I keep thinking about this column from Alex Johnson last month around financial health and savings. To me, one of the biggest disappointments around the past decade of fintech innovation is how little we are moving the needle for the financial health of consumers.

There are plenty of great tools that have been developed in the past decade but most people are still living paycheck to paycheck.

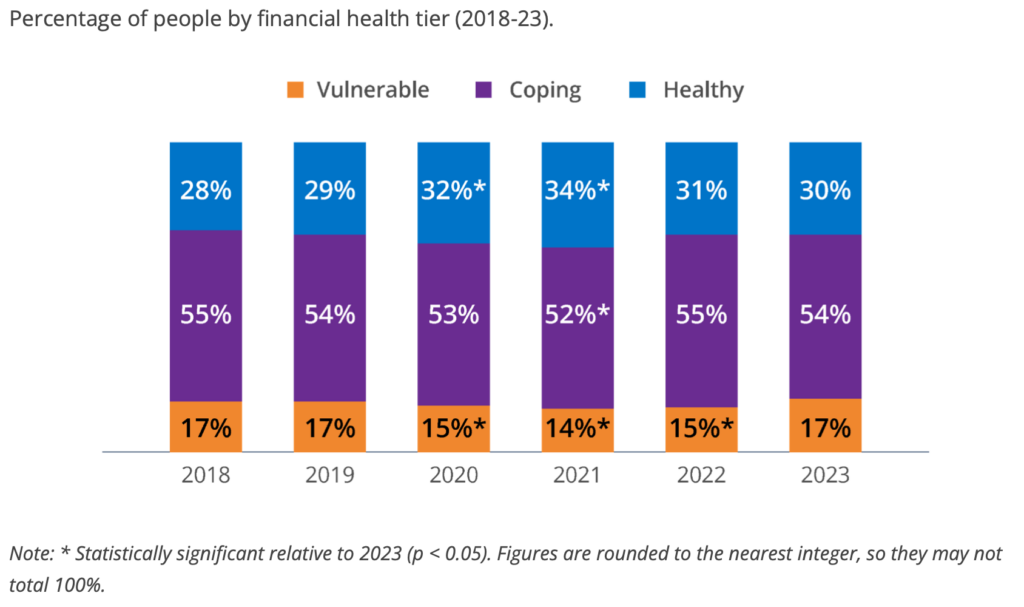

Take a look at the chart below from the latest Financial Health Network’s Annual Pulse Survey.

This shows the percentage of people who are financially healthy, financially coping and financially vulnerable. The survey goes into great detail about how one fits within a category but suffice it to say that as a country we are doing about the same financially every year with a small adjustment for the pandemic stimulus in 2020 and 2021.

I like how Alex put it in his column. We need to stop treating the “living paycheck to paycheck” phenomenon as a condition that needs to be cured and start treating it as something that needs to be managed, or as Alex puts it made “as benignly chronic as possible.”

He brings up the interesting idea of a Payroll Bank Account to help people save, separating long-term financial allocations and short-term spending decisions. There are certainly ways to do that today but they do require fiscal discipline and that is where so many of us fall short.

I believe the most important way to manage the living paycheck to paycheck phenomenon is with emergency savings accounts. And there is a new type of account that can help with this.

New in 2024: Pension Linked Emergency Savings Accounts

There is a little-discussed change that began at the start of the year that is a real attempt to address this problem. To be financially healthy everyone needs an emergency savings account, that is widely accepted. But how to get people started?

New legislation will help provide a boost. Many of the provisions of the SECURE ACT 2.0 came into force at the start of January and one feature that I am very interested in is the Pension-Linked Emergency Savings Account (PLESA).

As the name implies this is a savings account that is linked to your existing 401(k) or similar retirement plan. Starting on January 1, retirement plan sponsors are now able to add a PLESA to their retirement plan.

My favorite feature of this plan is that it allows for auto-enrolment. A PLESA is a Roth-type account meaning that contributions are with after-tax dollars. The maximum contribution is $2,500, in fact, your account is not allowed to go above this limit. It is for emergency savings, it is not an investment account. Participants can make withdrawals at any time on a monthly basis with the first four withdrawals taken at no charge.

Another cool feature is the possibility of an employer match. If an employee is receiving a 401(k) match from their employer then they can also receive a match on their PLESA, although the money from the match goes into the 401(k) account, not the PLESA account which I find a little strange. Still, by contributing to a PLESA employees can help build their retirement accounts courtesy of their employers.

Will this solve the emergency savings crisis in America? That is highly unlikely, but it is an excellent new tool that could help millions of people build emergency savings.

Fintech is also attacking emergency savings

Many fintech companies are also tackling the emergency savings challenge.

I really like what SecureSave is doing (listen to my podcast with CEO Devin Miller along with co-founder Suze Orman). It is a similar concept to a PLESA insofar as it is an employer-backed emergency savings program. But it has none of the regulatory requirements of a PLESA. Being a fintech company, there is a major focus on user experience with just a three-click signup process. They allow for employer matching as well.

Another fintech company that is using a celebrity connection to boost emergency savings is Acorns with their new Mighty Oak Card endorsed by Dwayne “The Rock” Johnson. This is a full-featured debit card linked to a checking account with a built-in emergency savings account that pays 5% interest.

I also like what Sunny Day Fund is doing. It is similar to SecureSave, it is an employer-sponsored savings account and they got on my radar when they were part of the 2022 cohort of the Financial Solutions Lab.

I should also give a shout out to Blackrock and the Blackrock Savings Initiative in collaboration with the Financial Health Network, Commonwealth and Common Cents Lab – all organizations I know and respect. Since launching in 2019 the initiative has reportedly reached 10 million people and created $2 billion in liquid savings targeting large companies and their employee savings programs.

This is not a huge category for fintech because you need a lot of scale to make the economics work. But it remains one of the most important areas of innovation.

We are not going to solve the financial health crisis overnight but we need to give everyone tools to help. Both the government and fintech now have some very useful innovations that, with time, can make a big difference.