Writing in AltFi Steven Bisoffi, Payments Advisory Lead at Huntswood, asks if 2019 will be the year that open banking will...

The Blockchain Insurance Industry Initiative B3i announces that 23 new entrants are joining its Market Testing program; The new entrants are: AIA, AIG, Aon, Chubb, Covéa, Everest Re, Gen Re, Guy Carpenter & Marsh, JLT Re and more; the new companies will join the existing group in testing the prototype platform. Source.

While the coronavirus continues to take most of the headlines the UK Chancellor Rishi Sunak released the 2020 budget; the...

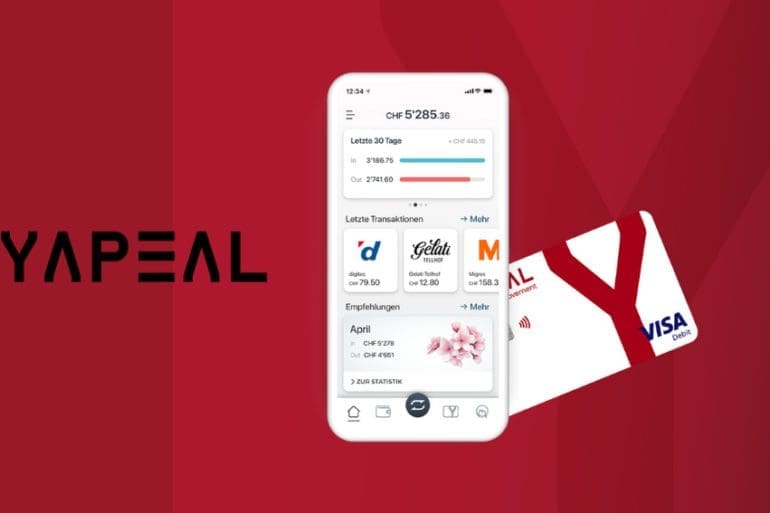

YAPEAL announced that FINMA has granted it a license extension to offer cross border services to international customers.

There is increased focus on UX Design but few understand its importance. Going beyond visual design, for many fintechs, UX can spell success or failure. We took a dive into UX with Design Accelerator's Federico Spiezia, understanding the value it brings to a business and how it can be measured.

Writing in the Financial Times Huw van Steenis, former adviser to the governor of the Bank of England and chair...

Buy now, pay later FinTech Clearpay has introduced cross borde

The co-founders of Xendit, Moses Lo and Tessa Wijaya, discuss payments infrastructure in Southeast Asia, smartphone penetration and why the opportunity there is so big.

Former bankers Antony Jenkins, Jonthan Larsen and Vikram Pandit all have found a great deal of success in moving into...

The United Kingdom's Payment Systems Regulator (PSR) has reportedly put the card schemes on notice that it is looking into their fees.