Change continues to come to fintech venture financing, and there's no sign of slowing down, Matt Harris said at Fintech Nexus 2022.

UK-based P2P lending platform Assetz Capital has announced a promotional interest rate increase for investors in its 30 day access account; investors will receive a 4.75% rate of interest for up to 90 days after investment through May 11; the promotion adds 50 basis points to the current rate on the account with interest paid monthly. Source

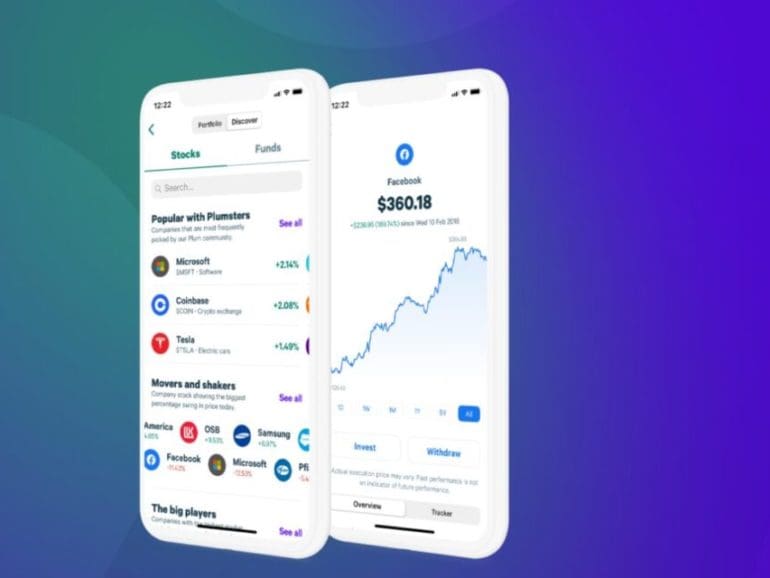

Global payments platform Airwallex is supporting European investing app Plum with the launch of its new stock investing feature.

A buyer’s guide to data aggregation Why Freelance Workers Should Be The First To Adopt Blockchain The Biggest Threat To...

The UK'S HM Treasury has announced regulations for the BNPL sector in response to controversy. Klarna UK Head, Alex Marsh, responds.

The UK Financial Conduct Authority has granted Coinbase an E-Money License; Barclays is also allowing Coinbase to access the UK’s Faster Payments Scheme which is the core payment infrastructure in the UK; Coinbase’s Zeeshan Feroz stated, “There is no other exchange today that has access to domestic banking. UK consumers today have to jump through all sorts of hoops around sending money to European accounts using euros in order to get money in and out." Source

Monzo has grown its customer base over five times in one year and used different methods that help keep that base coming back; they ask for community feedback, open the company for equity crowdfunding rounds so users can invest and they host small, intimate events; 80 percent of their growth is word of mouth, the remaining 20 percent is through ads on Facebook and Twitter; “The biggest challenge is that we’re growing very fast — our customer and employee numbers are growing fast — we want to keep the customer focus, how we operate a transparent customer growth approach, and how we do that at scale,” as Tristan Thomas, Monzo’s head of marketing and community, tells TearSheet. Source.

The two companies are both based in Berlin and will collaborate on SME loan financing; solarisBank has initially provided an eight digit investment for financing loans on the Lendico peer-to-peer lending platform; Lendico launched in 2014 and has total lending volume of over EUR100 million. Source

The company intends to list on the Nasdaq in Stockholm and raise approximately $227 million which would value the company...

Younited Credit is a marketplace lending platform that operates in France, Italy and Spain; the round included the French public investment bank Bpifrance among several other investors; total funding is now €103 mn for the company; François Fournier, chief innovation executive of Bpifrance stated, "We were attracted by Younited Credit’s team and by its unique positioning built in Europe. Its innovative digital platform model, great product agility thanks to big data, as well as its solid regulatory strategy, inspire confidence and sustainability." Source