While the future of payments is digital, Gnosis Pay co-founder and CEO Marcos Nunes said that leaves plenty of room for consumer choice.

decentralized financedigital securities / STOdigital transformationenterprise blockchainexchanges / cap mkts

·In this conversation, we talk Ajit Tripathi, currently the Head of Institutional Business at Aave and a former colleague of mine at ConsenSys, about the path from traditional finance, to enterprise blockchain and “DLT” consulting, to full-on decentralized finance.

Thinking about how to connect these worlds and different available journeys? Or the timeless risks developing in tranched DeFi that look like mortgage-backed securities? We even touch on hegelian dialectics! Check out our great conversation.

In this conversation, we geek out with Horacio Barakat, who serves as the Head of Digital Innovation for Capital Markets and the Head of DLT for the Repo Platform of Broadridge, about digital transformation, capital markets, and the role of blockchain in the institutional part of the financial industry.

Additionally, we explore the embedded complexities of capital markets and how fundamental they are to the smooth functioning of our economy, determining the growth of companies, and funding expansion. Touching on everything from the engine that powers capital markets, how that engine has evolved to becoming computational, and lastly how companies like Broadridge are leading the deep work going on in making that engine better.

In this conversation, we chat with Chris Dean, who is the Founder & CEO at Treasury Prime. Previously, Chris was the CTO & VP of Engineering at Standard Treasury, which was acquired by Silicon Valley Bank for an undisclosed amount.

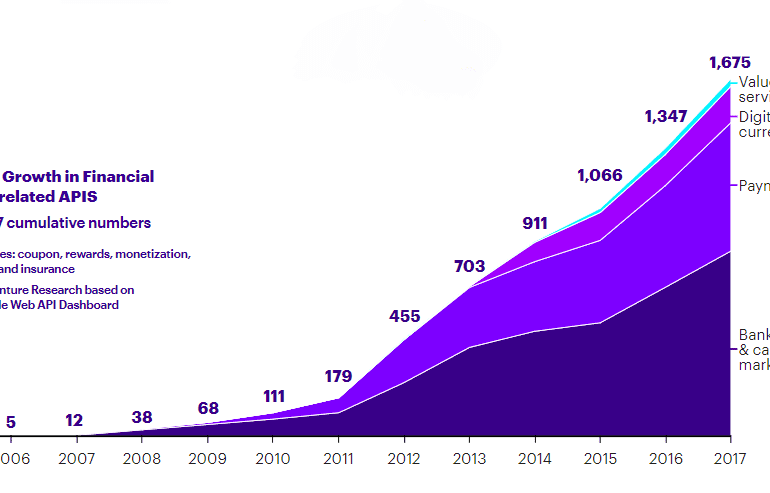

More specifically, we discuss all things banking-as-a-service, FinTech APIs, embedded finance, and the general evolution of the FinTech banking industry over the last decade.

This week, we look at:

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give

Uber has entered finance! The end is nigh! The boogeyman is here!

Oh. So what's involved? There's a debit card and a "debit account" powered by Green Dot, the same bank that's behind Apple Pay's person to person service. That means that Uber isn't a bank, but is renting shelf space on one. There's a wallet that will be integrated into the Uber app, within the driver's experience. So tracking your earnings and spending will be a feature that is part of the app -- not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there's a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!

This week, we look at:

How the medical reality is accelerating remote work and digital commerce, including the success of buy-now-pay-later companies like Affirm and Klarna

The emergence of virtual worlds and video game environments that generate $ billions in revenue and have millions of participants, with examples of Zwift, Fortnite, Tomorrowland, Roblox, Genshin Impact

How to connect digital environments to digital communities and their economic activity, including through mechanisms like non-fungible-tokens in Rarible and Async Art

Advice for shifting thinking from manufacturing financial product, to starting with the customer, to leveraging the community

central bank / CBDCdigital transformationgenerational changemega banksnarrative zeitgeistphilosophyvisual art

·This week, we look at:

The nature of innovation hubs, and how close groups of actors within a particular environment can be massively, fundamentally productive. Take for example the 30 million years of the Cambrian explosion.

The difficulty of experimenting with banking and money frameworks, the limits of traditional econometrics, and an overview of “free banking” in the 1840s.

How evolutionary theory can help us think about selection of economic models, and the hyper-competition and hyper-mutation that we see in crypto. DeFi protocols, like BadgerDAO and ArcX among hundreds of others, are experiments in designing different monetary policies and banking regime experiments in real time.

We have never before had such acceleration in the design space of the economic machine, subject to evolutionary pressures, built by a closely-wound nexus of developers. It is a fortune for the curious.

This week I discuss SpaceX, and its Dragon rocket carrying American astronauts to the International Space Station for the first time in 9 years. The 20 year old company is a testament to the incredible iron will and absolute insanity of the most visionary capitalist alive -- Elon Musk. We walk through various attributes of the company and recent launch to derive lessons for the financial industry and the entrepreneurs rebuilding it.

digital transformationEmbedded Financeenterprise blockchainexchanges / cap mktsmega banksneobankOpen Bankingopen source

·In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.