Whether banks or fintechs admit it, open banking is already a market-dominant feature, according to a 4,000 person Mastercard survey.

Representing respondents and data from U.S. and Canadian consumers, The Rise of Open Banking demonstrates a widescale adoption level, especially from younger generations.

“Open banking gives consumers choice by enabling them to use their own data to obtain financial services solutions quickly, simply and securely,” said Chiro Aikat, Executive Vice President, Product & Engineering, North America.

“Mastercard plays a central role in this ecosystem as a trusted intermediary and secure data network that powers smarter, more meaningful experiences and empowers consumers to practice good financial habits that enhance their day-to-day lives.”

The Survey was built through Mastercard’s open banking platform Finicity. Responses were gathered from May to June 2021.

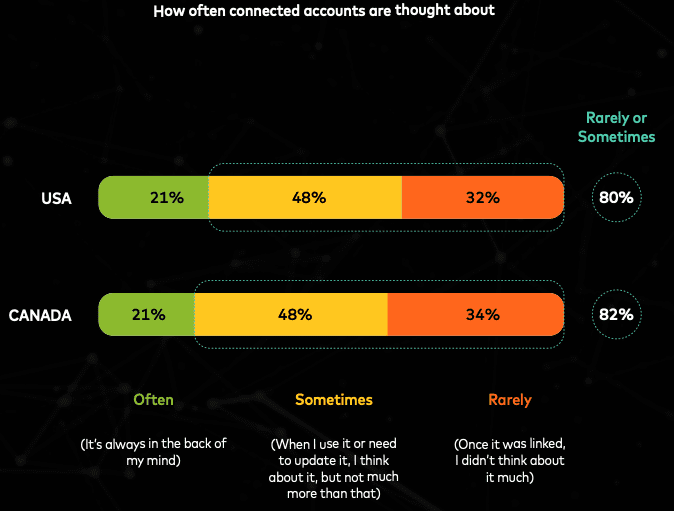

In one parameter, data show that 80% of USA consumers and 82% of Canadians use a payment or banking service connected to their primary accounts without thinking about the connection. The findings suggest open banking capabilities through services that safeguard and share personal data has quickly become an accepted, expected feature in modern banking.

Data showed that sending money to friends, family, and businesses, getting or refinancing a loan, and new products like buying cryptocurrencies were the most common ways respondents used open banking. Also, 59% of consumers used digital apps, and in the U.S., 36% of those surveyed said 2021 was the first year they used financial tech. In addition, 28% of respondents sought or refinanced a loan.

Trust in Fintech

Data shows the majority of respondents trust and expect technology-enabled financial services: 74% of consumers in the U.S. and 65% of Canadians have, or would, connect their bank accounts to financial apps and services to automate financial tasks. 68% in the U.S. and 69% of Canadians would link accounts to send money conveniently.

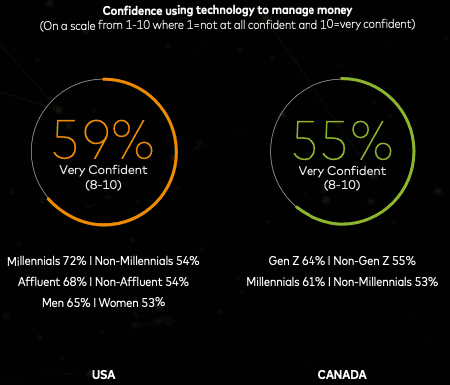

Still, less than half of respondents, 59% in the U.S. and 55% of Canadians, said they felt confident using tech to manage money. The data show wealthier; younger respondents were more likely to report confidence.

To read more about the Rise of Open Banking, download the report here.