A study of around 15,000 consumers in 15 different countries by Dutch bank ING found that the British are wary...

UK debt crowdfunding platform Property Crowd has announced the launch of its innovative finance individual savings account (IFISA); the minimum investment for the IFISA is 5,000 British pounds ($6,220) and the account will target returns of 7% to 10%; Property Crowd will compete for investment across the alternative debt market however its offerings vary slightly from traditional P2P lenders since the firm's debt products include structured real estate bonds. Source

Cryptocurrency exchange FTX has launched a $2 billion venture capital fund that will invest in firms pushing blockchain and web3...

Berlin-based Trade Republic, which claims to be Europe’s largest savings platform, has announced a €250 million Series C extension.

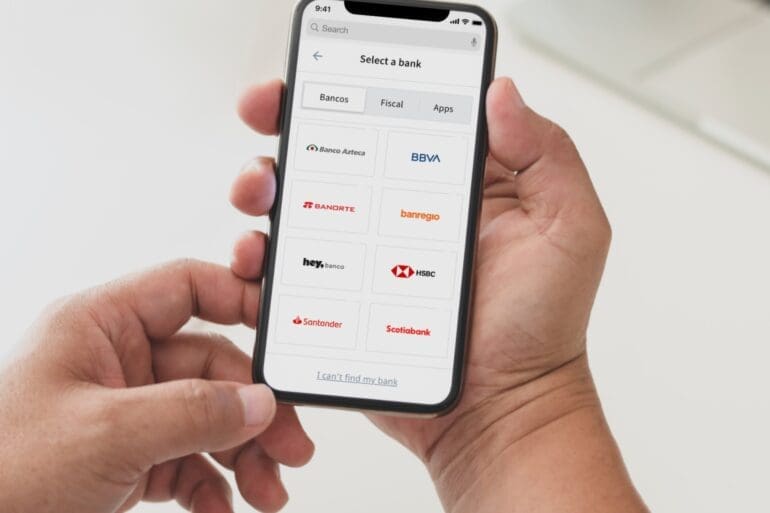

One of the hottest U.S. based fintech startups is now live in the UK with their first two customers; Plaid...

Peter O’Higgins, who had been the CFO for Revolut since 2016, resigned last month from the fast growing fintech; this...

Europe's fintechs are hitting the $1bn mark with fewer downloads than ever, a new analysis shows.

So-called iBuyers purchased a total of 70,402 homes in 2021, more than doubling the number purchased in 2019, according to a report from Zillow released on Tuesday.

Upon their acquisition of Zencap, Funding Circle took up operations in Germany, the Netherlands and Spain, though now you can remove Spain from that list; according to Ryan Weeks of AltFi, this was due in large part to a low quality pool of borrowers and limited understanding in Spain of P2P lending; in terms of their loan book this was only a fraction of global originations for Funding Circle; they will now be able to allocate more resources to Germany and the Netherlands where they are looking to increase their market share. Source

Funding Circle lead originations for the month of September followed by Zopa and RateSetter; many other originators across Europe are included in the list. Source