML comes down to forms of opt-in identity. Finally, we address questions about Circle and USDC, and how stablecoins differ from the rails on which they travel.